Trading recommendations for EUR / USD on September 1

Analysis of transactions

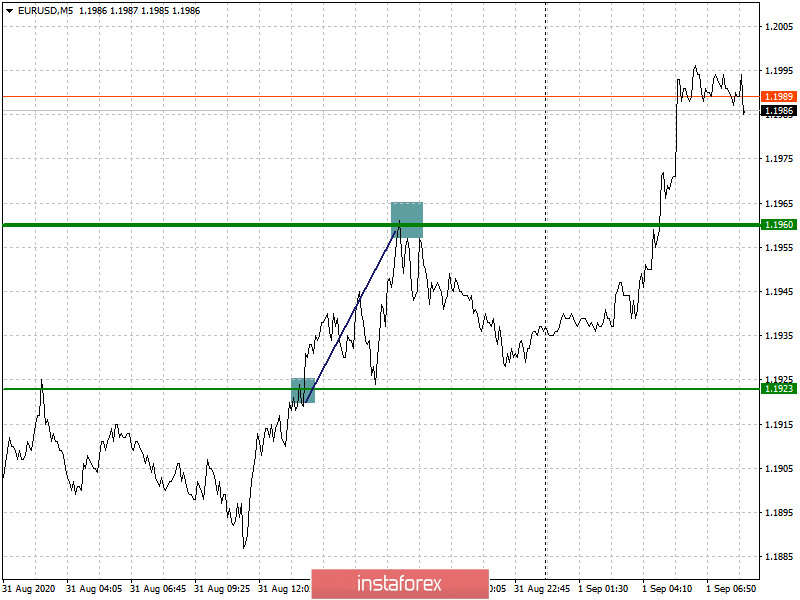

Price increased in the EUR / USD pair yesterday, even amid weak macroeconomic reports in Italy and Germany. Thus, long positions from 1.1923 to 1.1960 became profitable, bringing about 40 pips of profit from the market.

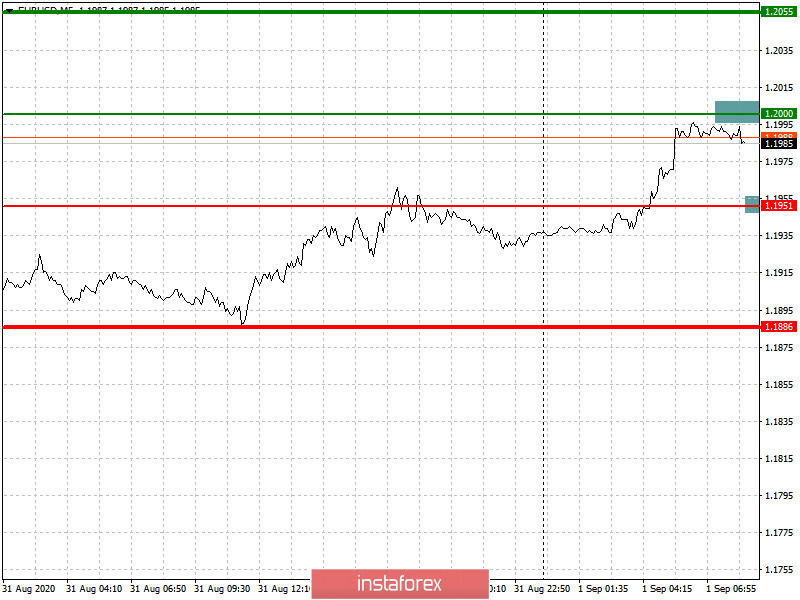

Today, a fairly wide range of reports are due to be released, among which is the inflation report for the eurozone. If data comes out weak, that is, indicating a slowdown in inflation, EUR / USD may decrease in the market.

- Open long positions from 1.2000 (green line on the chart) to 1.2055, and take profit at the level of 1.2055.

- Trade shorts from 1.1951 (red line on the chart) to 1.1813, but do not expect a very profitable outcome, as demand for the euro will persist even amid weak data on eurozone inflation. In any case, take profit at 1.1886.

