GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair continued to fall in the direction of the corrective level of 127.2% (1.2937). Closing the pair's rate below this level will increase the probability of a further drop in quotes towards the next corrective level of 161.8% (1.2789). The information background from the UK in the last week concerns strictly Brexit and negotiations between Brussels and London, which from time to time end very badly. The other day, Boris Johnson reiterated that he is not afraid to leave the EU without a trade agreement and conduct trade from 2021 under WTO rules. Moreover, Boris Johnson has set a deadline by which any negotiations must end on October 15. This date looks like a mockery given the current realities in which the groups of Michel Barnier and David Frost are located. The parties failed to resolve the key issues in 6 months, and Boris Johnson believes that they can be completed in 5 weeks. The British Prime Minister still wants an exclusive trade agreement, following the example of Australia or Canada. Further, the European Union is not going to go along with London, which shows no desire to concede in the negotiations. Thus, it seems that the negotiations will end in nothing, and traders will continue to sell off the British.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair secured under the lower border of the upward trend corridor and the Fibo level of 38.2% (1.3010). Thus, the fall in quotes can now be continued in the direction of the next corrective level of 50.0% (1.2867). Today, the divergence is not observed in any indicator. The mood of traders changed to "bearish".

GBP/USD – Daily.

On the daily chart, the pair's quotes closed under the corrective level of 100.0% (1.3199). Thus, on the daily chart, the pair performed a reversal in favor of the US currency and now has a high chance of continuing to fall in the direction of the corrective level of 76.4% (1.2776).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed above the lower downward trend line. Thus, the growth process can now be continued in the direction of the second downward trend line, fixing above which will further increase the probability of further growth of the British dollar.

Overview of fundamentals:

There were no major economic reports in the UK or the US on Tuesday. However, there are far more important events for Britain right now than economic reports.

News calendar for the US and UK:

On September 9, the UK and US news calendars again do not contain any interesting reports. However, there may be new information about the negotiations between Britain and the European Union on Brexit, which will again affect the demand for the British.

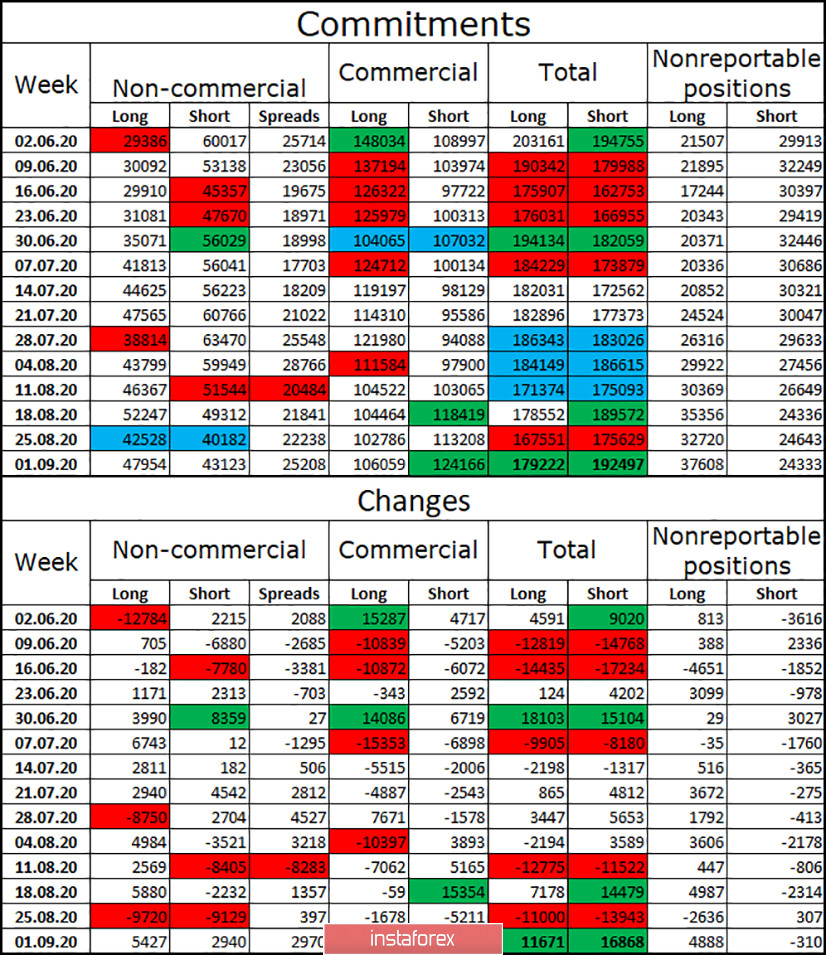

COT (Commitments of Traders) report:

Unlike the COT report on the euro, the latest COT report on the British pound was completely different. Major speculators during the reporting week again increased long-contracts, and also increased short-contracts. Thus, the mood of the "Non-commercial" group as a whole remained "bullish". Over the past 10 weeks, the total number of long contracts focused on the hands of speculators has also increased significantly, while the number of short contracts has decreased. So, according to the latest report, I can't conclude that the major traders have already decided to get rid of the pound. However, graphical analysis shows that the British pound has a high chance of continuing to fall. Thus, the next COT report may show a weakening of the bullish mood of major traders. I remind you that COT reports should not be used as signals to open position. They only show the mood of major traders.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with the targets of 1.2867 and 1.2720, as the quotes were fixed under the ascending corridor on the 4-hour chart and under the level of 38.2% (1.3010). I do not recommend opening purchases of the British dollar in the near future, as the pair has just established itself under the trending upward corridor.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.