The main focus on Thursday was the monetary policy of the European Central Bank, or rather, its prospects for changes in the future. And although at the end of the meeting the rates remained unchanged, the expected pressure on the euro did not happen, as traders did not wait for hints that the bond purchase program would undergo changes at the end of this year.

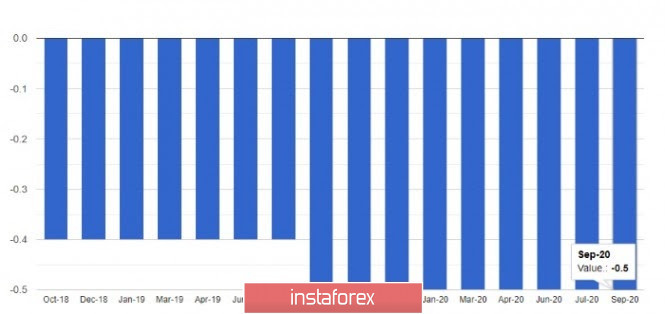

The European Central Bank decided to leave the refinancing rate at zero, and the rate on deposits at -0.5%. The ECB reiterated its intention to keep monetary policy unchanged until inflation approaches the target level. The regulator also kept the volume of the PEPP program unchanged, at 1.35 trillion euros, and also kept the APP asset purchase program in the amount of 20 billion euros per month. Additional acquisitions of assets under the temporary program in the amount of 120 billion euros will also remain until the end of the year. As for the duration of the main program PEPP, they have not been revised. This suggests that purchases will continue until at least June 2021.

The speech of the President of the European Central Bank, as well as the forecasts of economists, became noteworthy which led to such a sharp rise of the euro during the press conference. The ECB President Christine Lagarde stressed that recent data showed strong growth, in line with expectations, but the strength of the economic recovery is shrouded in significant uncertainty, so monetary policy should remain soft for quite some time. Lagarde attributed the recent increase in the number of coronavirus infections among the main risks for the EU, which will continue to impede its economic recovery. For example, on Wednesday, it became known that the UK has introduced new restrictions on public events, following many European countries in this direction. This was done amid a sharp increase in the number of new cases of Covid-19 infection.

Economists from the European Central Bank initially estimated a slightly less significant economic contraction in 2020 than before. As a result of the recent reports, the eurozone economy is projected to contract by 8.0% in 2020 against the June forecast of a contraction of 8.7%. In 2021, the economy is expected to grow by about 5.0%.

Although Lagarde focused on the euro on her speech, she said that she would continue to carefully evaluate the incoming information, including news about the exchange rate. According to her, inflation will remain in negative territory only in the coming months, and the high euro exchange rate may further put pressure on the indicator. Meanwhile, economists of the European Central Bank estimated that inflation in 2020 will be 0.3%. And expects it to grow to 1% by 2021 and to 1.3% in 2022.

At the end of her speech, Lagarde noted that fiscal measures should be targeted and temporary, and drew attention to the recent changes in inflation targeting by the Fed, adding that so far there is no need for similar measures by the ECB since the ECB's economic forecasts do not include deflation risk.

Summing up, it must be said that although the European regulator did not make changes in monetary policy and did not prepare the markets for the likelihood of such changes in the future, we did not hear any hysteria in the words of the ECB President that the euro exchange rate would seriously affect inflation and the prospects for economic recovery in the region. Against this background, all those who wanted to buy the euro at more attractive prices, after a downward correction, began to return to the market, since in the near future, you can forget about verbal interventions.

As for the technical picture of the EURUSD pair, a breakdown and consolidation of the resistance level of 1.1865 will be a burden on the sellers of the euro, leaving the market under the control of buyers. Only after that, one can expect a powerful wave of growth in risky assets to the area of the maximum of the 19th figure, as well as a rebound to the 20th figure, a breakdown of which will become the cherry on the cake in early autumn 2020.