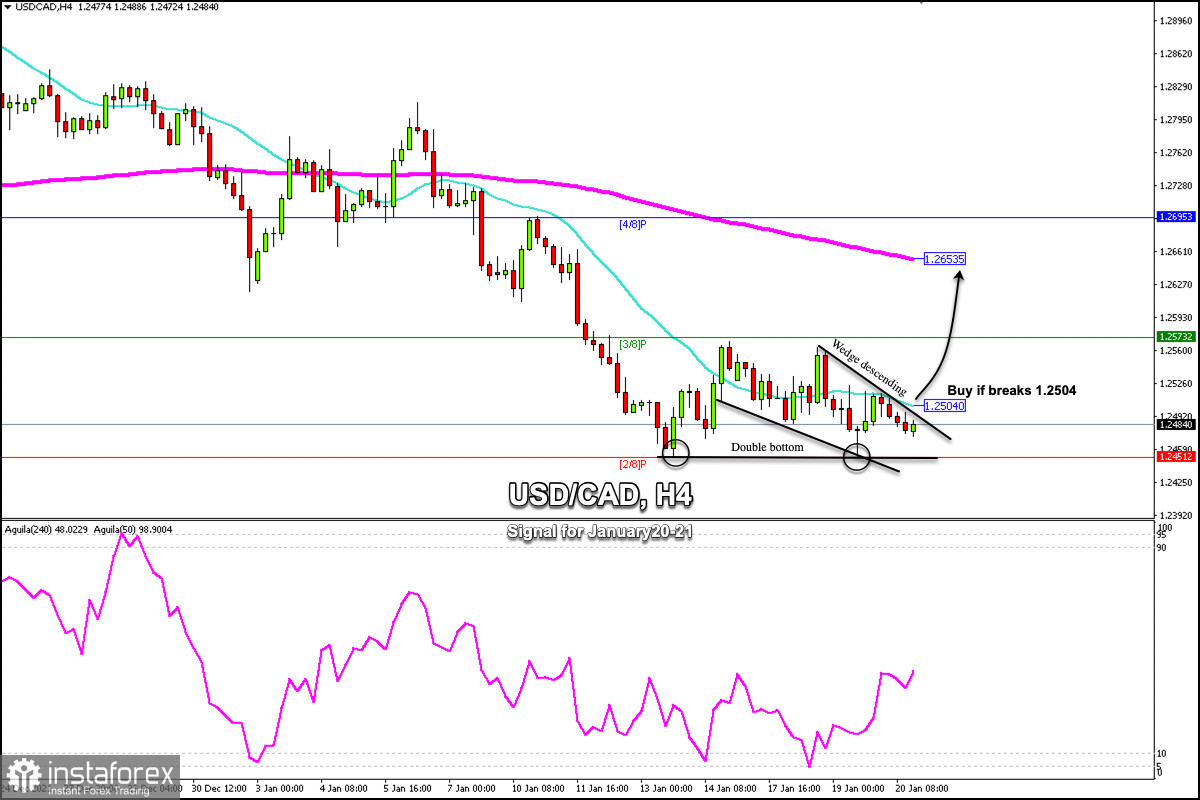

Early in the American session, the USD/CAD pair is moving lower, falling to a daily low around 1.2472 in the last hour. The loonie is trading below the 21 SMA located at 1.2504 and above the strong support of 2/8 Murray located at 1.2451.

The recent rally in oil prices,coupled with the better-than-expected Canadian CPI report supported CAD, a currency linked to commodity prices, leading it to fall and strengthen below 1.2500.

On the 4-hour chart, we can see the formation of a reversal pattern called a double bottom. If the Canadian dollar manages to consolidate above 1.2504, it could confirm the bullish move with targets towards the 200 EMA located at 1.2653.

A second pattern, a falling wedge ,an be seen on the 4-hour chart. A break above this wedge and above the 21 SMA could confirm the move higher and we could expect a rally towards 1.2653 and 4/8 Murray located at 1.2695.

Given that USD/CAD is very overbought, a technical bounce is likely in the coming days. This is expected to happen due to reversal technical patterns and because the US dollar may continue to strengthen ahead of the Fed's announcement next week.

On January 17, the eagle indicator reached the extreme oversold zone around 5-points. Since then, it is giving a positive signal. However, it is capped by the 21 SMA. A break above this area could ease the downside pressure, and the price could move higher towards 1.2653.

Support and Resistance Levels for January 20 - 21, 2022

Resistance (3) 1.2573

Resistance (2) 1.2541

Resistance (1) 1.2495

----------------------------

Support (1) 1.2451

Support (2) 1.2421

Support (3) 1.2392

***********************************************************

Scenario

Timeframe H4

Recommendation: buy if it breaks above

Entry Point 1.2504

Take Profit 1.2573 (3/8) 1.2653 (200 EMA) 1.2695 (4/8)

Stop Loss 1.2460

Murray Levels 1.2451 (2/8), 1.2573 (3/8), 1.2695 (4/8)

***********************************************************