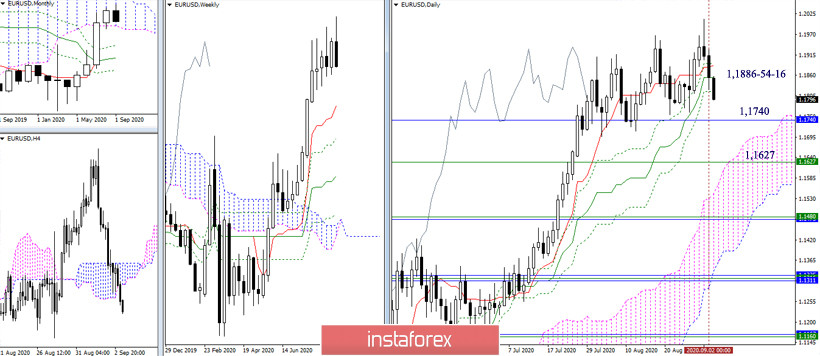

EUR / USD

The downward correction, which has been developing since the beginning of September, continues. At the moment, the issue of liquidating the daily golden cross (1.1816 Fibo Kijun) is being resolved, then the interests of the players on the downside will be directed to the lower border of the monthly cloud (1.1740). The next task will be to perform a weekly correction to support its first reference point, which is the weekly short-term trend currently located at 1.1627.

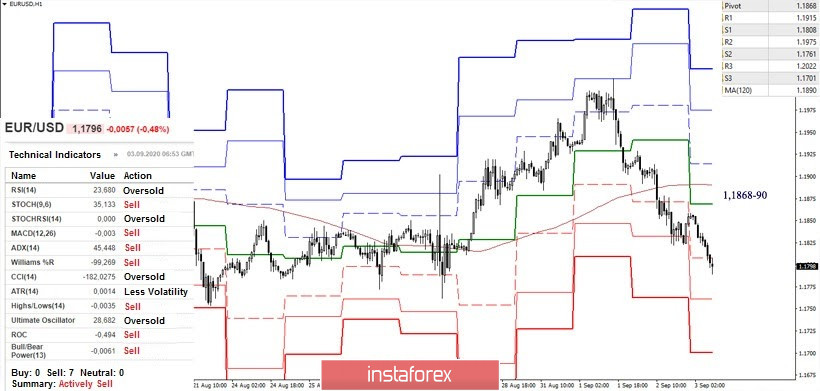

On lower time frames, the advantage is on the side of the players. The downward pivot points within the day are the support of the classic pivot levels 1.1808 (S1) - 1.1761 (S2) - 1.1701 (S3). The key levels of the lower halves, which influence the distribution of preferences, are acting as resistances today and are joining forces around 1.1890 (weekly long term trend) - 1.1868 (central pivot level of the day).

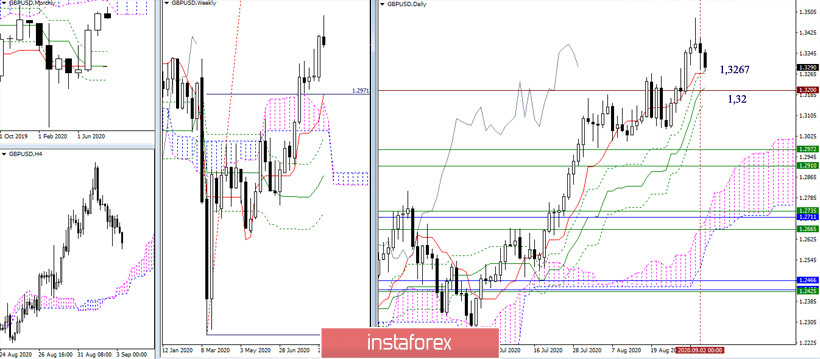

GBP / USD

The downward correction continues to develop. It managed to reach the influence zone of the daily short-term trend, which is now located at 1.3267. Furthermore, it will be important to overcome the most important boundary of this section - 1.32 (historical level + daily Kijun) and the elimination of the daily golden cross. The inability of the support levels to defend the bullish interests will change the current distribution of forces, which is still on the side of the bullish players, despite the correctional decline.

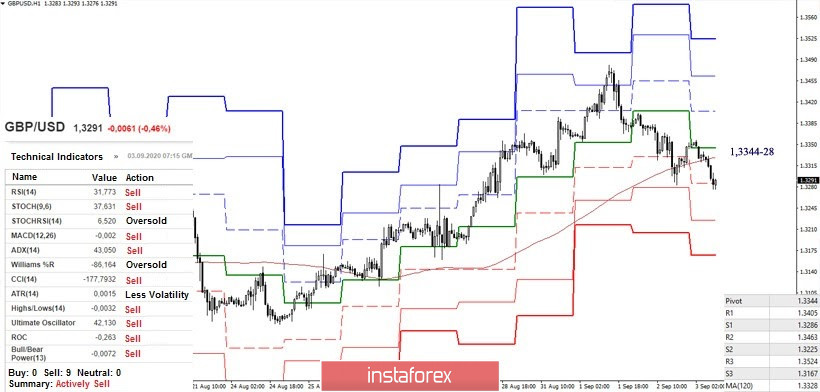

In the lower halves, players try to hold and consolidate their advantage. The classic pivot levels serve as support and downward reference points within the day 1.3286 - 1.3225 - 1,3167. Today, the resistance is formed by the key levels of the lower halves in the area of 1.3344-28 (weekly long-term trend + central pivot level). Now, breaking through it higher can contribute to the pair's decline, with the possibility of forming a rebound from the support of the higher halves.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)