The EUR/USD pair dropped as much as 1.1290 today where it has found support. Now, it's trading at the 1.1319 level. The pair rebounded as the Dollar Index has slipped lower after the US data came in worse than expected. Still, don't forget that the Dollar Index maintains a bullish bias as the FED is expected to take action and hike rates soon.

In the short term, fundamentally, the euro was somehow expected to appreciate after the Euro-zone reported some positive figures. The German Flash Services PMI jumped from 48.7 to 52.2 points even if the traders expected a potential fall to 47.9, the German Flash Manufacturing PMI raised unexpectedly from 57.4 to 60.5 points, while the Euro-zone Flash Manufacturing PMI was reported at 59.0 above 57.6 expected.

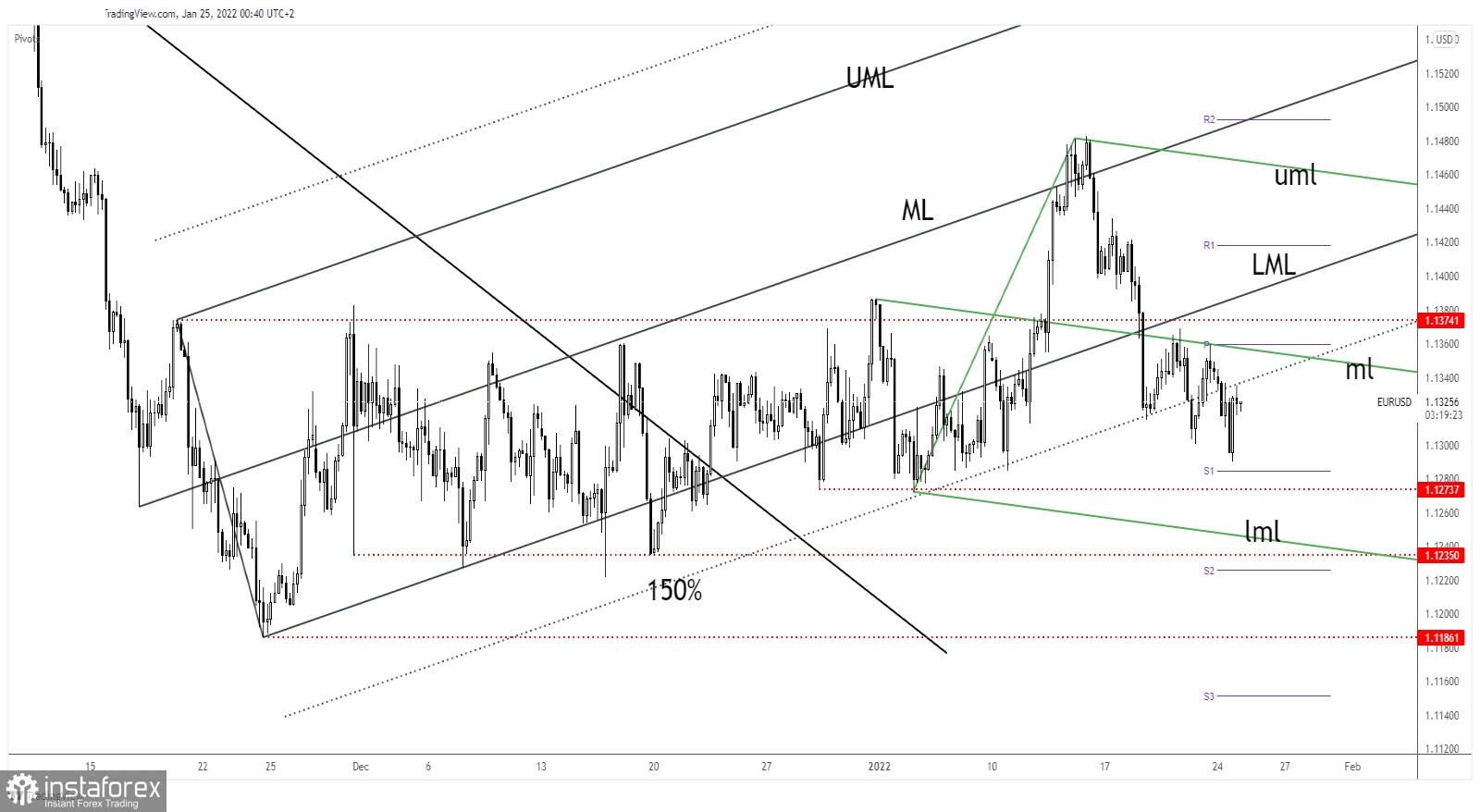

EUR/USD Rebound Could Be Over!

EUR/USD increased and now it has retested the broken 150% Fibonacci line which represented strong dynamic support. You already knew from my analysis that a valid breakdown below this line could announce that the upside is over and that the pair could drop towards new lows.

In the short term, EUR/USD could test and retest the immediate upside obstacles before dropping towards new lows. The 150% Fibonacci line and the median line (ml) of the descending pitchfork represent the near-term resistance levels.

EUR/USD Forecast!

Registering false breakout above the immediate resistance levels could bring new short opportunities. Also, a new lower low, dropping and closing below the 1.1290 could activate more declines.