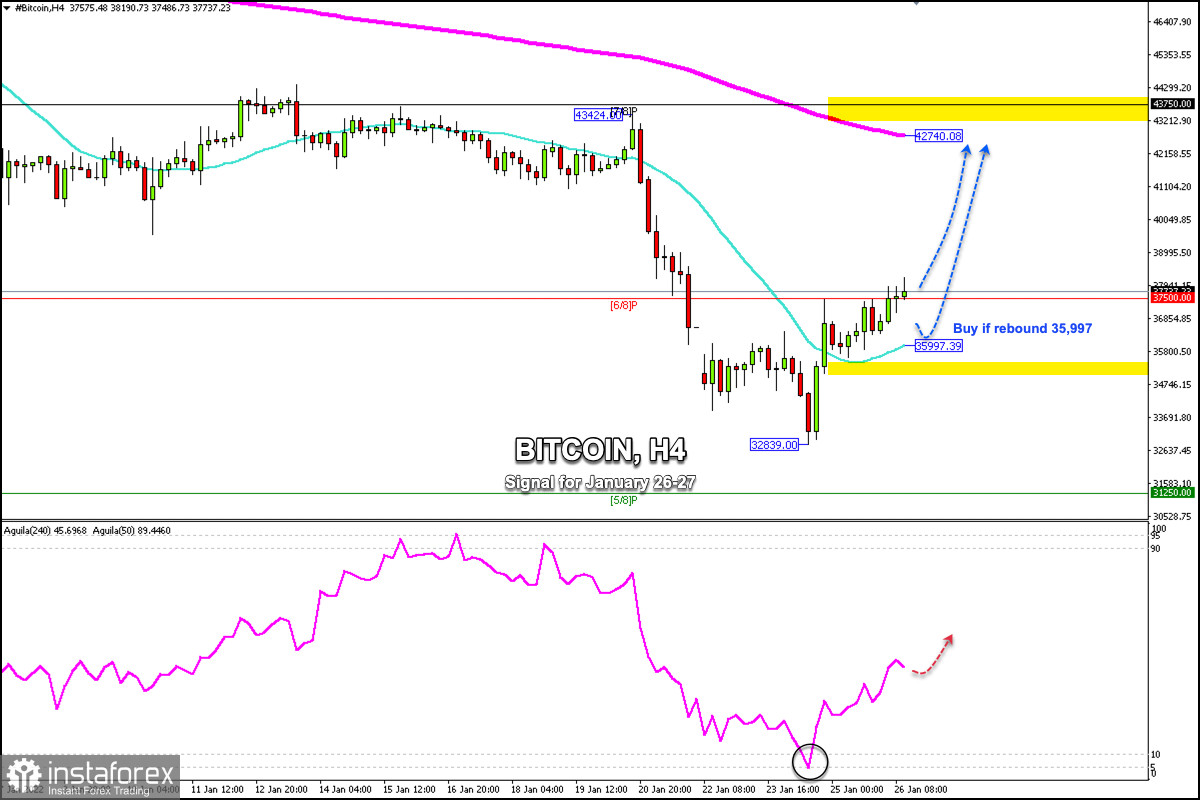

After falling to the low of July 2021 around 32,839, Bitcoin has managed to recover and is now above 6/8 Murray at 37,500. The trend remains bullish and it is likely that in the coming days it could go as high as 42,740 zone of 200 EMA.

The market focus is on the Federal Reserve decision at 19:00 GMT. This policy update can also affect Bitcoin, if the Fed decides to increase the interest rate in March. Bitcoin is likely to fall in the short term to the minimum of $32,839 and to the psychological level of $30,000.

Technically, Bitcoin has gotten relief from the downside pressure and is now approaching the psychological level of $40,000. As the market remains bearish below 42,740, any bounce is likely to be seen as an opportunity to sell with targets towards the 21 SMA at 35,997.

Around the 21 SMA, a technical bounce is expected that could give Bitcoin a chance to resume its upward movement again with targets towards 40,000 and up to 42,740.

On the contrary, if Bitcoin trades again below the level of 36,000 in the next few days, a continuation of the downward movement is expected towards 34,720 and up to 31,250 (5/8 Murray).

Our trading plan for the next few hours is to buy if Bitcoin consolidates above 37,500 or to wait for a technical correction towards the 21 SMA at 35,997 and to buy with targets at the psychological level of 40,000 and up to 42,740 (200 EMA).

Support and Resistance Levels for January 26 - 27, 2022

Resistance (3) 41,159

Resistance (2) 39,314

Resistance (1) 38,404

----------------------------

Support (1) 37,500

Support (2) 36,532

Support (3) 35,569

***********************************************************

Scenario

Timeframe H4

Recommendation: buy above o buy if rebound

Entry Point 37,500; 35,997

Take Profit 40,000; 42,740 (200 EMA)

Stop Loss 36,900

Murray Levels 31,250 (5/8) 37,500 (6/8) 43,750 (7/8)

***************************************************************************