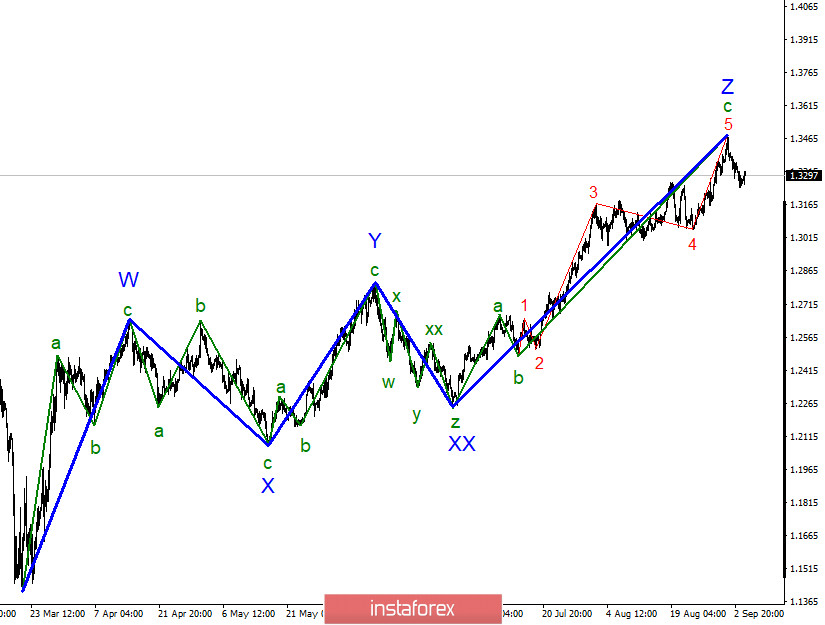

The wave structure of the uptrend area is almost completely formed. Wave Z looks quite complete, so the entire upward area of the trend can be completed. The trading instrument may build a new downward area of the trend with the first targets located around 25 and 27 patterns. In fact, almost everything depends on the news background, especially the form of the new downtrend. Demand for the US dollar has been extremely weak in recent months. Thus, if it remains unchanged, it will see the construction of a triangle or similar non-pulse wave structure in the best-case scenario.

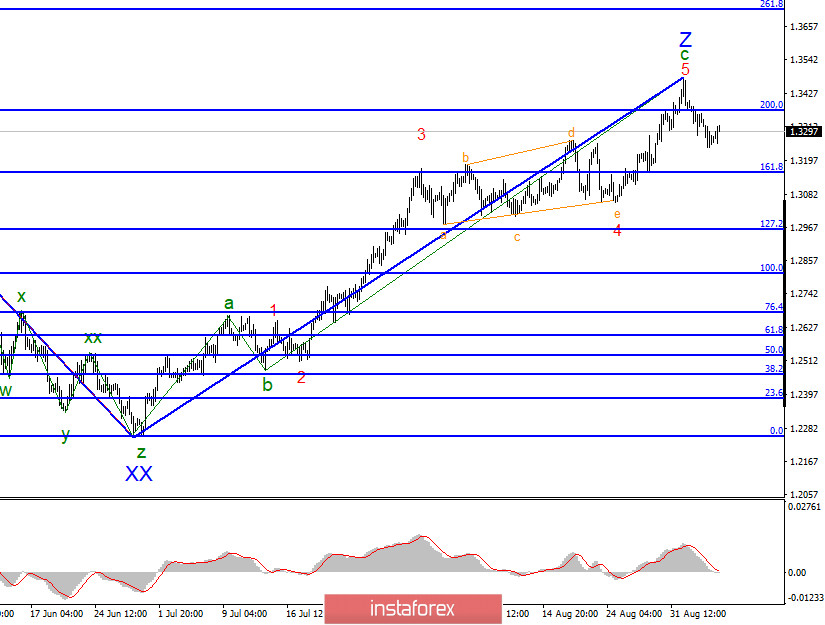

However, a closer examination of the current wave pattern allows us to see that the upward trend and, in particular, wave Z became more complicated and the waves c in Z and the wave 4 in C in Z became much longer. All this made a form of a triangle. The instrument itself made a successful attempt to break the 200.0% Fibonacci level, but later began to move away from the reached highs, which suggests that the construction of the 5 in c in Z is complete. As I said earlier, the internal wave structure of the Z-wave can be complicated almost indefinitely. However, its current appearance already implies that it is complete. Thus, the working option at this time is to build a downward wave.

During this week, the news background from the UK has been quite mixed. But I believe that the decline in the UK's quotes has grounds. After all, the wave marking warned us long ago about the formation of a downward wave. Moreover, there is not enough news to boost the pound sterling. This week, the Governor of the Bank of England, Andrew Bailey, allegedly promised not to introduce negative rates in the near future, but no one knows what will happen in a few months. If the economic situation requires it, then Andrew Bailey will have to break his promise. Moreover, Bailey did not say that the Bank of England will not expand the QE program, which is also an important monetary policy tool and can also put pressure on the British currency. At the same time, economists believe that the Bank of England will surely expand QE by 50 or 100 billion. And no one knows what will happen in 2021, given that there is no deal with the European Union and it is unlikely to be. The next stage of negotiations ended, and Michel Barnier called it "disappointing". There is no progress, so London and Brussels will hardly be able to reach a consensus on the most important issues of the agreement.

General conclusions and recommendations:

The pound/dollar pair has presumably completed the construction of upward wave Z. Thus, I would recommend selling the instrument with targets located near the 1.3158 and 1.2960 levels, which correspond to 161.8% and 127.2% of Fibonacci. The upward area of the trend may take a more complex form, but to do this, we need to wait for a successful attempt to break the current maximum of the wave 5 in C in Z.