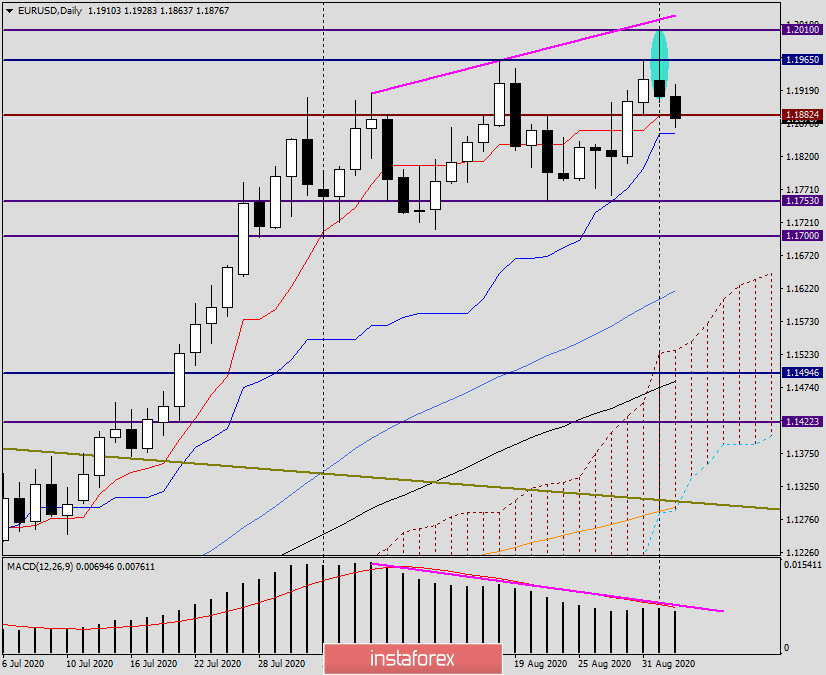

Daily

The confirmation that the pair will have a difficult time near the important psychological and strong technical level of 1.2000 was received yesterday. In the course of trading, the euro bulls tried to break through this significant level, but from 1.2010 (200 EMA on the monthly chart), the quote began to fall. At the same time, it should be noted that the EUR/USD pair reached such high values for the first time since 2018, and this is an event in itself. However, as expected in yesterday's review, such iconic levels are rarely overcome the first time.

If we recall yesterday's macroeconomic statistics, consumer prices in the Eurozone grew weaker than expected. Probably, COVID-19 left its negative imprint. In Europe, there is a slow and gradual economic recovery after the coronavirus pandemic, however, everything can not immediately return to normal. This is understandable. But in the United States, which was hit hardest by COVID-19, manufacturing activity continues to recover. This can be judged by yesterday's production index of the Institute for Supply Management (ISM), which came out better than expected. These macroeconomic factors may have influenced the price dynamics of the main currency pair. To finish with the fundamental part of the article, let me remind you that data on producer prices will be received from the Eurozone at 10:00 (London time) today. The United States will present the employment report from ADP at 13:15 (London time), and releases on production orders in the United States will be published at 15:00 (London time).

If we go back to the technical part of the review, the situation has changed compared to yesterday. Following the results of trading on September 1, a reversal model of candle analysis "shooting star" appeared on the daily chart. Given that the model was formed when trying to break 1.2000, as well as a very long shadow of yesterday's candle, this signal can be considered strong enough for the market to pay attention to it and start working out. Do not forget about the additional signal for a decline, which is a bearish divergence of the MACD indicator. All this together does not exclude the continuation of yesterday's decline in the euro/dollar, which is observed at the time of writing.

The main currency pair is currently trading near 1.1877, which is below another important level of 1.1900. At the same time, there are attempts to break through the red line of the Tenkan indicator Ichimoku, which is located at the former resistance level of 1.1882. The closing price of today's trading will be extremely important, however, there are still so many important events ahead that many things can change, and more than once.

EUR/USD bulls are in a rather difficult position. Now, to return the pair to the continuation of the upward trend, they need to absorb the growth of the "shooting star" reversal model, that is, close trading above the highs of September 1 - 1.010. At the moment, this task is very difficult. I dare say that the main impact on the outcome of weekly trading will be Friday's data on the US labor market. Although there will still be many macroeconomic reports before this important statistic. At the moment, we can state a reversal of EUR/USD and expect a further decline, the first target of which will be 1.1854, where the blue line of the Kijun indicator Ichimoku is located.

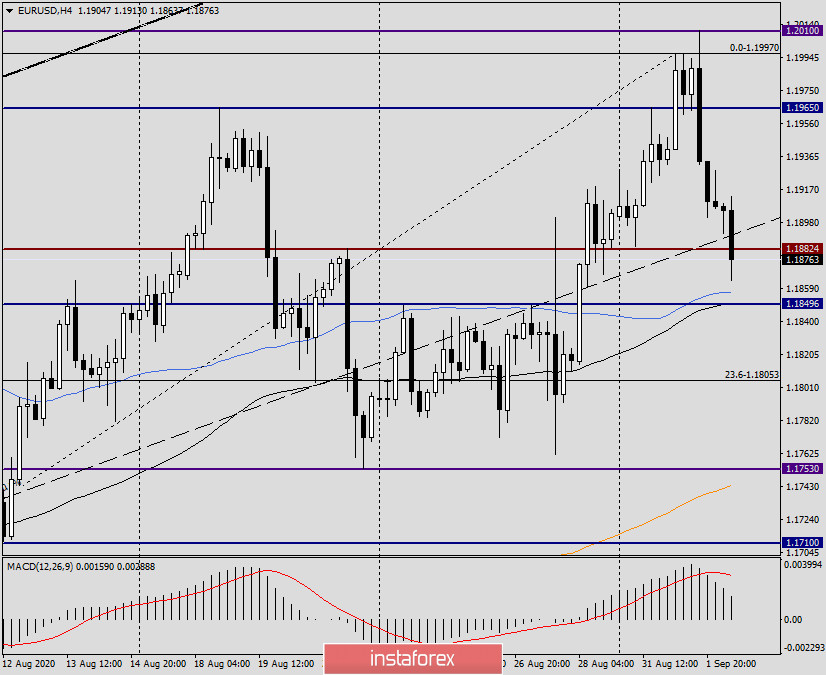

H4

In this timeframe, we can see that the pair is under very strong selling pressure right here and now. I would venture to assume that with a decline in the area of 1.1850, the euro bulls may find support. First, this level itself is quite strong technically. Secondly, there are 50 simple and 89 exponential moving averages, which can provide additional support to the price.

For today, I can offer the following trading recommendations. If bullish reversal patterns of Japanese candlesticks appear in the price zone of 1.1860-1.1850 on the 4-hour or hourly timeframes, this will be a signal for opening purchases. In the case of a true breakdown of the level of 1.1850 and fixing it on a pullback to the broken mark, I recommend trying to sell the single European currency.