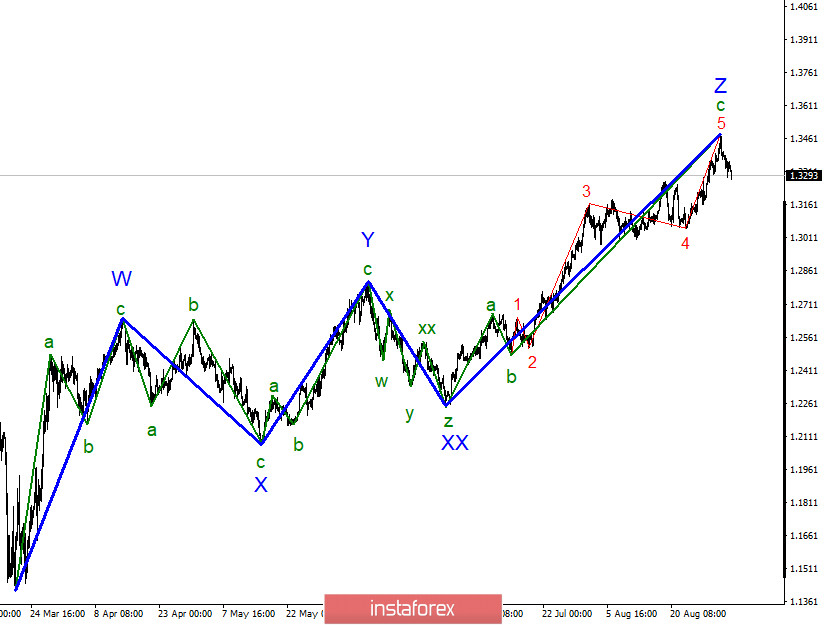

It is presumed that the wave structure of the upward trend is now completed. From the looks of it, wave Z is already complete, which might mean that the upward trend has already ended, thus the instrument will move on to building a new downward trend with targets around 25 and 27 marks. Much, of course, will depend on the news background as well. The strong rise in the pound sterling in recent months cannot be called absolutely logical. Nevertheless, even the wave marking indicates the beginning of the downward trend structure.

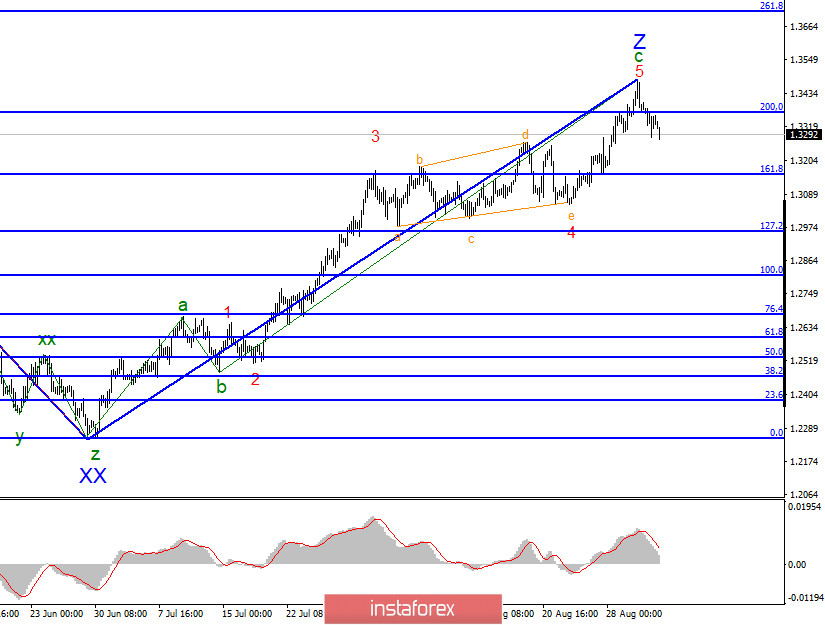

The current wave pattern suggests that the wave z has become more complicated. The wave c in Z, in particular, was significantly longer, and the wave 4 in c in Z has established a triangle formation. The very same tool has carried out a successful attempt to break the level of 200.0% Fibonacci but later began to retreat from the highs, which suggests the completion of the construction of wave 5 in Z. As initially stated, the internal wave structure of the wave Z can be so complicated almost indefinitely. Its current appearance, alone, already implies that it is completed. Thus, the working option at this time is to build a new downward wave.

The news background from Great Britain at the beginning of the current week turned out to be rather weak. On Wednesday, the Governor of the Bank of England, Andrew Bailey gave optimism to the markets, through his speech, saying that the use of negative interest rates in the near future is not planned. "They are part of our toolbox, but we are not going to use them anytime soon," Bailey said. However, the optimism in Bailey's rhetoric did not last long, as he almost immediately stated that the risks to the economy still remain at a fairly high level, since the problems of coronavirus and Brexit have not gone away. Moreover, the risks associated with the pandemic are even higher than the risks associated with Brexit. In addition, the Bank of England may decide to increase the asset repurchase program by 50 or 100 billion pounds in the coming meetings.

Another speech by the Governor of the Bank of England will take place this afternoon, important information is expected to be heard. In general, however, I cannot say that Wednesday's comments or statistics triggered a market reaction. Thus, the news background is now having a strong influence on the movement of the instrument. Moreover, the index of business activity in the US services from ISM is expected today and market participants expect an increase of 57%. Any reading below this level could lead to a slight drop in the US dollar.

General conclusions and recommendations:

The Pound-Dollar instrument has presumably completed the construction of the upward wave Z. Thus, at the moment, I would recommend selling the instrument with targets located around 1.3158 and 1.2960, which corresponds to 161.8% and 127.2% Fibonacci. The upward part of the trend may take on a more complex form, but for this, you need to wait for a successful attempt to break the current high of wave 5 in c in Z.