Trading recommendations for EUR / USD on September 10

Analysis of transactions

Unsuccessful attempts to bring the quote down from 1.1757 brought losses, but fortunately in the afternoon, longs from 1.1788 gave more than 40 points of profit, which compensated the minus realized earlier.

This sharp rise in the euro is largely due to expectations that the ECB will revise its prospects for economic recovery. In addition, the bank will announce its decision on interest rates today, which will certainly affect trading in the market, favoring bullish sentiments in particular.

- Set long positions from 1.1841 (green line on the chart) to 1.1899, and then take profit at 1.1899. However, a large movement will not occur if the ECB does not announce serious changes in the monetary policy.

- Sell shorts from 1.1817 (red line on the chart) to 1.1750, as such will lead to a further decline to the area of weekly lows.

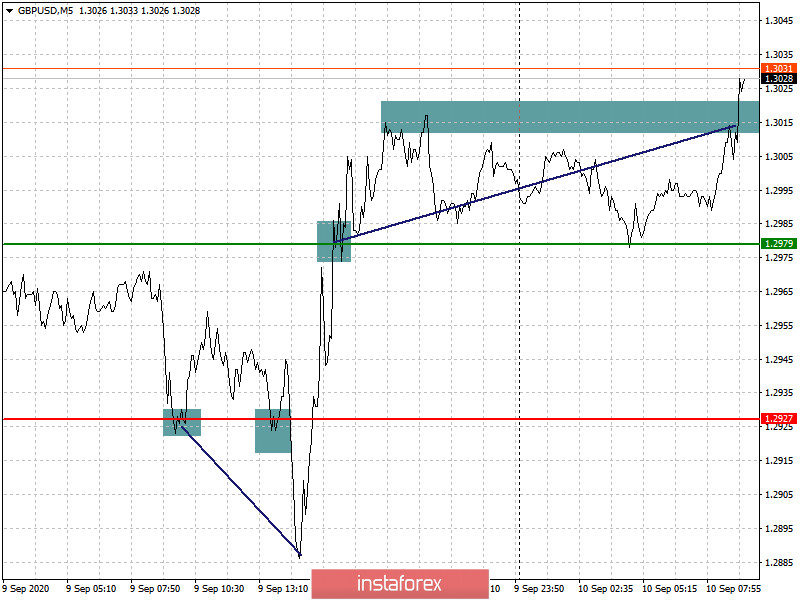

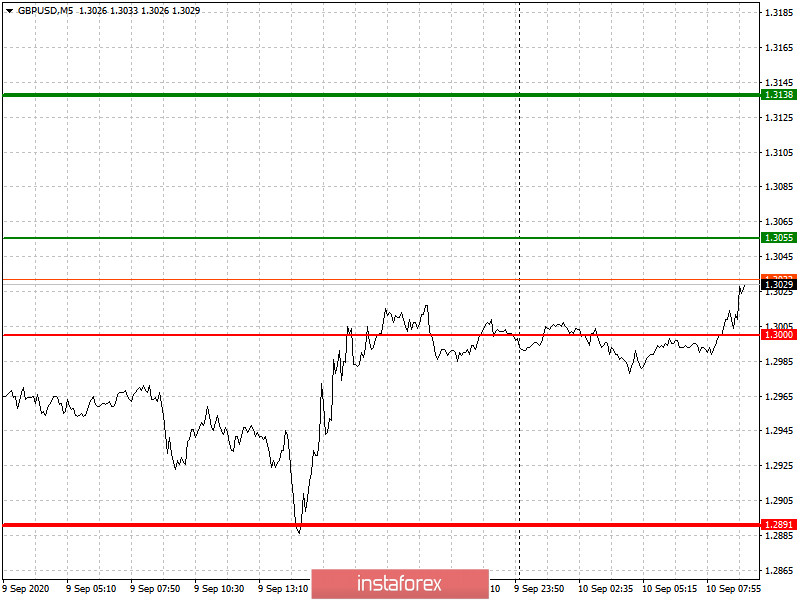

Trading recommendations for GBP / USD on September 10

Analysis of transactions

Both long and short positions were very profitable in GBP / USD yesterday, as the quote moved down 30 points from 1.2927, and then moved back up 40 points from 1.2979.

A decline is much more probable in GBP / USD today, as the pound will only rise on the announcement of trade agreement on Brexit. Otherwise, it will continue to fall in trading in the market.

- Set long positions from 1.3055 (green line on the chart) to 1.3138 (thicker green line on the chart), and then take profit around 1.3138.

- Sell shorts from 1.3000 (red line on the chart) and then take profit when the quote reaches 1.2891.