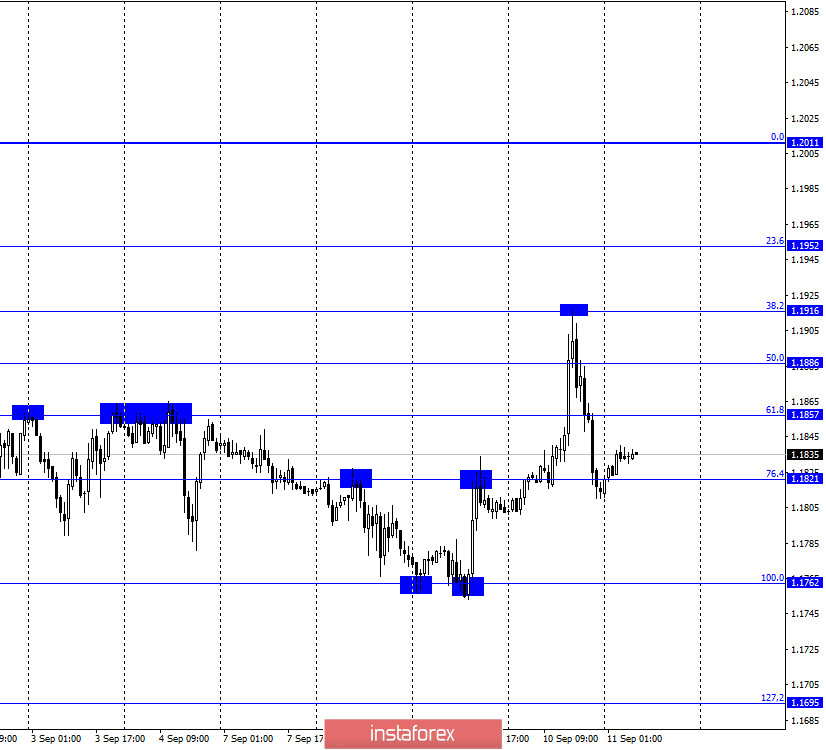

EUR/USD – 1H.

On September 10, the EUR/USD pair performed a sharp increase to the level of 38.2% (1.1916), rebound from it, and an equally sharp drop to the corrective level of 76.4% (1.1821), from which all yesterday's movement began. There are no questions about what exactly caused the euro to grow by 100 points. The meeting of the European Central Bank is an important event for the currency market. Another thing is that there were no special reasons for such strong growth in the euro currency. The ECB left the key rates and the PEPP program (emergency program to counter the pandemic) unchanged. Thus, the European regulator did not make any important decisions. The GDP forecast for 2020 has been improved to -8%, and for 2021 and 2022 – the left it unchanged at +5% and +3.2%, respectively. The inflation forecast for 2020 has not changed – 0.3%. For 2021 and 2022, the inflation forecast is 0.8% and 1.3%. Christine Lagarde herself said that the EU economy is waiting for a long recovery, and the ECB will not raise key rates until inflation reaches the target value of 2%. Given the inflation forecasts for 2020-2022, which were provided by the ECB itself, it is safe to assume that there will be no tightening of monetary policy in the coming years. Lagarde also said that her bank will use the full 1.35-trillion PEPP package to get the Eurozone out of the crisis, however, the economy may need more stimulus in the future.

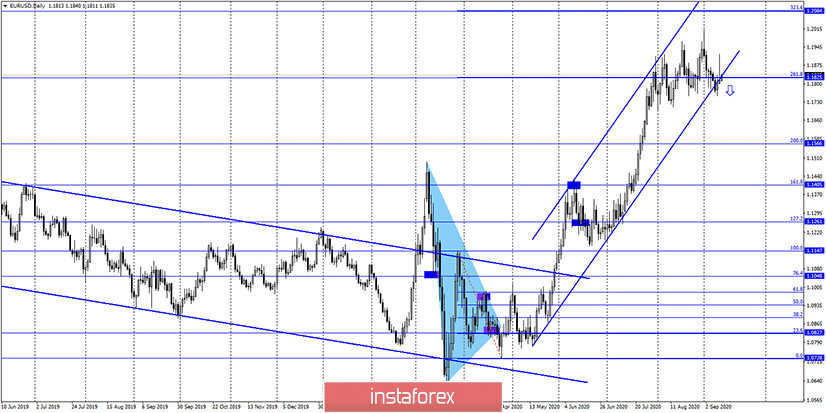

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair rose to the upper border of the side trend corridor, rebounded from it, and resumed the process of falling, while remaining inside the side corridor. Thus, the fall in quotes can be continued in the direction of the corrective level of 127.2% (1.1729) and the lower border of the side corridor. Today, the divergence is not observed in any indicator. Fixing the pair's rate above the side corridor will work in favor of the euro and increase the probability of further growth in the direction of the Fibo level of 161.8% (1.2027).

