During the Asian session, the euro/dollar pair continued to gradually decline to the base of the 18th figure, demonstrating the priority of bearish moods. It has been sliding down for a week already, that is, since the ECB chief economist Philip Lane was concerned about the growth of the euro rate. Since then, buyers of EUR/USD have been on the defense in anticipation of the September meeting of the European Central Bank, which will take place this Thursday. The market is afraid of conducting or announcing currency interventions, although in my opinion, everything will be limited to verbal interventions at the current stage. As you can see, Lane's verbal "attack" had a positive effect from the ECB's point of view: the EUR/USD pair fell by more than 200 points in just a week, that is, from a multi-month high of 1.2011 to the current level of 1.1805.

The EUR/USD bears clearly intend to test the nearest support level of 1.1740 (the lower line of the Bollinger Bands indicator on the daily chart). But there is one warning here: the US currency is still a vulnerable currency, which is under the pressure of its own problems. The weakness of the euro does not allow buyers of EUR/USD to return to the area of the 19th figure, but similar weakness of the dollar does not allow the bears to go below the support level of 1.1740. Moreover, at the moment, the bears cannot even consolidate in the area of the 17th figure, not to mention test key levels.

Let me remind you that the dollar is under pressure due to Fed's updated strategy. The Fed's new tactic, which provides for a more flexible approach to inflation targeting, actually postponed the term of the interest rate increase. And if inflation grows at a slower pace relative to preliminary forecasts, the dollar will fall in price, even despite the positive dynamics of the US labor market. Moreover, the problem of low inflation with an increase in the number of employees and a decrease in the unemployment rate worried the members of the Fed and Jerome Powell even before the coronavirus crisis. Before him, Janet Yellen also spoke about this, stating that such an uncorrelation looks unusual.

Therefore, the August Nonfarms had a limited impact on the market, especially before the release of data on the growth of US inflation. According to general forecasts, the general consumer price index will decline on a monthly basis to 0.3% (from the previous value of 0.6%), and on an annual basis to 0.9%. The core index (excluding food and energy prices) should demonstrate similar dynamics - slowdown in growth is expected both in monthly and annual terms. If the indicators come out worse than rather weak forecasts, the dollar will be under a wave of sales. Considering such prospects (albeit of a hypothetical nature), traders are not in a hurry to invest in the dollar, and this fact allows the EUR/USD pair to flat at the base of the 18th figure.

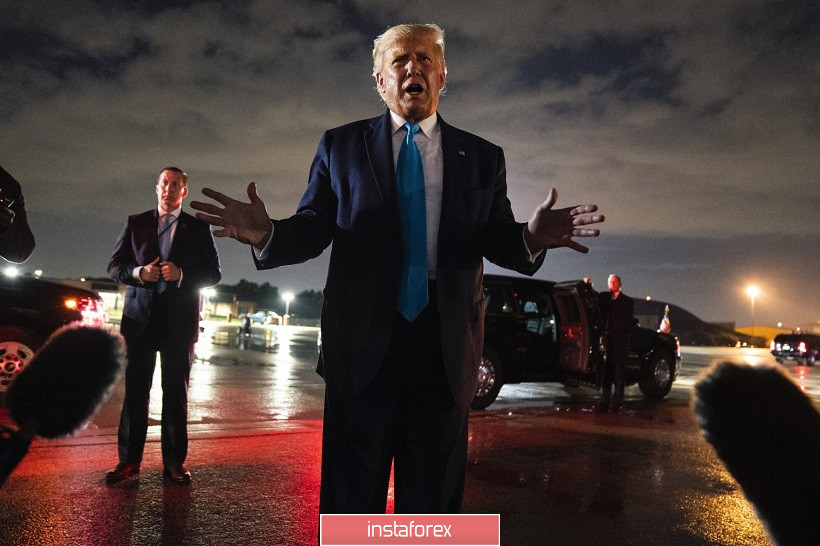

In addition, the US currency is under pressure from another factor – politically this time. Here, the US-China relations were targeted again: Trump is stepping up anti-Chinese rhetoric, and the White House plans to impose a ban on the import of cotton products from China. For example, the US President announced again yesterday that if he was re-elected, he would "end the country's dependence on the Chinese economy." According to him, during his second term of office, the White House will be able to return jobs from China, and companies that want to leave the States "will be required to pay colossal amounts." The president also repeated the mantra that America is losing billions of dollars in the course of disadvantageous economic cooperation with Beijing.

And if Trump's rhetoric can be viewed through the perspective of the election campaign, then the White House's sanctions intentions are quite practical and clear. According to The New York Times, Washington may impose a ban on the import of cotton products from Xinjiang in connection with the alleged violation of human rights there. Earlier this summer, Trump signed into law sanctions against China over violations of Uygur rights. But then those people and organizations that, in the opinion of the American side, were involved in the persecution fell under restrictive measures. In this regard, human rights groups estimate that more than a million Uygurs and other Muslim minorities are in "re-education camps" where they are forced to abandon their religion, culture and language.

Now, this issue may shift to the economic plane. According to journalists, the corresponding ban may be introduced by the US Customs and Border Protection Service today. But at the moment, the scope of the sanctions ban is unclear. According to some reports, cotton products imported into the United States exclusively from the Xinjiang Uygur Autonomous Region will be banned, while some reported that imports of products from China will be banned as a whole. Third sources claim that the restrictions may also affect foreign clothing manufacturers using raw materials and products from Xinjiang, China. In view of the continuing intrigue, dollar bulls are in no hurry to react to this fact - if the ban is local in nature, the dollar will ignore it. But if it's on a larger scale, the dollar will be under pressure.

In any case, it can be stated that anti-Chinese rhetoric is now "in trend" in the United States, at least due to the fact that the country is now in the midst of the election campaign. Therefore, it remains under background pressure until the presidential elections, which will be held in November. Technically, the behavior of the dollar in the medium term will depend on the behavior of inflation indicators. The European currency, in turn, is awaiting the September meeting of the ECB.

In view of this uncertainty, the EUR/USD pair will continue to hang out in a flat, at least until Thursday, when the ECB will announce its verdict. Therefore, at the moment, we can consider short positions with the main target at around 1.1740 (the lower line of the Bollinger Bands indicator on the daily chart). And with a cautious approach to this target, it is advisable to open longs - with the targets of 1.1800 and 1.1850.