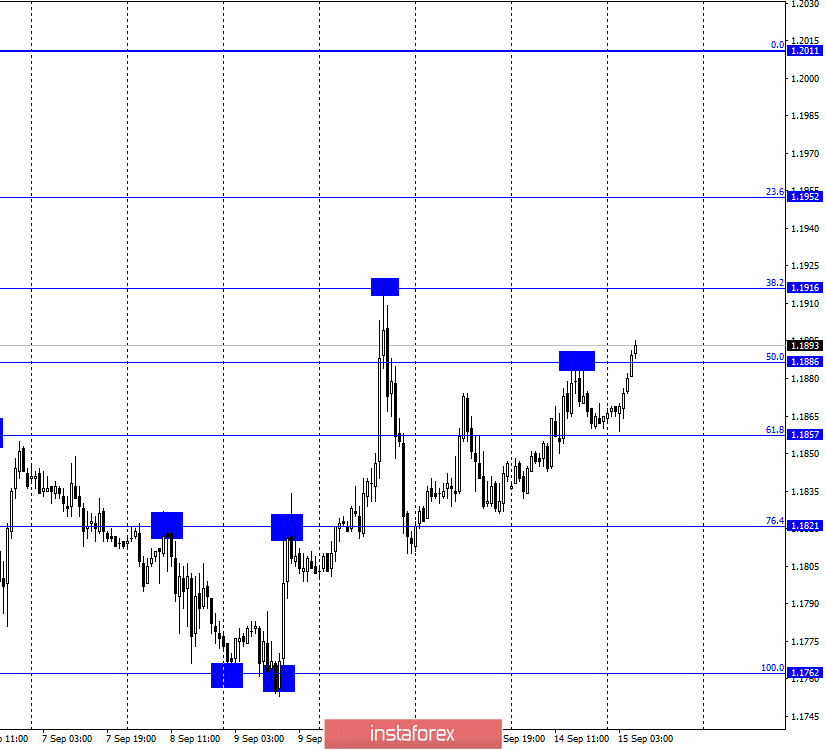

EUR/USD – 1H.

On September 14, the EUR/USD pair increased to the corrective level of 50.0% (1.1886) and consolidated above it this morning. Thus, the growth process can be continued in the direction of the next corrective level of 38.2% (1.1916). The upper border of the sideways trend corridor passes near this level on the 4-hour chart. Thus, a rebound and reversal in favor of the US currency are possible. The information background for the euro remains almost zero, and for the dollar - quite interesting. In America, everyone continues to wait for the election. According to the latest opinion polls, Donald Trump managed to reduce the gap from Joe Biden to a minimum. The election is still a month and a half away, thus, Trump can further reduce the distance in political ratings. In general, if it seemed that there were no chances for Trump to be re-elected two months ago, now they have reappeared. I also note that the work of the US Congress is not effective, since representatives of the Democratic and Republican parties have not been able to agree on the size of the new package of financial assistance to the US economy. Let me remind you that US Treasury Secretary Steven Mnuchin said that the new aid package will be approved in early August. As we can see, in reality, the feuding Trump and the Democrats failed to reach a consensus, which is bad for the dollar and the American economy.

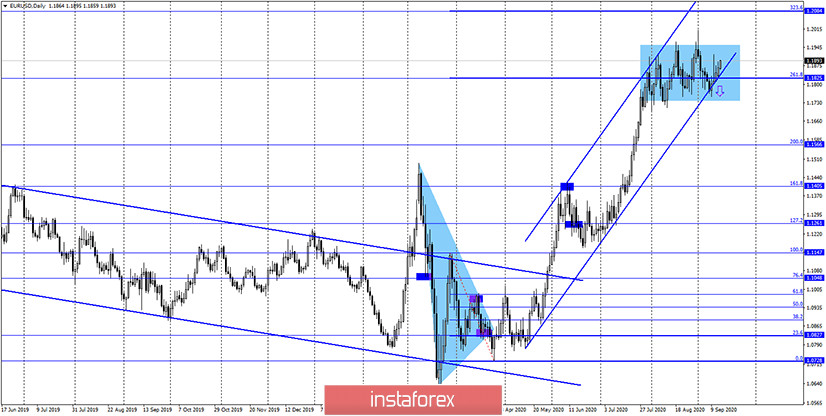

EUR/USD – 4H.

