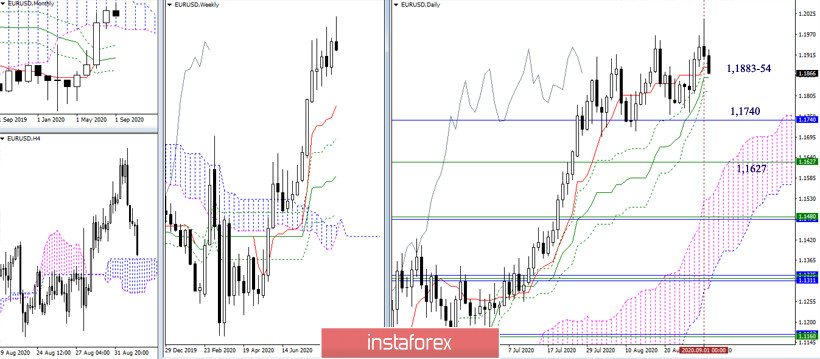

EUR / USD

The bulls took a break after closing the week and month positively. The opponent immediately took advantage of the situation, and currently, we have a correctional decline to the supports of the daily cross (Tenkan 1.1883 + Kijun 1.1854). A consolidation below and a change in the direction of the daily Ichimoku cross will contribute to the strengthening of bearish mood and the development of a weekly correction. On the other hand, the next important support is waiting for the euro at 1.1740 (lower boundary of the monthly cloud) and 1.1627 (weekly short-term trend).

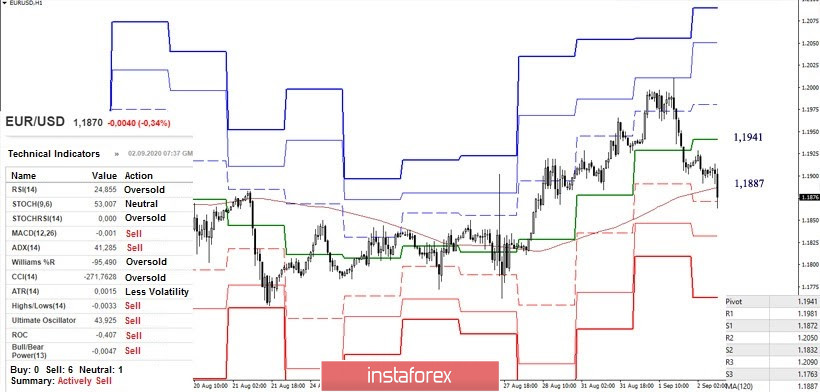

At the moment, the pair on H1 is testing the significant zone 1.1887-72 (weekly long-term trend + S1), breaking through below which will give preference to the lower halves to further strengthen the players on the downside. Today, the next support is expected for the Euro at 1.1832 (S2) and 1.1763 (S3). It should be noted that the 1.1887-72 zone has a gain from the support of the upper halves, so the downside players in this section will decide on the advantages not only in the lower halves, but also on changes in the balance of forces of the upper time intervals. The central pivot level of the day today is located at 1.1941, which currently serves as a resistance. Now, if the pair consolidates above the level, players will be allowed to consider plans to restore their positions and form a rebound from the tested supports.

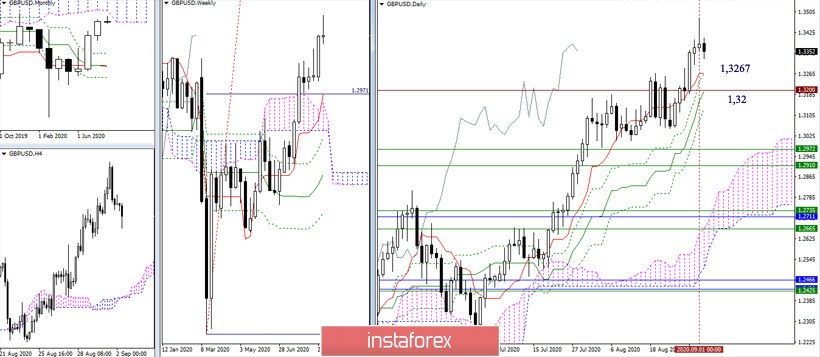

GBP / USD

The tactics of major players in the pound and euro are similar now. Players on the increase successfully closed the previous week and the month of August, after which they took a break, which has now turned into a daily downward correction. The nearest correction reference point is the daily cross of 1.3267 (Tenkan) and 1.32 (Kijun + historical level). A consolidation below will change the current balance of power and open up new prospects for players on the downside.

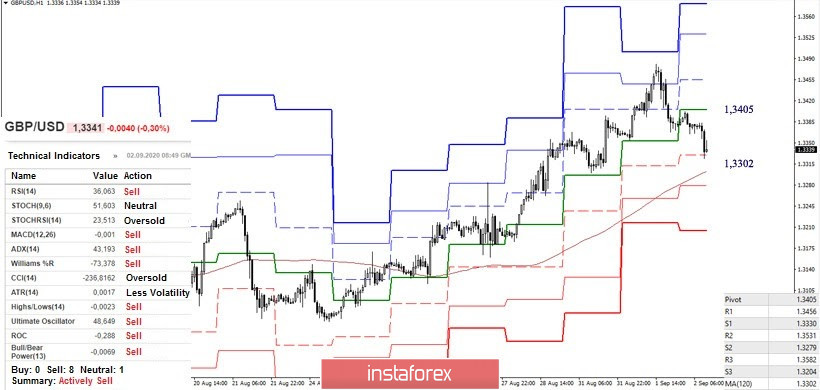

A downward correction at the lower halves led the pair to support levels at 1.3330-02 (S1 of classic pivot levels + weekly long-term trend). A breakdown below will change the balance of power in the lower halves in favor of the bears. Furthermore, testing the support levels for higher halves in the area of 1.3267 - 1.32 will be very important. The supports met can become a reason for the players to slow down and restore their positions. In this case, 1.3405 (central pivot level) and 1.3481 (maximum extreme) will be primarily important for the formation of further prospects.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)