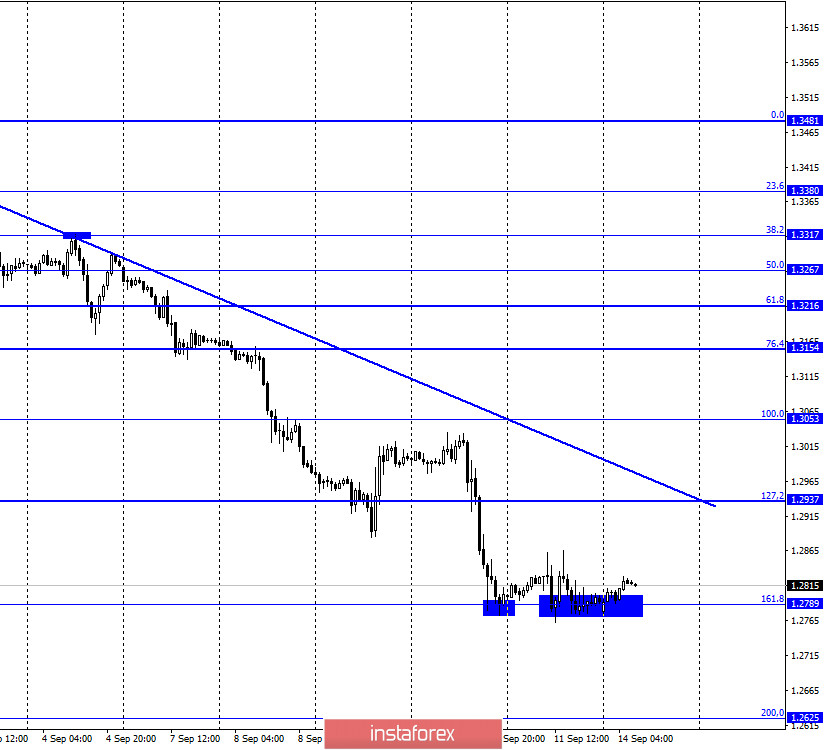

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell to the corrective level of 161.8% (1.2789) and they were trading above this level last Friday. Thus, the rebound of quotes from this level did not allow the British to show even a small increase. Based on this, I conclude that traders are now fully focused on Boris Johnson's resonant bill "on the internal market of the UK", which could start a long-term conflict with the European Union. A vote on the bill, which involves a direct violation of the Brexit agreements with the European Union that were reached at the end of last year, is due to take place on Monday. No one in the opposition forces in the British Parliament supports this bill. However, Boris Johnson's party members can pass this law on their own, since the number of their votes alone should be enough. Thus, this week, the relations between Brussels and London may change from "tense" to "hostile" and "conflict". The European Union has already threatened Britain with retaliatory measures if the bill is passed. However, Boris Johnson does not seem to be afraid of any retaliatory measures. Now it is difficult to say how this whole story will affect the British currency. But at this time, the British dollar has already fallen by 700 points and can continue its decline quite easily and calmly.

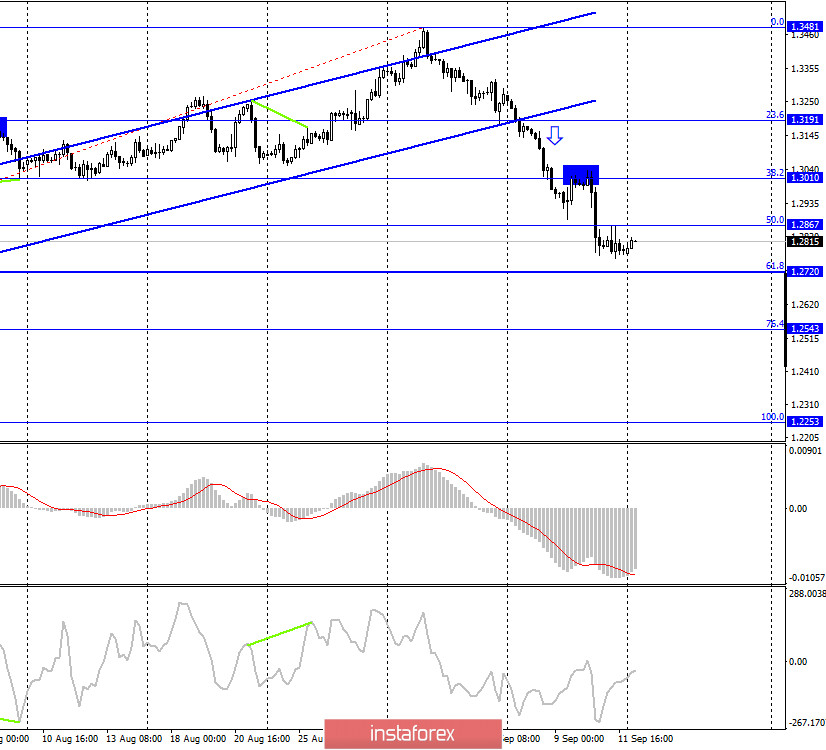

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation under the corrective level of 50.0% (1.2867). Thus, the fall of quotes may continue in the direction of the next Fibo level of 61.8% (1.2720). On the hourly chart, the pair faced a fairly strong level of 1.2789. Thus, it is the consolidation of the pair's rate under this level that will allow traders to count on a further drop in quotes.