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal in favor of the US dollar and fell to the lower border of the upward trend corridor, closing under which will allow traders to count on the continuation of the fall in quotes in the direction of the corrective level of 200.0% (1.1566). However, there is no such closure yet.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has completed a consolidation above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On September 10, the European Union held a summing up of the European Central Bank meeting and a press conference with Christine Lagarde. This is described in detail above. In America, there were no important reports or events on this day.

News calendar for the United States and the European Union:

US - consumer price index (12:30 GMT).

US - consumer price index excluding food and energy prices (12:30 GMT).

On September 11, all eyes are on the US inflation report. In the European Union, the calendar of events is empty.

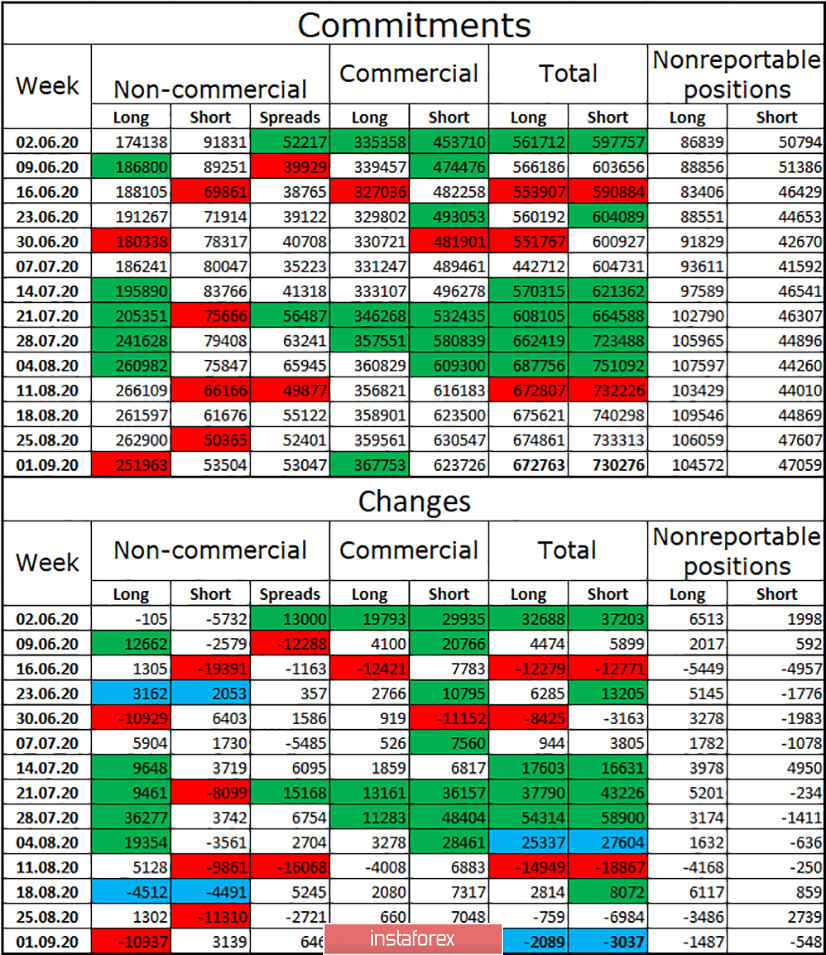

COT (Commitments of Traders) report:

The latest COT report was very interesting and informative. At the end of the reporting week, major traders of the "Non-commercial" group closed 10,937 long contracts and opened 3,139 short contracts. This means that during the reporting week, "bearish" sentiment prevailed among speculators. But does this mean that the general mood of speculators has changed to "bearish" and now the euro currency will be actively sold off? The "Non-commercial" group still has 5 times more long contracts than short. Over the past 10 weeks, speculators have been building up long contracts and getting rid of short ones. Thus, so far, only one COT report suggests that the upward trend in the euro is complete. Nevertheless, this is a bad "bell" for the euro currency.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with targets of 1.1762 and 1.1703, if the close is made under the level of 76.4% (1.1821) on the hourly chart. I recommend buying the pair if there is a rebound from the lower border of the side corridor on the 4-hour chart of 1.1703 with goals of 1.1762-1.1821.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.