Fed Chairman, J. Powell, managed to surprise the markets as he spoke at a virtual symposium in Jackson Hole. Instead of the expected mode of targeting the yield curve, the Fed introduces a mode of targeting average inflation. Here, inflation will now be allowed to exceed the 2% target to offset the recent decline.

But what does this actually mean? The real yield on US securities will decline due to rising inflation, while in Japan, for example, even lower yields will be offset by deflation that has already begun. The Euro zone with its low inflation will look even more attractive, but there is nothing to say about emerging markets – in fact, Powell urged buying securities instead of American ones.

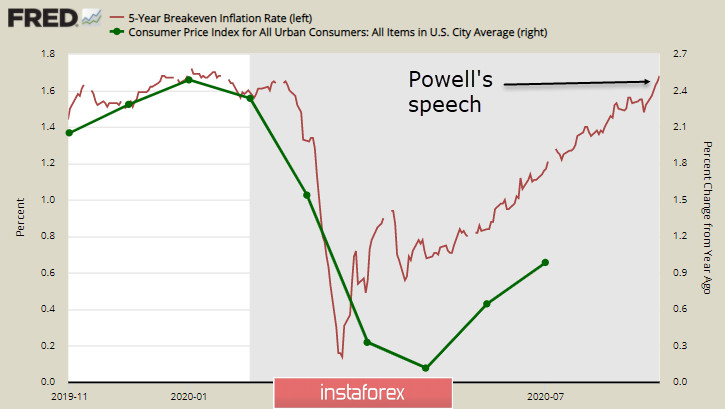

It is clear that the dollar in these changed conditions is losing impulse to grow. The higher the real inflation rate at unchanged Fed rates, the more chances that the US debt market will plunge into the negative zone. Accordingly, if investors decide that inflation will continue to rise, then the dollar may weaken. The dynamics of 5-year TIPS bonds suggest this scenario:

Thus, on Monday morning, the probability of the dollar weakening is high, but everything will be decided by the FOMC meeting in September.

On the other hand, Friday's CFTC report should have been outdated after Powell's speech last Friday, but, as it turned out, large players guessed that the Fed would not insist on targeting the yield curve. The total short position in the dollar rose by 2.138 billion and reached a new long-term low at -24.051 billion. In fact, the dollar in the medium term turns out to be weaker than other G10 currencies again. It also needs to receive additional positive signals to resume growth before the Fed meeting on September 17.

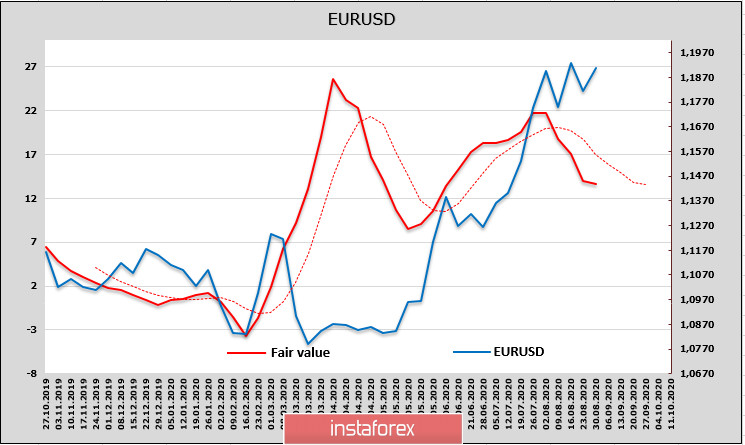

EUR/USD

Speculators on CME continue to buy the euro after taking a short break. The net long position increased by 58 million, but the buying volume has significantly declined. At the same time, the level of the fair price has not yet resumed its growth, which indicates that investors may wait to see if the ECB is ready to reflect Fed's actions.

The EUR/USD pair failed to renew the high of August 18. At the moment, there is already a third attempt to overcome the resistance at 1.20, which may fail again. We assume that a local top will be formed in the 1.1920/30 area, after which the bears will try to resume pressure.

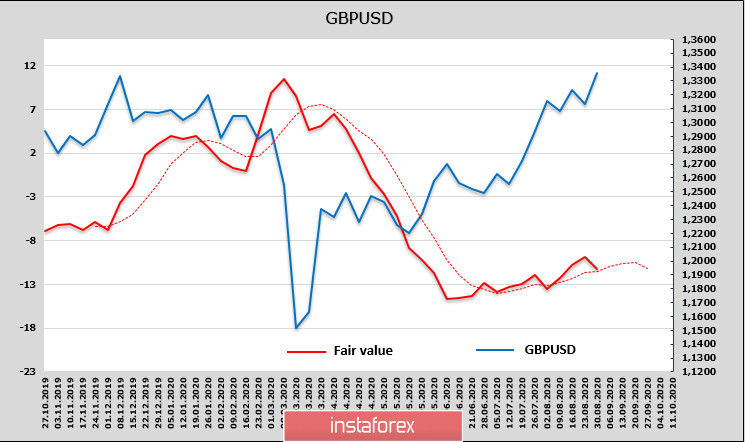

GBP/USD

The pound, along with commodity currencies, was in a noticeable positive position at the end of the week, but the reaction to Powell's speech is unlikely to be long - the fair price of the pound is not growing.

The speech of Andrew Bailey, Governor of the Bank of England, did not have a noticeable effect on the pound. He only said that the Bank of England "... has significant opportunities to ease policy, including by reducing territories and expanding the range of purchased assets."

Therefore, the players will most likely focus on the Fed's policy, since the Bank of England will take its actions after the Fed. On Tuesday, the Parliament will resume hearings on the inflation report. Haldane and Brodberg are expected to speak, and there may be comments on the Bank of England's view on the change in the Fed's rhetoric, which may lead to increased volatility.

Technically, resistance at 1.3510 will limit the pound's growth and there are no grounds for updating it. During the week, a drift to the lower limit of the 1.30 channel is more likely.