Crypto Industry News:

The idea of banning cryptocurrencies in Russia sparked a wave of criticism from many famous names, including Chief of Staff Alexei Navalny Leonid Volkov and the founder of the Telegram communication platform - Pawel Durov.

On January 20, the Russian Central Bank published a report proposing a complete ban on cryptocurrency trading and mining. As stated in the document, the risk associated with digital assets is "much higher in emerging markets, including Russia".

It seems, however, that the idea was not approved by many members of the local high-tech community. One of the opponents turned out to be Pawel Durow:

"Such a ban will inevitably slow down the overall development of blockchain technology. These technologies improve the efficiency and safety of many human activities, from finance to art. "

While Durov admitted that "it is natural for any financial authority to want to regulate the circulation of cryptocurrencies," he concluded that "such a ban is unlikely to stop unscrupulous players, but will put an end to legitimate Russian projects in this area."

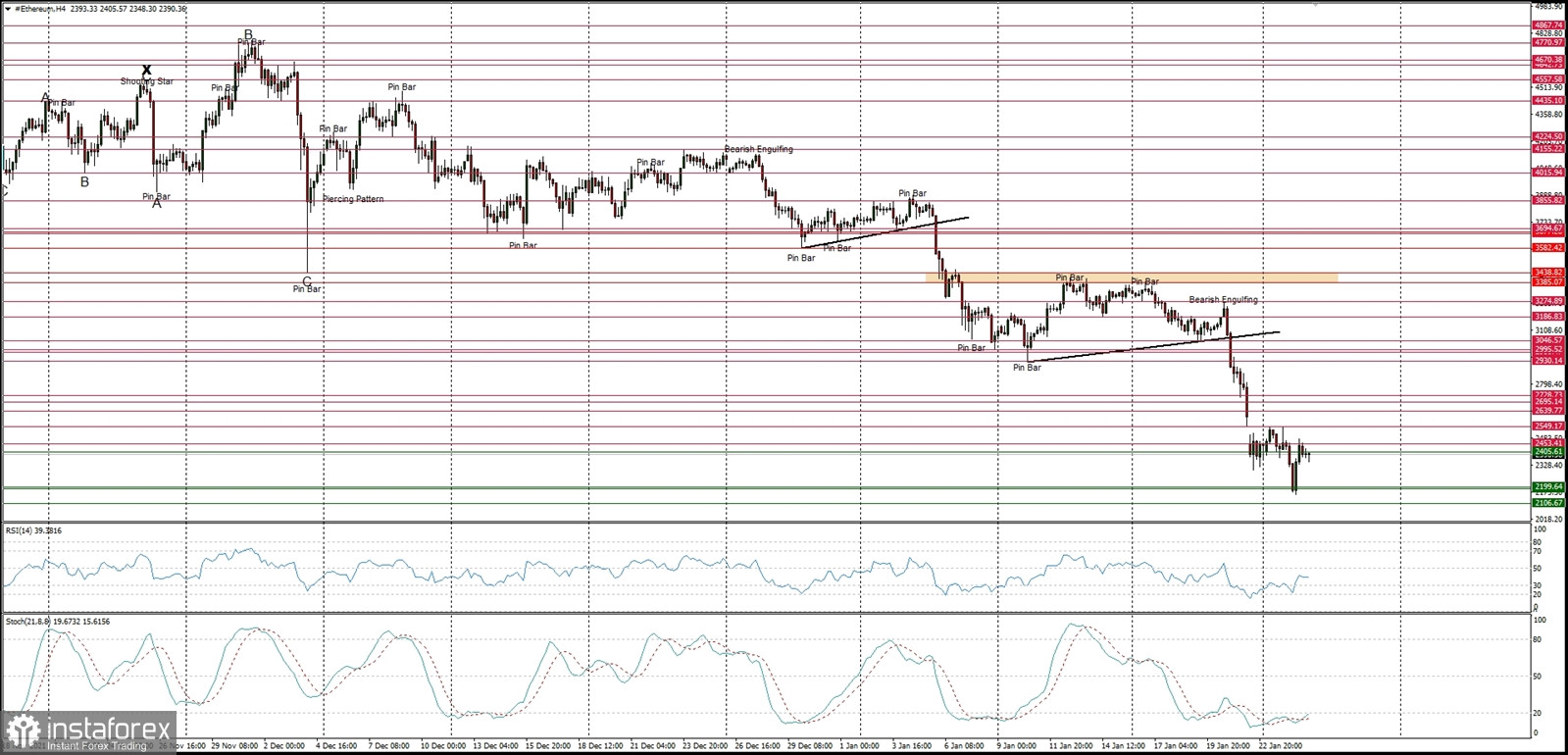

Technical Market Outlook

The ETH/USD bulss are trying to bounce after the level of $2,199 had been hit recently. The next target for bears is seen at the level of $2,000, $1,941 and $1,731- this is the line in sand before a collapse under the $1,000 level. On the other hand, the nearest technical resistance are $2,549, $2,638, $2,778, $2,930 and $3,000. The market conditions are extremely oversold on H4 and Daily time frames, so this might help the demand side to bounce higher.

Weekly Pivot Points:

WR3 - $3,996

WR2 - $3,638

WR1 - $2,926

Weekly Pivot - $2,584

WS1 - $1,819

WS2 - $1,512

WS3 - $812

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.