European indices are trading in the "red" zone, there is an increase in demand for bonds, oil futures are declining, while on the contrary, gold futures are growing. In general, the picture in the markets is slowly changing in favor of increasing demand for protective tools, which before the Fed meeting, may indicate growing market concerns about its results.

As expected, the positive effect of reports of the resumption of vaccine trials has been temporary. It is difficult to feel positive about something that does not really exist. The pandemic has fulfilled its role, legitimizing a deep slowdown in the global economy, but not completely – the weak recovery after lifting restrictive measures cannot be attributed to the consequences of the coronavirus. Obviously, the markets are preparing for new shocks.

NZD/USD

Manufacturing PMI in New Zealand slowed in August from 58.8p to 50.7p, activity in the services sector fell from 54.4p to 46.9p, and recovery was temporary. ANZ Bank believes that the decline in GDP in Q2 was not as deep as previously assumed, but the recovery in Q3 will not be 16%, but almost half as weak, as there is a high probability of resumption of coronavirus restrictions, which will deal a strong blow to the tourism sector during summer.

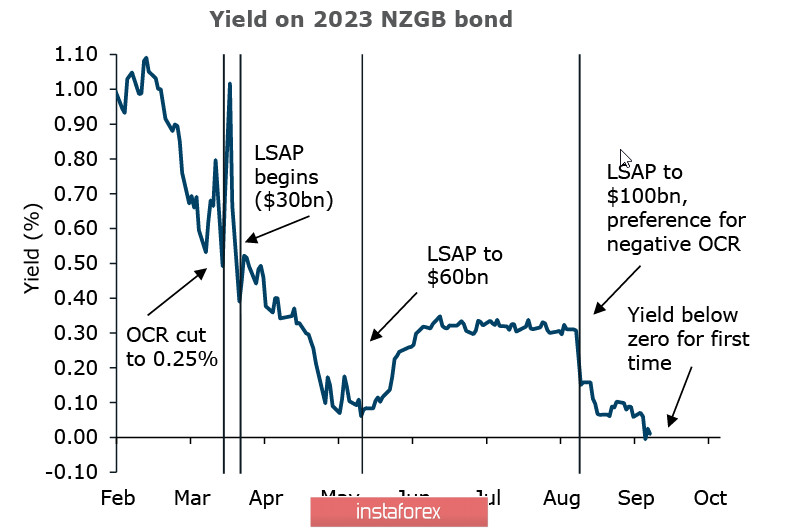

A government report ahead of the election is due this week, which is expected to reflect changes in fiscal policy, but the key point of this report is likely changes in the bond issuance guidelines. We have growing expectations that the RBNZ will cut the interest rate to -0.25% and these have already led to the fact that GKO was traded below zero last week for the first time in history.

Hence, we can assume that the NZD will start experiencing increasing bearish pressure on a number of key parameters. This is a decline in the rate below zero, and the expansion of the lending program (LSAP) to 120 billion, and, possibly, following in the wake of the Fed's neglecting of yield targeting.

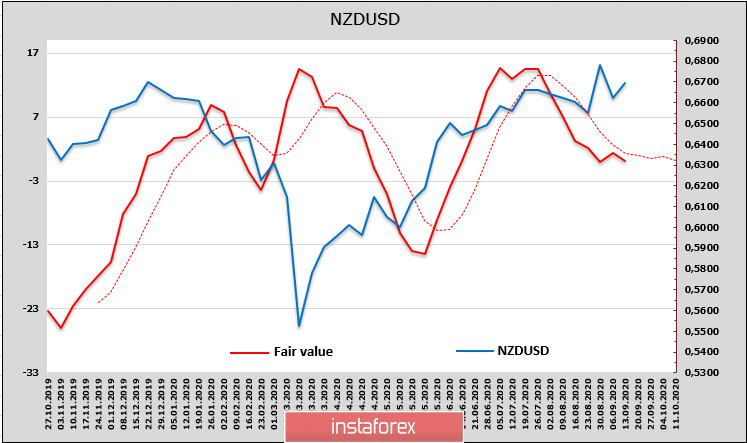

The CFTC report should be considered neutral. The net long position has declined by 147 billion and is near zero, but the fall in bond yields and weak growth in the stock market indicate insufficient capital inflows to support the NZD rate. The estimated fair price is below the spot price and still directed below, which increases the chances of a bearish reversal.

Before the RBNZ meeting, the first strong movement may take place after the FOMC meeting on September 17 and it will most likely be directed downward. The zone of support is 0.6550/70, passing the zone with the strengthening of the fall is likely. However, it is early to give long-term forecasts until the Fed has fixed a change in its position.

AUD/USD

The rate of the Australian dollar changes insignificantly. There are practically no publications of macroeconomic data and the AUD follows in the wake of external factors that act in different directions.

These positive factors include confident data from China (strong growth in foreign direct investment, growth of iron ore futures by 2.2%, inflation in August 2.4%, export growth by 9.5%, etc., as well as high rates of financing of infrastructure projects) and the RBA's refusal to give any hints of a possible rate cut below zero. Tomorrow, the minutes of the RBA meeting will be published, but the markets do not expect any discussion of this issue.

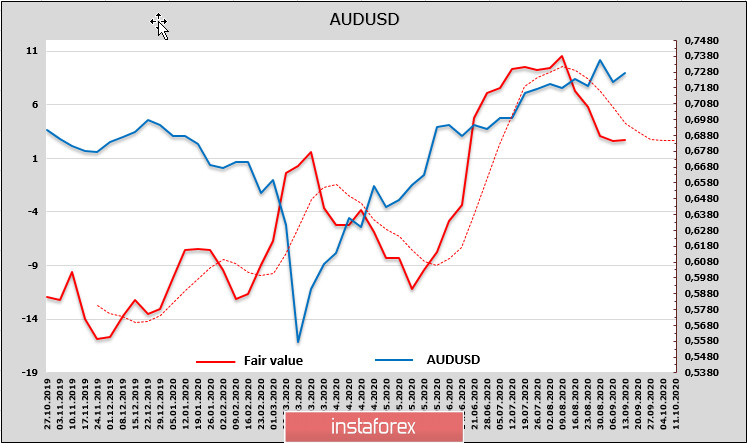

The total position of AUD in the futures market is confidently neutral and balances around zero, with a decline of 135 million over the reporting week, which is not enough to cause a market reaction. The estimated price is below the average and below the spot, which is a bearish factor, but the decline in the estimated price is clearly slowing down.

The Australian employment report for August, which will be published on Thursday, can bring the Australian currency out of its dormant state. In addition to the results of the Fed meeting, it will be published on Thursday, but we must assume that the AUD is still bullish on long-term charts and the reversal has not yet occurred.

Exiting from the consolidation zone is approaching and taking into account the likely bullish reversal in the dollar, we assume that the exit will take place to the downside. The trend line zone is at 0.7210/20, while support is located at 0.7290. From a technical point of view, further decline significantly increases the fixation of a bearish reversal.