Jerome Powell's speech on the Jackson Hole symposium set off a storm in financial markets: bonds, gold, and the dollar flutter in response to the Fed's decision of shifting from a 2% PCE targeting policy to managing average inflation. Investors believe that this will deprive the USD index of the main driver of growth and will contribute to its further decline. However, history knows many examples when shocks in the financial markets actually turned out to be nothing more than a storm in a glass of water.

If we ignore such factors as trade wars, pandemic, presidential and parliamentary elections, then the monetary policy of central banks is rightly considered the key driver of currency formation in Forex. The deteriorating state of the economy gives rise to a rate cut, reduces the attractiveness of assets, and leads to a weakening of the national currency. On the contrary, the recovery in GDP fuels inflation and allows one to count on an increase in borrowing costs, which is a bullish trump card for the monetary unit. By changing the inflation targeting methodology, the Fed deprived the dollar of this trump card.

The EUR / USD rally in June-August was caused not only by the divergence in the economic growth of the Eurozone and the United States but also by narrowing yield spreads of the peripheral countries of the currency bloc and Germany. Indicators are returning to pre-crisis levels, which indicates extremely low risks of the collapse of the eurozone and allows the ECB to reduce the volume of asset purchases in the framework of QE. This is good news for the euro, which can be interpreted as some tightening of monetary policy.

Dynamics of yield spreads for European bonds:

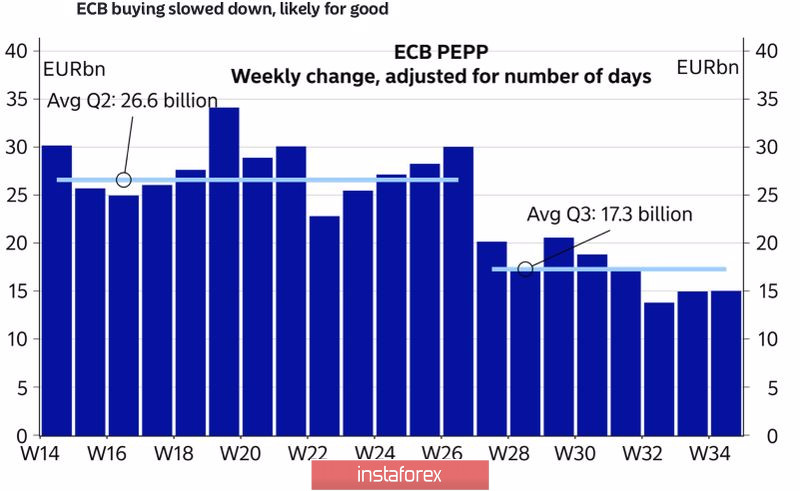

Dynamics of purchases of the ECB assets in the framework of QE:

It should be noted that the activity of the European Central Bank in the debt market of the Eurozone declined not only in the traditionally drowsy August but also in July, which indicates the strength of the recovery of the currency bloc economy. In September, the situation may somehow change as per usual, during this period, the volume of bond issues grows, yield differentials widen, and a slowdown in European core inflation from 1.2% to 0.8% may push the ECB to the idea of targeting the average CPI.

If there is a 10% increase in the 14-day average number of COVID-19 cases per week in Germany, which signals an increased risk of a second wave of a pandemic, then the 1.2 level can be presented not only as psychologically important but also as a tough nut to crack. Will the bulls on the main currency pair break their teeth about it?

Technically, the inability of the euro sellers to take the quotes below the dynamic support in the form of a combination of moving averages indicates their weakness. The renewal of the August high will increase the risks of continuing the rally towards $ 1.2025 and $ 1.2065. I recommend to gradually fix the profit on the longs formed from the level of $ 1.175.

EUR / USD daily chart: