Trading recommendations for EUR / USD on September 9

Analysis of transactions

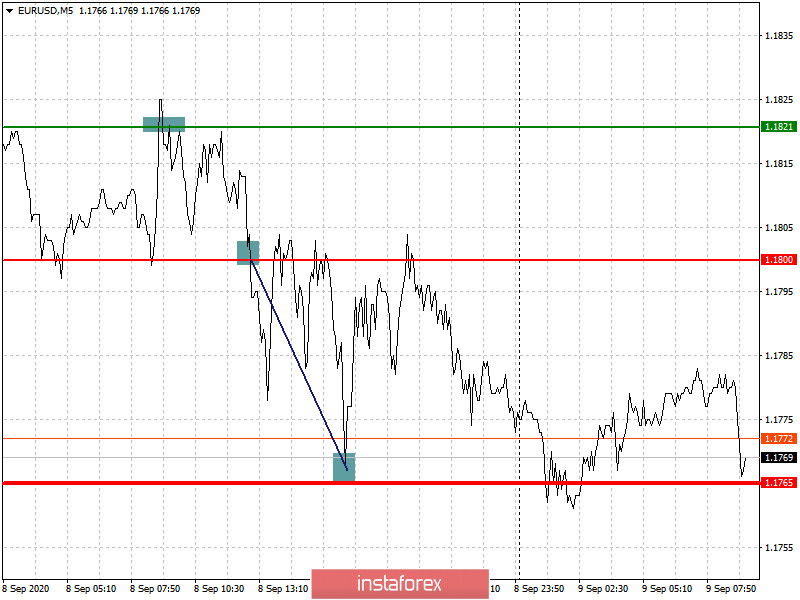

Another unsuccessful attempt to raise EUR / USD in the market resulted in losses, however, a sell signal, which was formed after the test of 1.1800, made it possible to compensate for the minus. Thus, the quote moved downwards by about 30 pips, almost bringing the price to the target level of 1.1765. The main cause of this decline was the weak data on the EU labor market and economy.

Today, the calendar is empty of important events, but tomorrow, the ECB will announce its decision on interest rates. In line with this, it is likely that pressure on the euro will continue, but for this, it is necessary to break below today's lows.

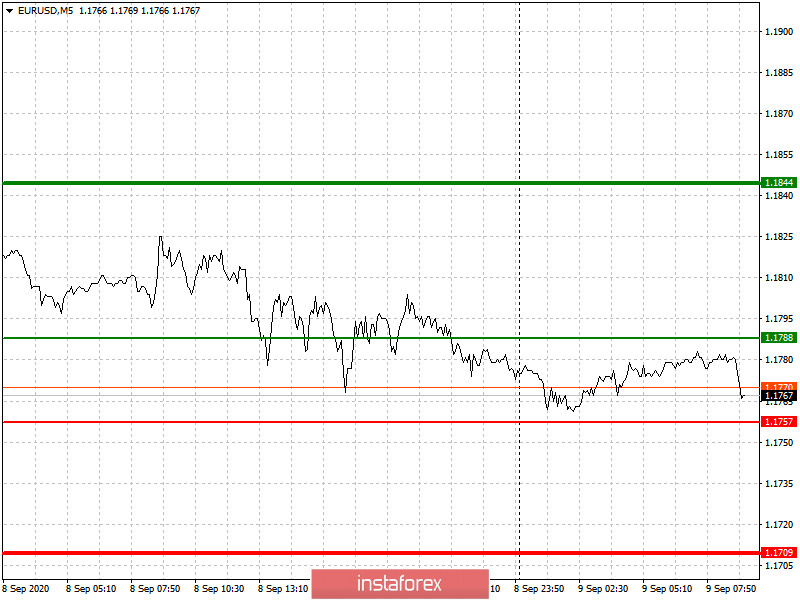

Thus,

- set long positions from 1.1788 (green line on the chart), and take profit at the level of 1.1844. However, it is difficult to see a large upward movement in EUR / USD today.

- Meanwhile, sell shorts from 1.1757 (red line on the chart) to 1.1709, as such will lead to a further decline towards new lows in EUR / USD.

Trading recommendations for GBP / USD on September 9

Analysis of transactions

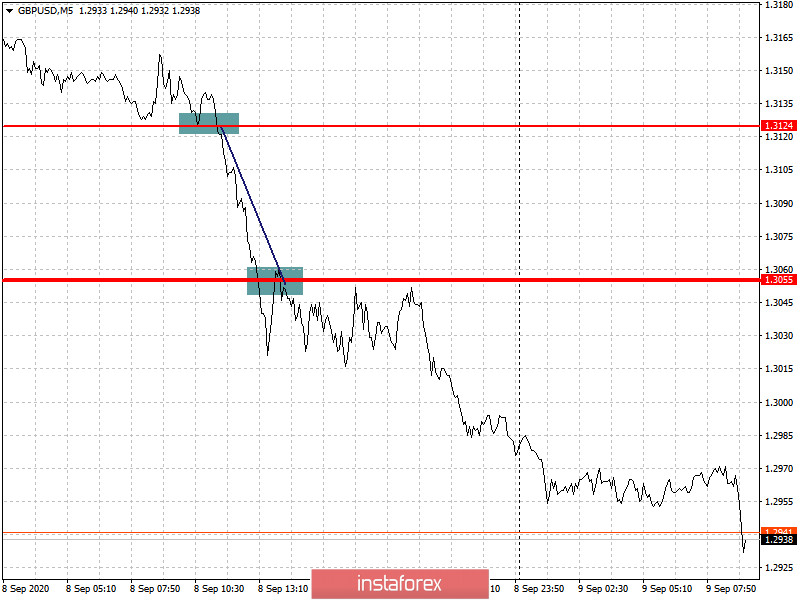

Demand for the pound remains low in the market, largely due to uncertainty surrounding Brexit and its trade agreement. As a result, bears are ahold of GBP / USD, pulling the price down by 70 points.

Most likely, the pair will continue to fall even lower, since no good news is expected. In addition, the harsh statements of UK Prime Minister Boris Johnson puts more pressure on the pound, which drags GBP / USD down in the market.

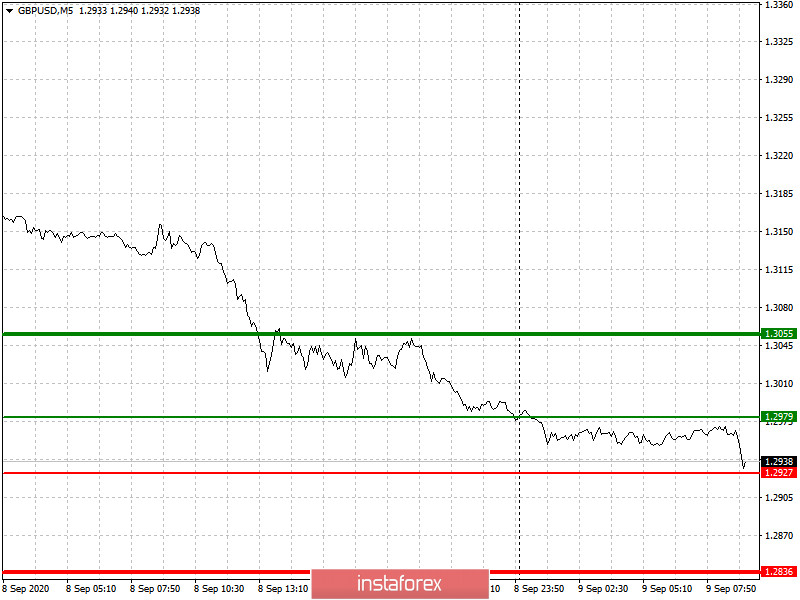

- Trading long positions is very risky today, thus, set them from 1.2979 (green line on the chart) and take profit at the level of 1.3055 (thicker green line on the chart).

- As for shorts, sell from 1.2927 (red line on the chart) and take profit at the level of 1.2836.