GBP/USD – Daily.

On the daily chart, the pair's quotes fell to the corrective level of 76.4% (1.2776). The rebound of quotes from this level will allow traders to expect some growth in the direction of the Fibo level of 100.0% (1.3199). However, it is more likely to consolidate under it and further fall in quotes.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, so a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

On Friday, the UK again did not have any important economic reports. However, for the British pound, the adoption of Boris Johnson's law, which could put Britain and the EU at odds, is now much more important.

The economic calendar for the US and the UK:

UK- UK Parliament vote on Brexit deal.

On September 14, the UK news calendar contains the very vote that can greatly affect the fate of the UK. So all the attention is on this event. There is no exact time when parliamentarians will vote on this bill.

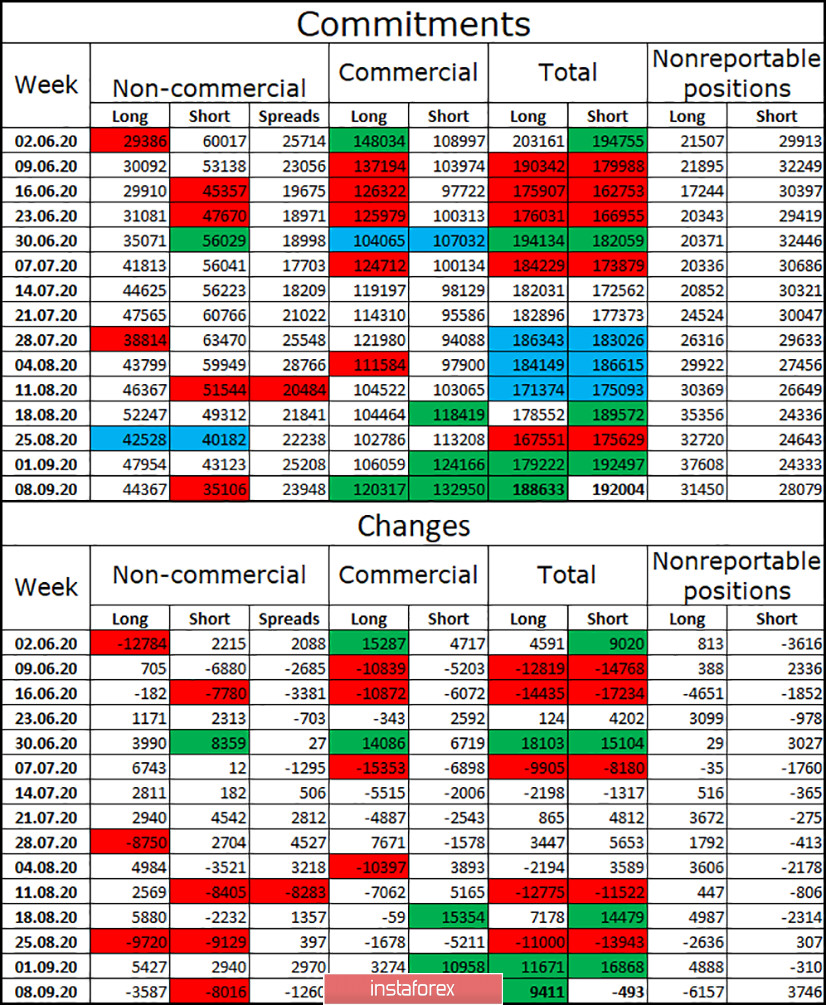

COT (Commitments of Traders) report:

Paradoxical COT report on the pound. You can't say otherwise. According to the latest COT report, major players in the "Non-commercial" group were cutting long contracts, however, they were also cutting short contracts. Thus, it turns out that the British even had to show growth. However, on September 2, it began a severe fall and has now fallen by 700 points. The same applies to the "Commercial" group, which increased long contracts in the amount of 14 thousand and increased short-contracts in the amount of 9 thousand. Again, it turns out that the British pound should have shown growth in the reporting week. In general, the report data turned out to be very strange and did not correspond to what was happening in the foreign exchange market.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with a target of 1.2625 if the close is made under the level of 161.8% (1.2789) on the hourly chart. I recommend opening purchases of the British currency if the consolidation is performed above the descending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.