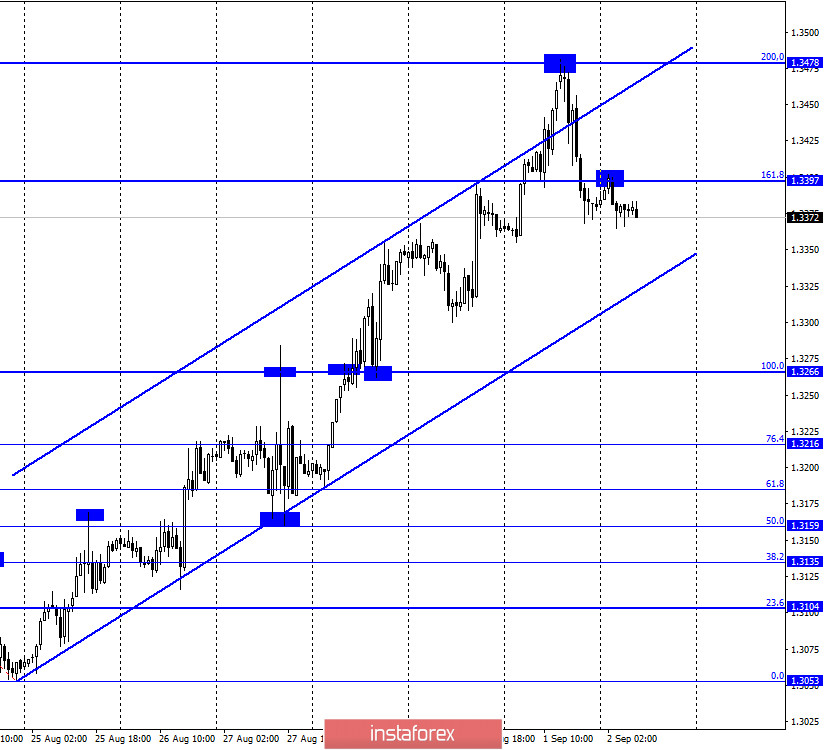

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a rebound from the corrective level of 200.0% (1.3478), a reversal in favor of the US currency, and began the process of falling in the direction of the lower border of the ascending trend corridor. Thus, the mood of traders at this time remains "bullish", and the growth process can be resumed at any time. For example, the rebound of quotes from the lower border of the corridor may work in favor of the British. Fixing the pair's exchange rate under the corridor will increase the probability of further falls. Meanwhile, the speaker of the House of Representatives of the US Congress, Nancy Pelosi, said that negotiations with the party of Donald Trump are continuing, however, the parties still can not reach a consensus on the size of the new aid package, which will be provided to the unemployed, American families and businesses. Pelosi said that the White House does not realize the seriousness of the situation in which Americans find themselves. Republicans are offering a $ 1 trillion aid package and are ready to increase their offer to $ 1.3 trillion. The Democrats are pushing for $ 3 trillion, however, they are also willing to give in and reduce the demands to $ 2.2 trillion.

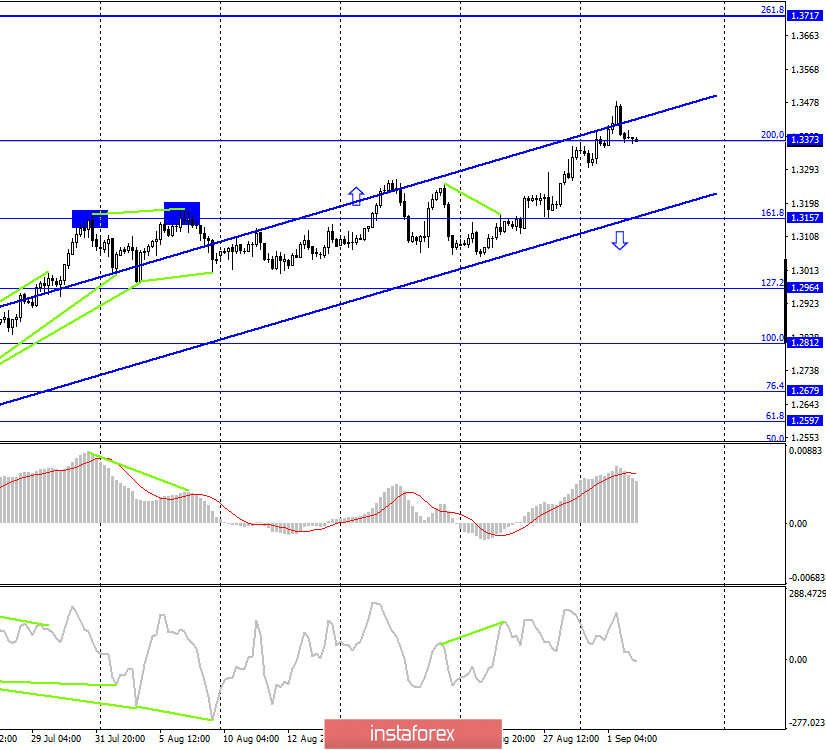

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a rebound from the upper border of the uptrend corridor and a reversal in favor of the US currency with the beginning of a fall in the direction of the corrective level of 161.8% (1.3157). Thus, the current chart now speaks only in favor of continuing the decline in quotes. The closest signal to buy can be formed in the event of a rebound from the lower border of the upward trend corridor, which continues to characterize the current mood of traders as "bullish".

