To open long positions on EURUSD, you need:

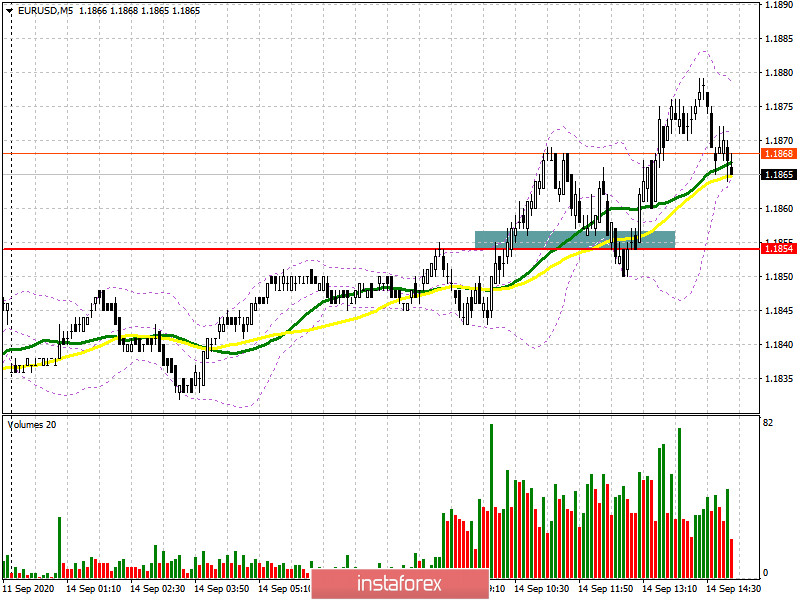

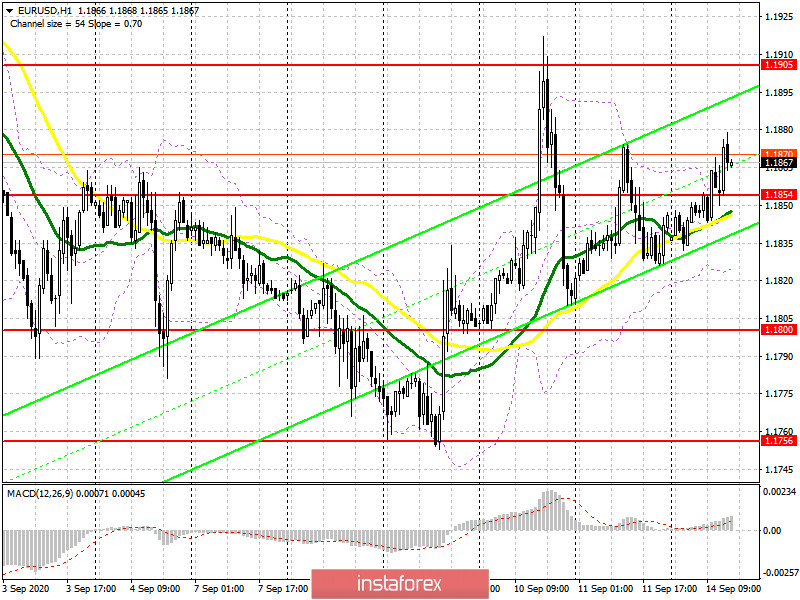

The first half of today was exactly the same as last Friday, which I paid attention to in the morning forecast, as well as purchases from the level of 1.1854 at the breakdown and consolidation above, which happened. The lack of important fundamental statistics did not prevent the bulls from continuing their attempts to resume the growth of the European currency. As long as trading is conducted above the range of 1.1854, you can expect the EUR/USD to continue growing to the resistance area of 1.1905, where I recommend taking the profits. However, it will not be so easy to expect a breakout of this range due to the lack of important data in the afternoon. A consolidation above 1.1905 will open a direct road to the highs of 1.1949 and 1.1994, where I recommend fixing the profits. If the pair again falls below the level of 1.1854 in the afternoon, then I recommend returning to long positions for a rebound from the larger support of 1.1800, based on a correction of 20-30 points within the day.

To open short positions on EURUSD, you need to:

Sellers need to return the euro to the level of 1.1854, and its test on the reverse side on the volume forms a good entry point for short positions with the main goal of updating the minimum of 1.1800, where I recommend fixing the profits. The area of 1.1756 will be a more distant support level, however, it will also not be very easy to reach it without support from good macroeconomic indicators for the Eurozone. If the demand for EUR/USD continues in the second half of the day, it is best not to rush with sales. However, you should wait for the test of yesterday's resistance of 1.1905 and open short positions subject to the formation of a false breakdown. It is best to sell the euro immediately for a rebound from the more recent high of 1.1949, based on a correction of 20-30 points within the day.

Signals of indicators:

Moving averages

Trading is above the 30 and 50 daily moving averages, which indicates an attempt by the bulls to resume the upward correction of the euro.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair declines, support will be provided by the lower border around 1.1825, from which you can open long positions immediately for a rebound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.