To open long positions on EURUSD, you need:

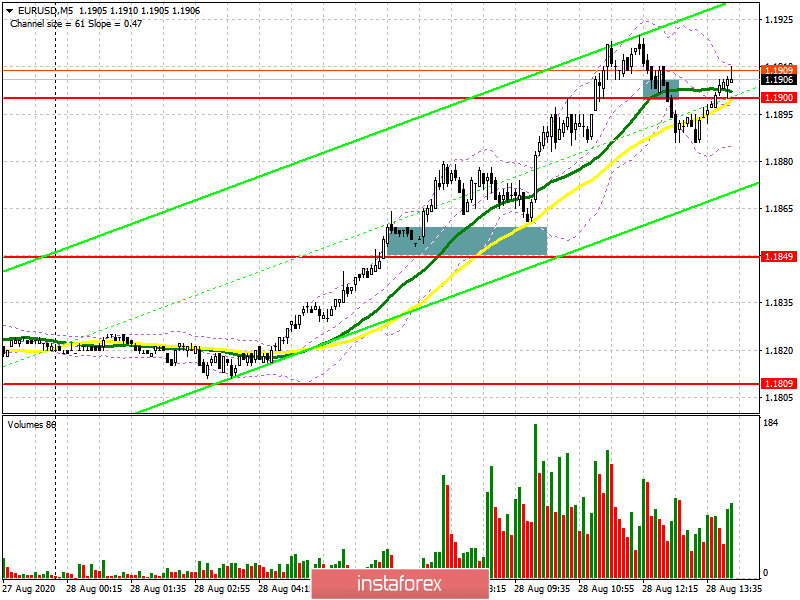

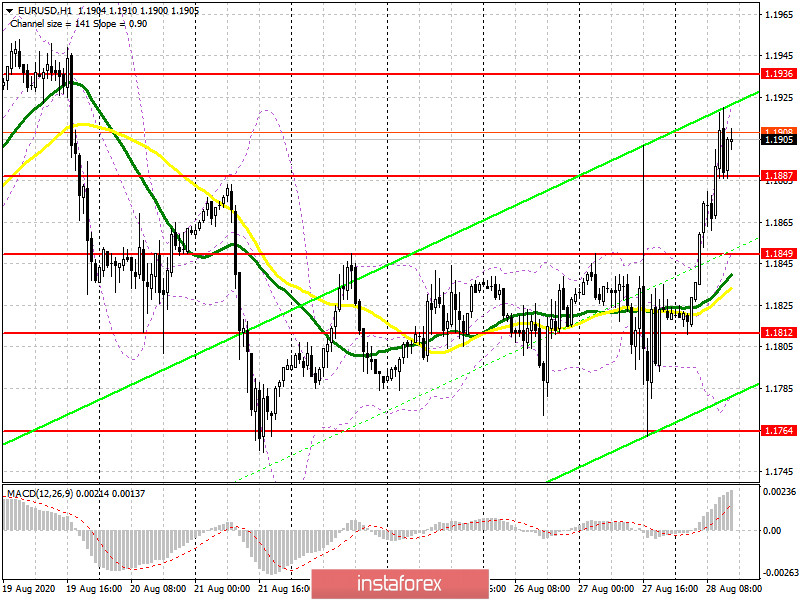

In the first half of the day, I paid attention to purchases after the breakdown and fixing above the resistance of 1.1849, which happened. If you look at the 5-minute chart, you will see how the bulls break above the area of 1.1849 and get fixed on it, forming a good entry point to continue the upward trend. The test of the level of 1.1900 slightly cooled the ardor of buyers, however, there was also a signal to open long positions. At the moment, the technical picture in the EUR/USD pair has changed slightly, however, the next target of the bulls is still the resistance of 1.1936, where I recommend fixing the profits. An important task for buyers is also to close the trading day above the support of 1.1887, which was formed in the European session. If this happens, it will be possible to say for sure about the formation of a new upward wave in the pair at the end of this month and the beginning of next month in the expectation of a break of the 20th figure. If EUR/USD falls below the level of 1.1887 today in the afternoon, it is best to postpone long positions until the update of the minimum of 1.1849 in the expectation of correction of 20-30 points within the day.

To open short positions on EURUSD, you need:

Weak data on the economy of France and Germany did not lead to the formation of pressure on the European currency, and a quick breakdown of the resistance of 1.1849 canceled all the bears' plans to return EUR/USD to the support area of 1.1812. In the second half of the day, you can open short positions immediately for a rebound from the resistance of 1.1936, counting on correction of 20-25 points within the day. But when you do this, you need to understand that you will be trading against the trend. An equally important task for the bears is to return EUR/USD to the support level of 1.1887, fixing under which forms a good signal to open short positions to demolish the stop orders of the bulls and reduce the pair to the area of 1.1849, where I recommend fixing the profit since it is unlikely that the bulls will let the euro fall below this range. There are also moving averages that play on the side of euro buyers.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily moving averages, which indicates the formation of a bull market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair declines, you can open long positions immediately on a rebound from the average border of the indicator in the area of 1.1849.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.