EUR/USD

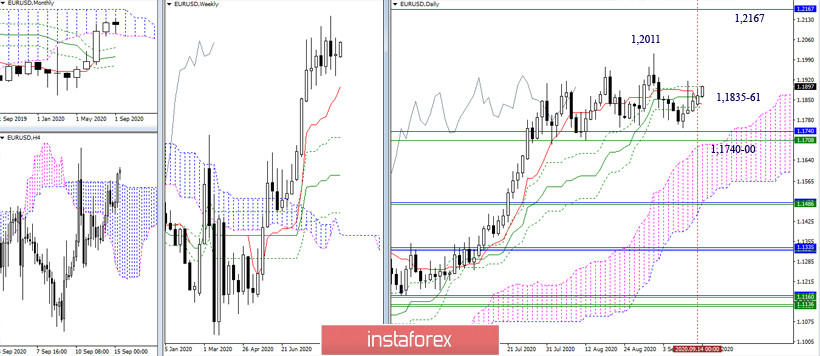

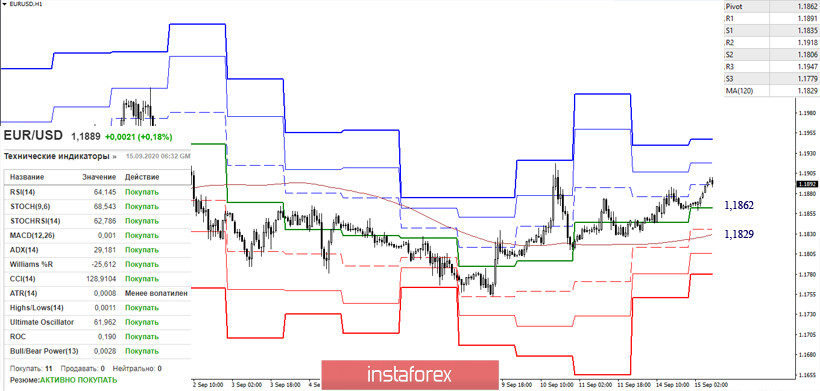

The euro/dollar pair is still trading within the previous range. Traders are focused on the Ichimoku day cross (Tenkan 1.1835 – Kijun 1.1861). An important support area is now located at the limits of 1.1740-00 (the lower border of the monthly cloud + the weekly short-term trend + the upper limit of the daily cloud). If the pair breaks this support area, it will eliminate the current uncertainty. The maximum extreme of the current movement is at 1.2011. A reliable recovery of the uptrend will allow us to consider the next upward target of 1.2167 (the upper limit of the monthly cloud).

In the smaller time frames, we can see that bulls are in control of the market. Today's intraday resistance levels are R1 (1.1891) – R2 (1.1918) - R3 (1.1947). If the pair breaks the maximum extremes of 1.1917 and 1.2011, it is likely to resume rising and the uptrend will prevail. The key support for the smaller time frames today is located at 1.1862 (Central Pivot level) - 1.1829 (weekly long-term trend). If the price fixes below these levels the current balance of power will change on the one-hour chart. Further support can be provided by the support of the classic Pivot levels of 1.1806-1.1779 and the last week's minimum of 1.1753. Further strengthening of bearish sentiment will depend on the support on bigger time frames (1.1740-00).

GBP/USD

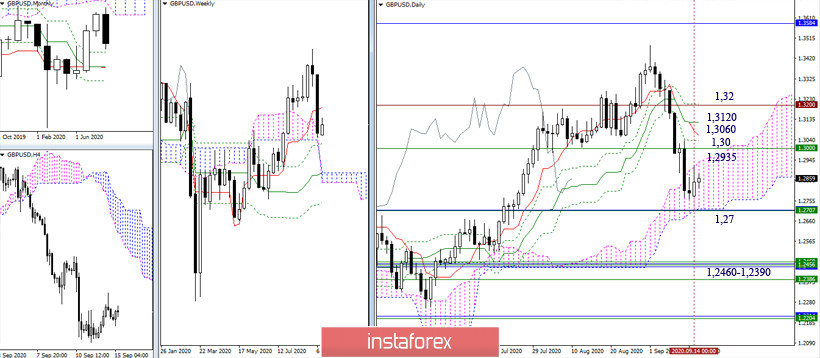

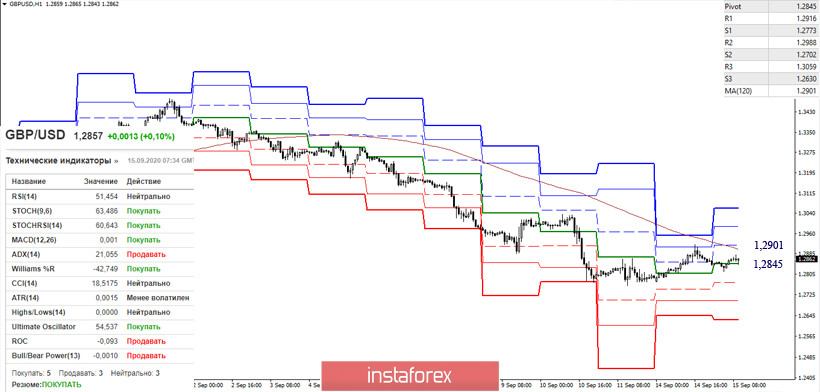

After a significant drop, the pound/dollar pair reached a strong support area near 1.27 (monthly Fibo Kijun + weekly Fibo Kijun + lower limit of the daily cloud). If the pair breaks the support level after the current pause, bears may again become active. The next important support area is located at the levels of 1.2460-1.2390 (monthly cross + weekly Kijun + weekly cloud). If the pair manages to start the upward correction, the main resistance will be located at the levels of 1.2935 (the upper limit of the day cloud) – 1.30 (weekly short-term trend) – 1.3060 (daily Tenkan) - 1.3120 (daily Kijun) - 1.32 (historical level).

On the one-hour chart, bulls are still controlling the correction zone trying to achieve the key levels of 1.2845 (Central Pivot level) – 1.2901 (weekly long-term trend). If the price consolidates above these levels and the trend reverses, bullish sentiment will become stronger. The main resistance levels on the daily chart are R2 (1.2988) and R3 (1.3059). Support of the classical pivot points today is located at the levels of 1.2773-1.2702-1.2630.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)