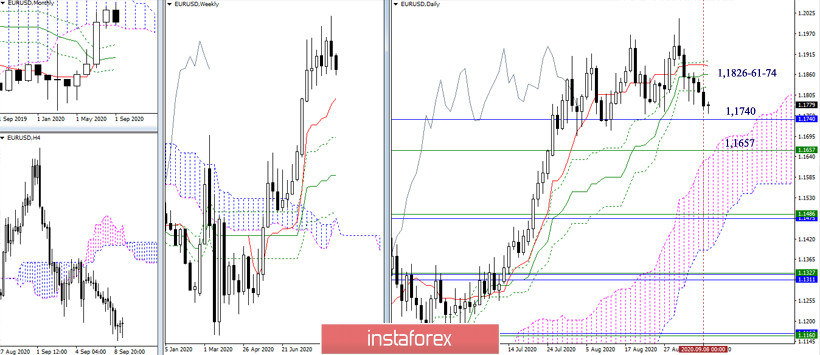

EUR / USD

The pair continues to decline, while downward reference levels retain their relevance and positions. The first support is waiting for the euro at 1.1740 (the lower border of the monthly cloud), then the weekly short-term trend (1.1657) and the daily cloud will come into operation. The daily cross is now left behind and formed a resistance zone at 1.1826-61-84.

In the smaller halves, the bearish players continue to maintain the advantages and support of all analyzed technical instruments, despite the current small upward correction. Here, the downward targets are supporting the classic pivot levels 1.1752 - 1.1729 - 1.1691 if the decline continues within the day. Meanwhile, the key resistances on H1 are located today at 1.1790 (central pivot level) and 1.1822 (weekly long-term trend). Breaking through above which will affect the current balance of power. In this case, it would be better to reevaluate the situation.

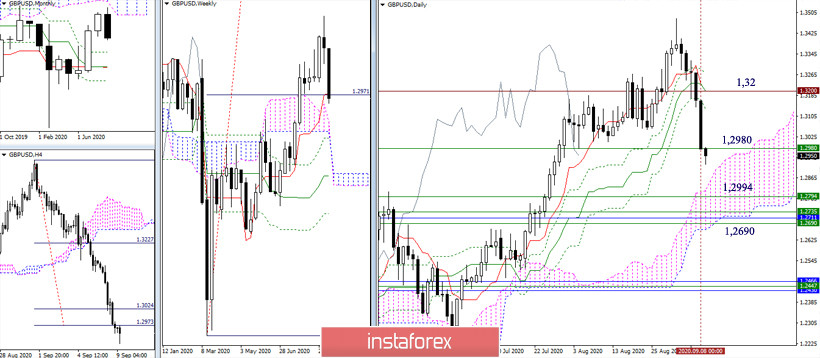

GBP / USD

The area of the historical confrontation 1.32 did not allow players again to build far-reaching plans for the increase. Over the past day, the bears have shown the greatest performance. As a result, support for the weekly short-term trend (1.2980) is now being tested and a downward target for breaking the four-hour cloud has been worked out. The following downward benchmarks combine their efforts in a fairly wide zone of 1.2994-1.2690 (weekly levels + monthly Fibo Kijun + daily cloud).

In the lower halves, bears are actively dominating. The downward trend is still developing and now, the first support of the classic pivot levels 1.2913 (S1) is being tested. We also have further intraday supports that are located at 1.2848 (S2) and 1.2721 (S3). If an upward correction develops, its key reference points at H1 can be noted at 1.3040 (central pivot level) and 1.3199 (weekly long-term trend), and the intermediate resistance at 1.3105 (R1).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)