Dollar volatility rose sharply yesterday amid revisions on the Fed monetary policy.

Fed chairman Jerome Powell said that inflation target will go beyond 2%, but did not specify the formula for achieving this level. Nonetheless, he reassured the markets that he would not hesitate to fight against excessive inflation if it occurs, but at the moment, persistently weak inflation is a more serious threat to the economy. In any case, economists expected these statements, so the US dollar stayed afloat against the euro and the pound yesterday.

With regards to the labor market, the opinions of market participants and the head of the Federal Reserve are fundamentally different. The former expected a revision of interest rates only after the return of unemployment rate to historic lows, while Powell perceives differently. In his opinion, although the Fed needs to focus heavily on maintaining a strong labor market that would bring benefits to the entire economy, changing the monetary policy because of it is not ideal. Even in the event of rapid economic growth, the emphasis will still be on inflation, and good labor market performance will only help achieve the set goals even faster.

At the end of his speech, Powell said that the Fed will revise its monetary strategy approximately every five years, and the current new Fed strategy does not dictate the final policy results.

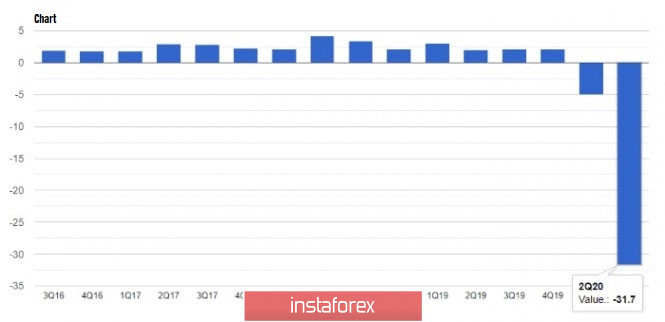

Aside from the revision of monetary policy, US GDP for the 2nd quarter was also revised yesterday, and it turned out to be slightly higher than previously reported. The report by the US Department of Commerce revealed that Q2 GDP contracted only 31.7% per annum compared to the first quarter, while earlier it was reported that the fall was 32.9%.

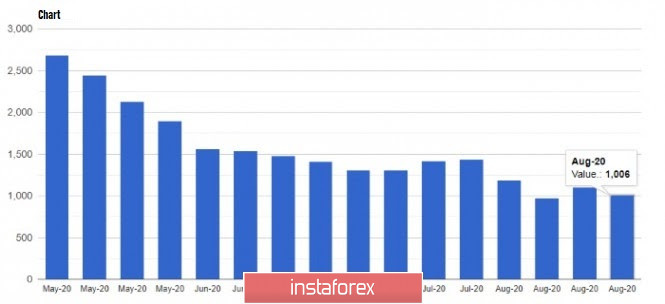

Meanwhile, data on unemployment claims remained largely unchanged, perhaps due to the recurring fear of people on a resurgence in COVID-19. Thus, the report of US Department of Labor presented a decrease in initial applications by 98,000, listing about 1.006 million applications, which is fully in line with the forecasts of economists.

As for data on home sales in the United States, high demand and low interest rates provided sharp increase in the indicator, according to the National Association of Realtors. Hence, contracts in July rose 5.9% and amounted to about 122.1, while economists had expected it to be 3.5%. Compared to July 2019, the indicator increased by 15.5%.

Industrial activity in the area of Kansas City Fed also rose in August this year, coming out at 14 points, from 3 points in July. Economists forecasted the indicator to just be 2 points.

With all these data, the task of euro bulls this weekend is a confident exit and price consolidation above 1.1850, as such is a good basis for a new upward trend next month. However, given the problems awaiting the eurozone economy this fall, reaching this goal will be very hard to achieve. A strong movement towards 1.1975 will not be enough to break above the 20th figure, especially without news of a policy change from the European Central Bank. In addition, a downward correction could occur if the quote breakout of the support level around 1.1750, and such will return the price of EUR/USD to the lows of 1.1650 and 1.1540.