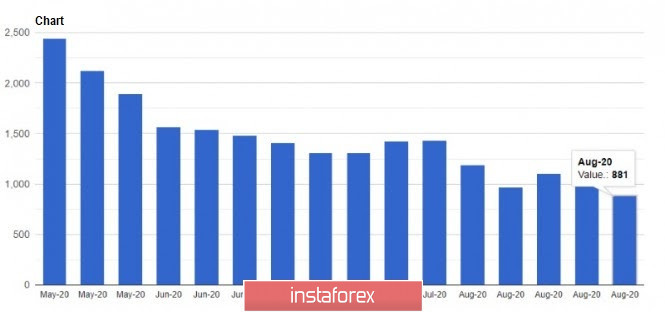

US jobless claims dropped sharply last week, indicating an improvement in the market situation. However, it still did not increase dollar demand in the market, so USD kept on trading around its current level.

Today though, a more important report will be published for the US labor market, and it will set the direction of USD. If data on non-farm payroll coincides with the forecasts, that is, an improvement or recovery in the indicator, demand for the dollar will rise, which will cause EUR/USD to decline.

Thus, the bears should become active in trading EUR/USD, since only a breakout from 1.1830 will lead to a price decrease to weekly low 1.1790. Passing this range will quickly push the quote down to 1.1750 and 1.1710, and perhaps, even return the price to the 16th figure.

However, if the US report come out weaker than the forecast, bulls may be able to return the quote to 1.1880, or to 1.1910-1.1950.

Meanwhile, data on US foreign trade deficit was also published yesterday, which has improved, largely due to recovery in imports. Thus, deficit rose 18.9% in July and amounted to $ 63.6 billion, while economists had expected it to be $ 58.9 billion. This growth in the indicator means that consumer spending is increasing in the US, and demand for American goods are also rising from abroad.

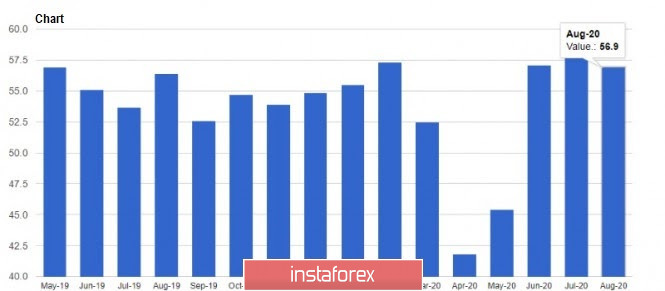

As for economic activity in the US non-manufacturing sector, the report of ISM indicated an improvement in the month of August, however, its growth rate slowed due to the current social distancing measures that continue to put pressure on the service industry, as well as the resurgence of coronavirus in the country. Thus, PMI was just 56.9 points, while economists expected it to be 57.0 points.

GBP/USD

The British pound stopped its decline against the US dollar, but this pause is likely to be temporary. This is because uncertainty remains high on the issue of trade negotiations between the UK and the US, since a compromise seems to be quite difficult to reach

Negotiations between the UK and the EU remain to be a problem as well, as up until now, no obvious compromises have been found. Both sides are stubbornly defending their demands, thus, very few are expecting the conclusion of a deal. Nonetheless, possibility for it remains, since the EU may make concessions given the difficult situation both countries are experiencing now.

In another note, GBP/USD declined yesterday, after the quote broke out of support level 1.3315. Its next movement will depend on the published data for US non-farm payrolls, which, if the indicators come out better than forecasts, the quote may move past 1.3240 and head to 3165 or 1.3060. Movement will only become bullish if the quote consolidates above 1.3380, but such could only occur if non-farm payrolls turn out weak and below the forecasts.