To open long positions on GBPUSD, you need:

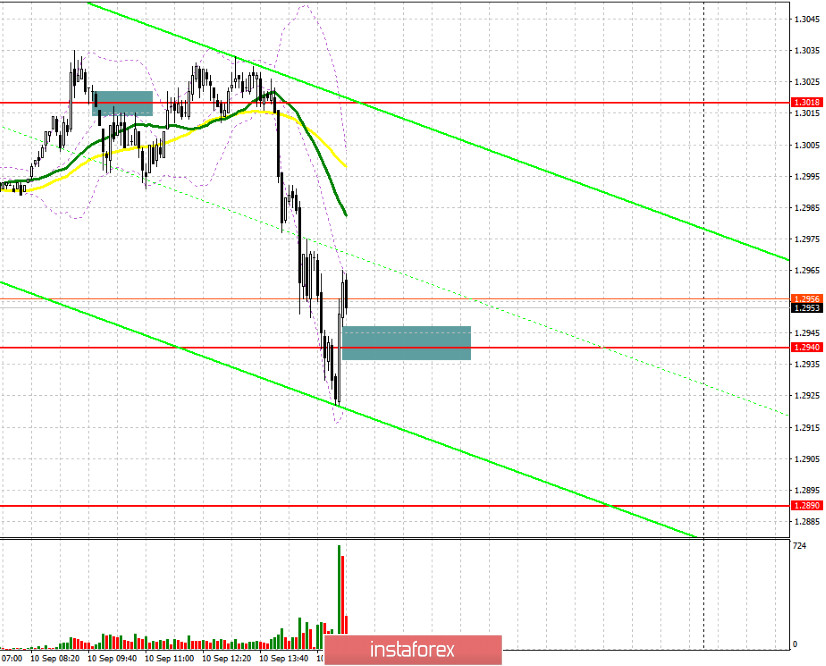

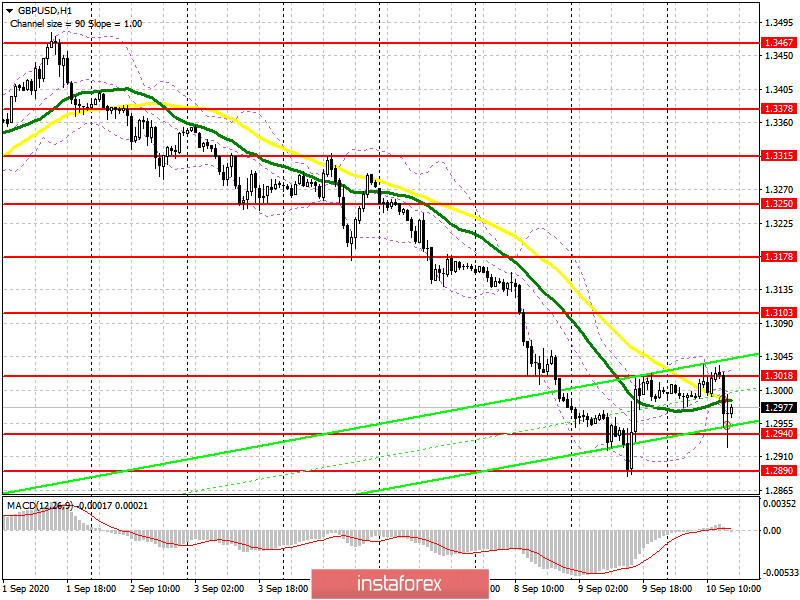

In my morning forecast, I recommend opening short positions after the formation of a false breakout at the level of 1.3018, which is what happened. On the 5-minute chart, the bears quickly returned the pair to the level of 1.3018, which led to a major sell-off of the pound to the support area of 1.2940. Now the bulls need to protect this range and return to it. Another top-down test of this level after forming a false breakout forms a good entry point into long positions in the expectation of a repeated return of the pair to the highs of the day in the area of 1.3018, where I recommend fixing the profits. Holding the level of 1.2940 will also allow you to form the lower border of a new upward correction channel. An equally important task will be to break through and consolidate above the resistance of 1.3018, which will form another entry point for long positions in the expectation of updating the maximum of 1.3103. If the bulls are inactive during the repeated test of the support of 1.2940, it is best to abandon long positions until the minimum of 1.2890 is updated or buy GBP/USD even lower – immediately on the rebound from the new support of 1.2840 in the expectation of correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

The bears have coped with their tasks and the goal in the afternoon is to break through and consolidate below the support of 1.2940. This will destroy buyers' plans to restore the pound and lead to a decline in GBP/USD to the area of the weekly low of 1.2890, which will not be so difficult to break. If not from the second, then from the third time, the area of 1.2890 will still be passed, which forms an additional entry point for short positions. This will allow you to count on updating the next lows in the area of 1.2840 and 1.2725, where I recommend fixing the profits. In the scenario of the pair's growth in the afternoon, the next formation of a false breakout at the level of 1.3018 will be a signal to open short positions. You can sell GBP/USD immediately for a rebound from the maximum of 1.3103, based on a correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which indicates an active confrontation between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.2940 should lead to a larger sell-off of the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.