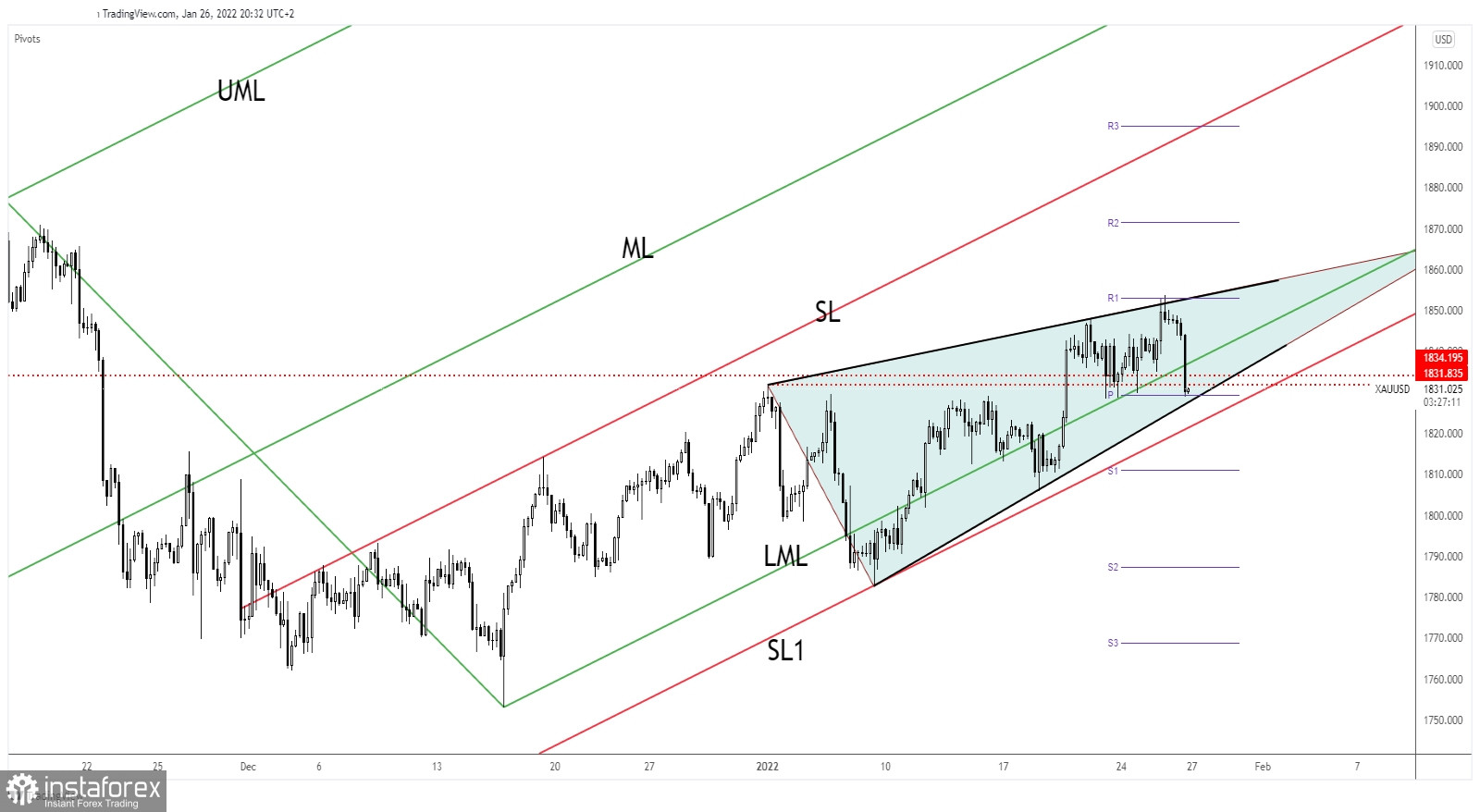

The price of gold plunged after reaching 1,853.88 yesterday's high. The price action developed a Rising Wedge pattern. Still, the reversal formation is far from being confirmed. You have to be careful as the fundamentals will move the rate later. Dovish FOMC could boost the XAU/USD, while more hawkish than expected FED could push the yellow metal towards new lows.

Gold dropped by 1.34% from yesterday's high to 1,829.01 today's low. The pressure is high ahead of the FOMC. The FED is expected to keep the Federal Funds Rate at 0.25%. Still, the FOMC Statement and the FOMC Press Conference could really shake the markets. You have to be careful as a dovish or hawkish tone could bring sharp movements.

XAU/USD massive drop

Gold registered only a false breakout above the weekly R1 (1,853.10) and now it has reached the 1,829.37 weekly pivot point. It has failed to stay above the Ascending Pitchfork's lower median line (LML) and above 1,834.19 - 1,831.83 signaling strong sellers and that the upside movement ended.

Still, in my opinion, only a valid breakdown below the Rising Wedge's support, through the black uptrend line, and below the outside sliding line (SL1) could really confirm a downside reversal. Staying above the weekly pivot point and above the black uptrend line could announce a new bullish momentum.

XAU/USD forecast

Technically, XAU/USD is in a support zone, false breakdowns could signal a potential rally. A valid breakdown below the immediate support levels could activate a larger downside movement.