Dollar demand increased in the market since last Friday, largely due to the release of very good data on the US labor market.

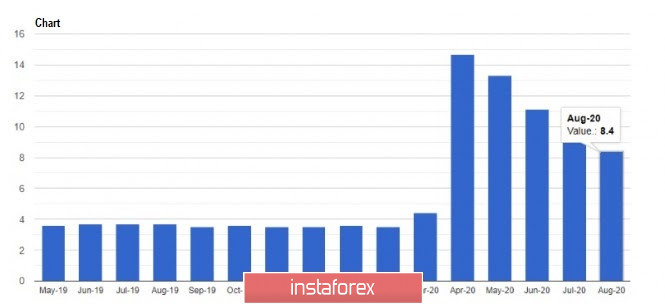

The report indicated that unemployment rate in the US dropped significantly this August, because of the return of self-employed and contracted workers to their work, as well as 1.4 million new jobs created in the country.

These new jobs were outside of agriculture and have contributed to the 8.4% drop in unemployment. It also suggests that economic recovery shall continue in the country, and may even jump sharply this 3rd quarter.

Thus, Fed officials called on the government to once again support the economy, asking for more stimulus measures and ultra-soft monetary policy. Such are needed to limit further damage to the economy, which suggests that in the next few years, interest rates will not increase in the US until these programs are completed.

With regards to EUR/USD, the bulls are currently focused on 1.1790, as a breakout from which will lead to the resumption of a bear market, which will push the quote to the lows of 1.1710 and 1.1640. However, if the bulls manage to raise the pair to 1.1870, then the quote will most likely return to 1.1950, and then test the 20th figure.