Trading recommendations for GBP / USD on September 1

Analysis of transactions

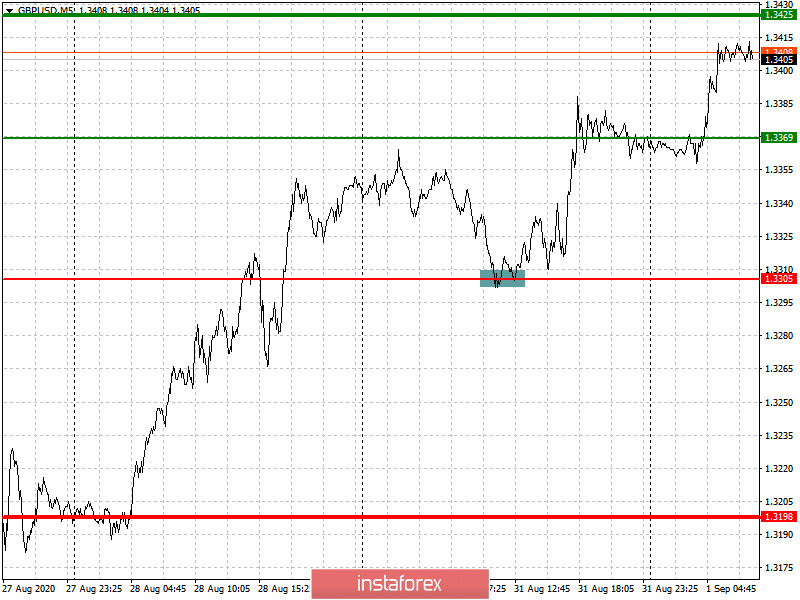

Short positions in the pound brought only losses yesterday, mainly due to the persistence of the upward trend in the market.

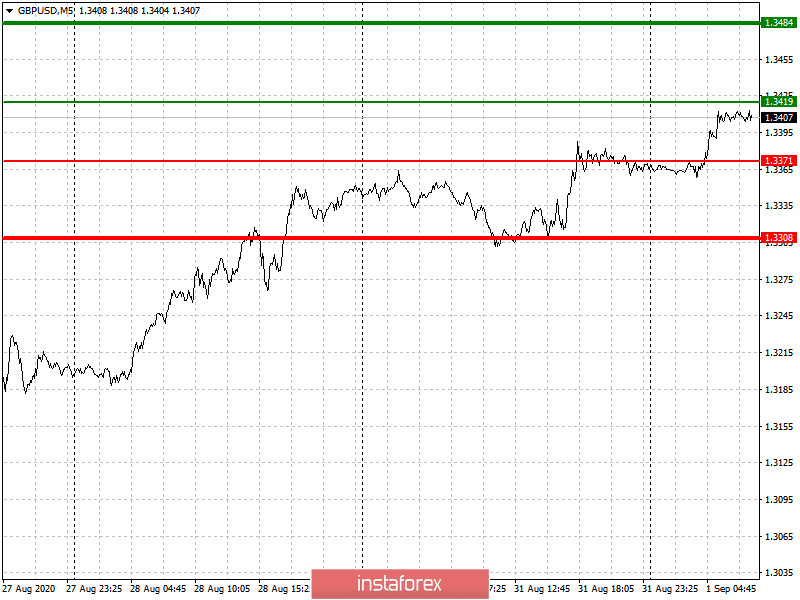

In addition, good manufacturing PMI for the United Kingdom may be published today, and such will not only point to a good recovery in the sector, but also add force in raising the rate of GBP / USD in the market.

A similar report will also be released for the United States in the afternoon, and it would contribute as well to the rise of the pound in trading.

- Set long positions from 1.3419 (green line on the chart) to 1.3484 (thicker green line on the chart), and take profit around 1.3484.

- Sell shorts at a price level of 1.3371 (red line on the chart), as a breakout from which will lead to a larger decline in the GBP/USD pair. Take profit around 1.3308.

However, keep in mind that trading against the trend is not a good idea, as such will only be unprofitable in the market.