The British pound continues to make attempts to rise against the US dollar, as well as the European currency, which is gradually approaching a fairly large maximum in the area of 1.1950. From a technical point of view, nothing has changed, as the bulls managed to protect a fairly important support level of 1.1885. Now their new target is the resistance of 1.1950, the breakout of which will provide new growth for risky assets in the area of the 20th figure. At the beginning of next month, you can also expect a new jump in the euro to the highs of 1.2060 and 1.2105.

Today's series of reports on Italy, where the forecast for economic contraction was revised for the worse, and inflation in Germany, which declined, did not put much pressure on the euro, which continues to strengthen its position against the US dollar after statements by Federal Reserve Chairman Jerome Powell last week.

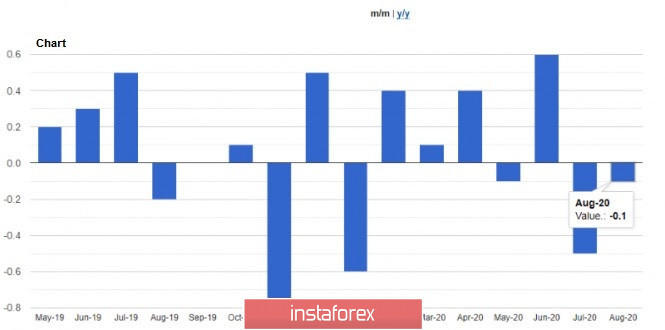

Many experts expected that inflation would remain unchanged in August this year, however, this did not happen. A temporary reduction in VAT in Germany led to the indicator moving to the negative side. We should not forget that the pandemic-related restrictions in the service sector continue to operate, which leads to a reduction in sales. As for the positive contribution to the indicator, in August, it was associated with an increase in oil and energy prices. According to the report, the preliminary consumer price index (CPI) in Germany in August this year decreased by 0.1% compared to July and remained unchanged compared to the same period last year. Economists had expected both values to remain unchanged. As for the German consumer price index, which is harmonized according to EU standards, it fell by 0.2% and 0.1% in August, respectively.

Another interesting report was published today by the Ifo Institute. It indicates that the number of part-time companies in Germany is declining. In August, the number of such companies fell to 37% from 42% in July. The reduction must be observed in all sectors, however, it is still a long way from completely abandoning such a system of work. In the manufacturing sector, 53% worked on a reduced schedule in August, compared to 57% in July. In the service sector, the indicator fell to 33% and in trade - 26%.

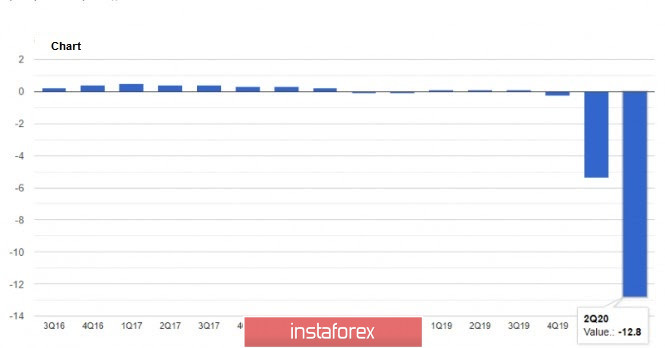

Another indicator also did not lead to the formation of serious pressure on the euro. We are talking about the fall of the Italian economy, which in the 2nd quarter of this year was even more than previously announced. According to the National Bureau of Statistics Istat, from April to June 2020, Italy's GDP decreased by 12.8% compared to the previous quarter, while previously a reduction of 12.4% was announced. These figures once again confirm the plight of the Italian economy, which has suffered serious damage due to quarantine measures related to the coronavirus pandemic in the first half of this year. Consumer spending for the reporting period fell by 8.7%, and gross investment in fixed assets - by 14.9%. Meanwhile, due to the closure of borders and the suspension of several companies, exports fell by 26.4%, while imports decreased by 20.5%. Compared to the same period in 2019, Italy's GDP declined by 17.7% in the 2nd quarter.

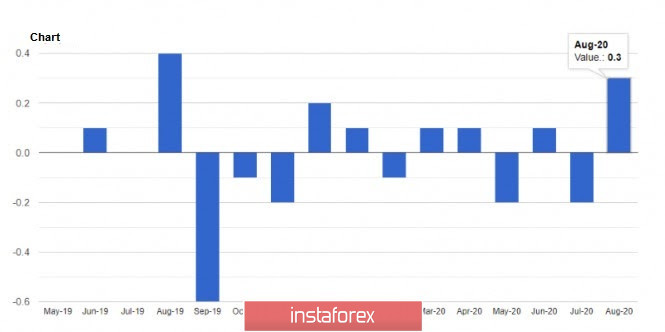

As for inflation expectations in August this year, things are a little better. The preliminary Italian consumer price index in August this year increased by 0.3% compared to July and decreased by 0.5% per annum. The data completely coincided with the forecasts of economists.

GBPUSD

As for the British pound, it continues its growth against the US dollar after recent statements by the Governor of the Bank of England, Andrew Bailey. According to the Governor, the Bank of England has not exhausted its capabilities, however, the choice of the instrument that will be used in the future is more important than ever before, as it depends on which path the next economic cycle will take.

Bailey also noted that the set of monetary policy tools in the future may have "more nuances", thus making it clear that the topic of negative interest rates has not yet exhausted itself and this option continues to be considered by economists. Let me remind you that in March this year, the Bank of England lowered its key interest rate to a record low of 0.1% against the background of the government's introduction of strict quarantine measures to contain the new coronavirus pandemic. The existing asset purchase programs were also significantly increased, as well as additional lines of credit for enterprises and companies were opened. At its meeting in August, the Bank of England did not resort to changes in policy, saying that there are no good reasons for this yet.

As for the technical picture of the GBPUSD pair, the further direction of the trading instrument will depend on how the bulls will show themselves in the support area of 1.3270, where the pound is gradually falling now. Approximately in the same range is the lower limit of the ascending price channel from August 24. A break in the resistance of 1.3390 will be another starting point for the GBPUSD pair, which will lead to an update of the highs in the area of 1.3470 and 1.3530.