Crypto Industry News:

From yesterday to the end of the month, Kazakh cryptocurrency miners will have their energy supply cut off. A memo from national grid operator KEGOC, dated January 21, says that "planned electricity supplies to digital miners are completely canceled" from January 24 to January 31 inclusive.

Kazakhstan's power grid has been shut down due to its energy demand being met, especially in the winter. KEGOC said it would consider lifting restrictions if the energy situation improved.

The memo was signed by the Managing Director of KEGOC for System Services and Development of NES Bekhzan Mukatov and sent to 196 companies producing, transmitting and trading energy.

Kazakhstan was home to about one-fifth of the world's bitcoin mining in late August 2021, according to the University of Cambridge's Center for Alternative Finance. However, during the current shortage, local miners faced electricity rationing. Some want to expand their business overseas, especially considering that the government has proposed a 100-megawatt power limit for all new cryptocurrency mines.

Technical Market Outlook

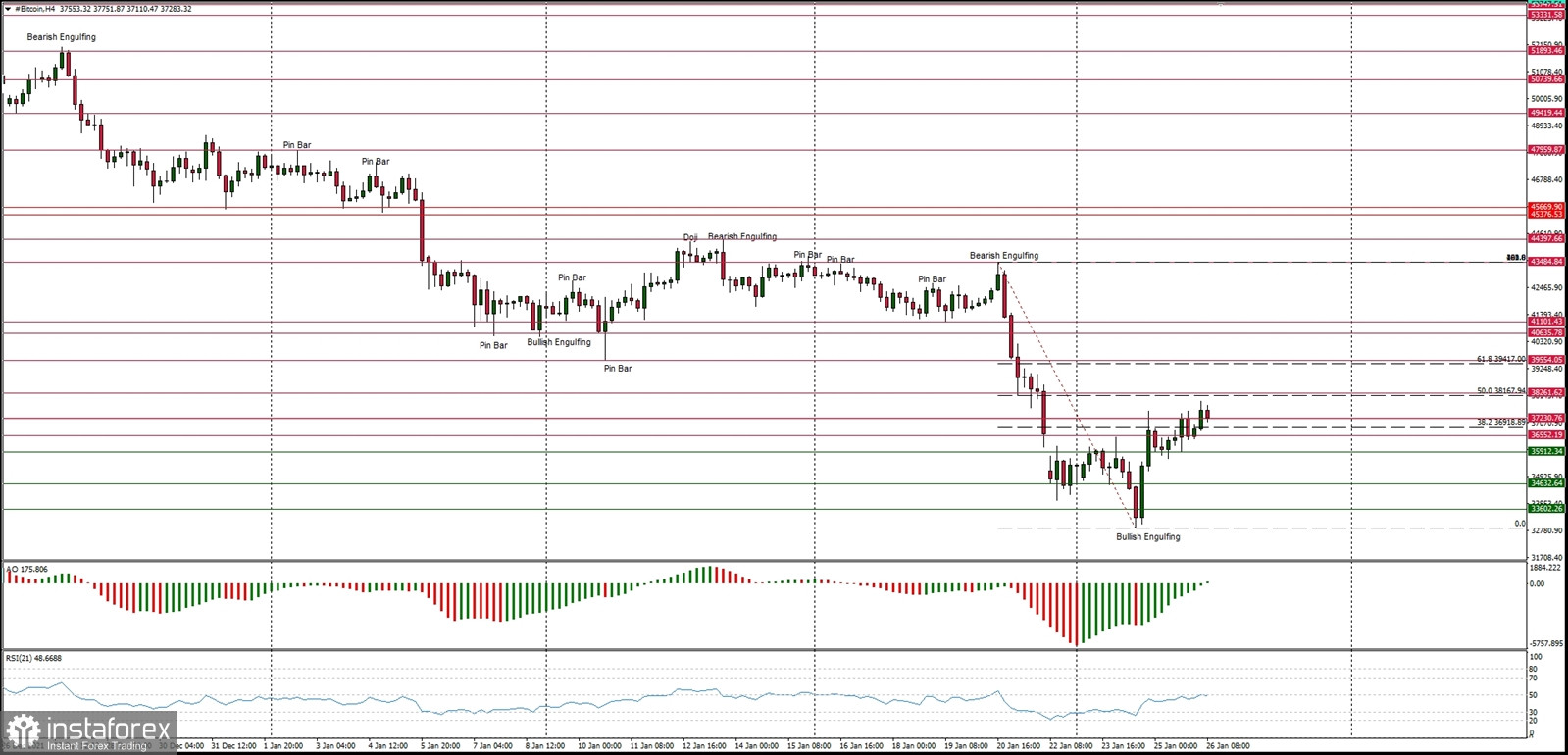

The BTC/USD pair keeps moving up as the bounce continues towards 50% Fibonacci retracement located at $38,167. The

bulls are trying to break through the nearest technical resistance seen at $38,261 and $39,555. The market conditions are extremely oversold on H4 and Daily time frames, but the momentum is pointing up towards the neutral level of fifty. The next target for bulls after the FOMC meeting tonight is seen at $39,417 (61% Fibonacci retracement level) and $41,101 (technical resistance level).

Weekly Pivot Points:

WR3 - $49,548

WR2 - $46,360

WR1 - $39,808

Weekly Pivot - $37,007

WS1 - $32,011

WS2 - $27,102

WS3 - $20,525

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $40k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $69,654 and the next long-term technical support is located at $29,254. The corrective cycle is still in progress and is much more complex and time-consuming than anticipated.