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a consolidation above the corrective level of 100.0% (1.3199), which now allows us to count on continued growth in the direction of the next Fibo level of 127.2% (1.3684).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed above the lower downward trend line. Thus, the growth process can now be continued in the direction of the second downward trend line, fixing above which will further increase the probability of further growth of the British dollar.

Overview of fundamentals:

There were no economic reports in the UK again on Tuesday. Thus, the information background on this day was expressed only by the ISM report for the US manufacturing sector, which helped the US currency to start the growth process.

News calendar for the US and UK:

US - change in the number of employees from ADP (12:15 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (13:00 GMT).

On September 2, Andrew Bailey will give a speech in the UK, which is always interesting. There will also be an important event in America - the ADP report.

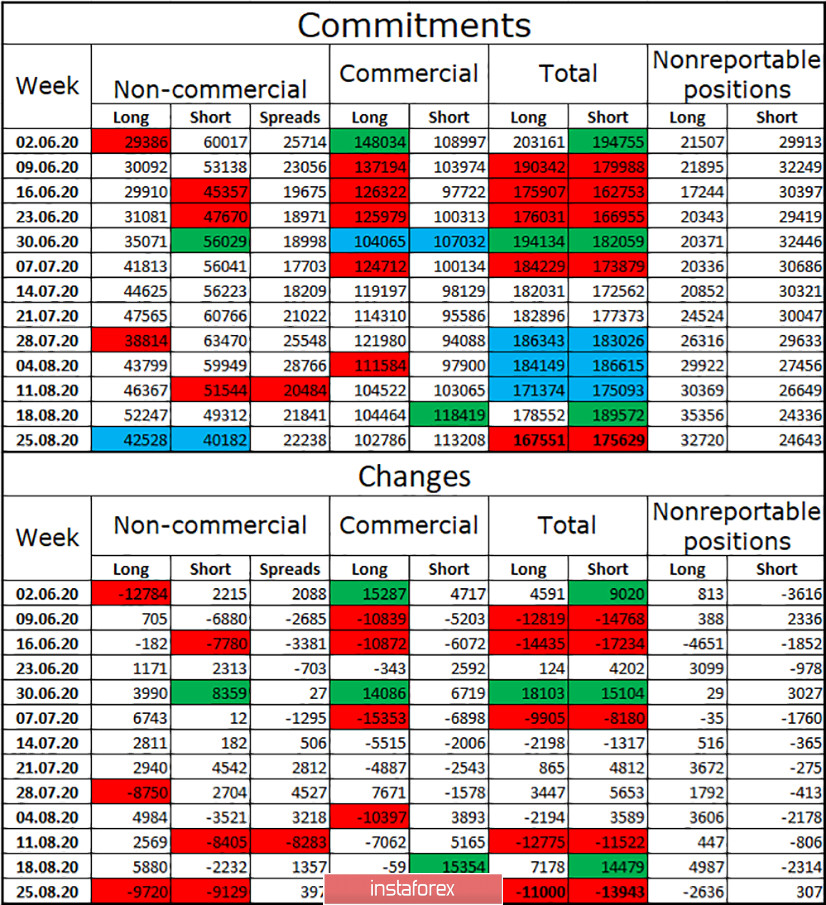

COT (Commitments of Traders) report:

The latest COT report on the British dollar showed a sharp drop in interest among speculators in this currency. A Group of non-commercial traders cut both long and short contracts in equal amounts during the reporting week. Thus, despite the fact that the number of contracts focused on their hands has decreased by 19 thousand, the mood among large traders has not changed, that is, it has not become more "bearish". Thus, according to the COT report, there are still no prerequisites for the end of the upward trend. Moreover, in the last days of last week, the British dollar resumed growth, so we can assume an even more strengthening of the "bullish" mood among major traders. The reduction in the number of contracts for both the "Non-commercial" group and all groups of traders combined did not affect the pair's volatility in any way.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with a target of 1.3200-1.3250, as the rebound from the level of 200.0% (1.3478) was performed on the hourly chart. You can also wait for the quotes to close under the ascending corridor on the hourly chart. Purchases of the British dollar can be opened if there is a rebound from the lower border of the ascending corridor on the hourly chart with the goal of 1.3478.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.