On the 4-hour chart, the EUR/USD pair quotes returned to the upper border of the sideways trend corridor. Thus, a new rebound of the pair's rate from this line will again work in favor of the US currency, and some fall in the direction of the corrective level of 127.2% (1.1729). Fixing quotes above the corridor will increase the probability of continuing growth in the direction of the Fibo level of 161.8% (1.2027). Today, the divergence is not observed in any indicator.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal in favor of the EU currency and fixed above the corrective level of 261.8% (1.1825), which does not mean much. To make it easier to understand, I have highlighted the movement of the last few weeks with a blue rectangle. This movement is now characterized as a flat. However, the pair remains inside the ascending corridor, which means that the growth of the euro is not yet complete.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On September 14, the European Union released a report on changes in industrial production, which turned out to be slightly better than traders' expectations. However, the euro showed growth on Monday without this report.

News calendar for the United States and the European Union:

EU - business sentiment index from the ZEW Institute (09:00 GMT).

US - change in industrial production (13:15 GMT).

On September 15, the calendar of economic events in the European Union and America was almost empty.

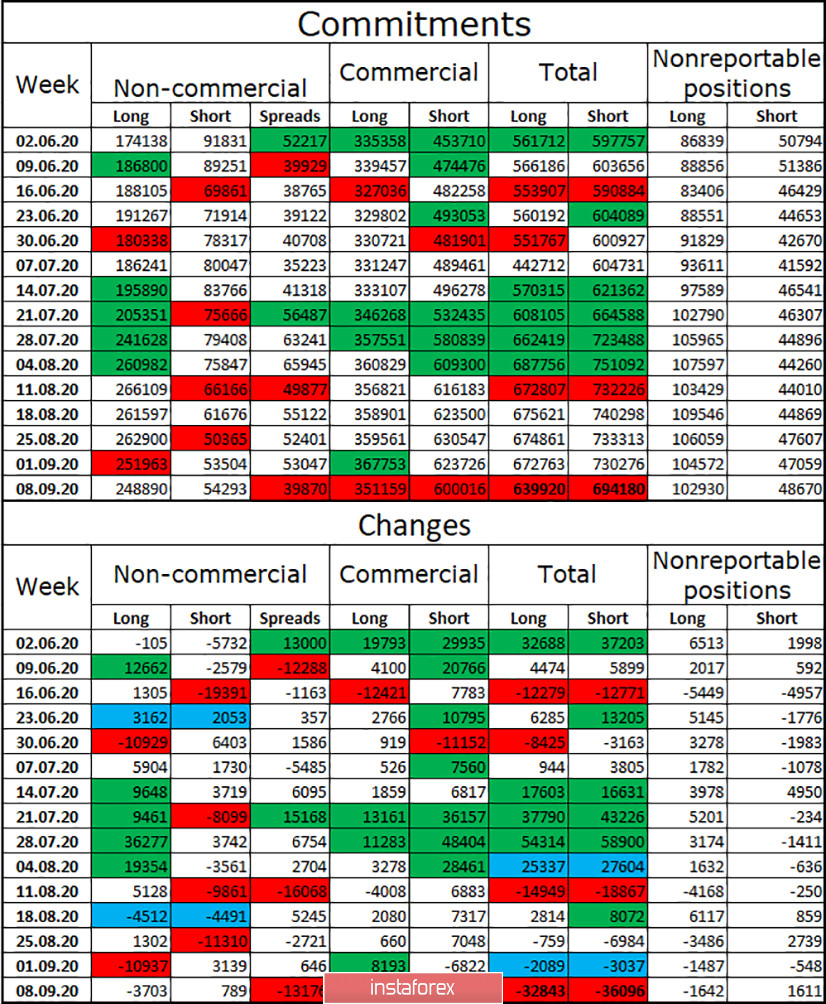

COT (Commitments of Traders) report:

The latest COT report was very interesting. According to the results of the previous report, major traders of the Non-commercial group closed about 11 thousand long contracts. The latest COT report showed a reduction of another 3,700 purchase contracts. At the same time, speculators increased their sales contracts. Thus, the last two COT reports show that the mood of the most important group of traders (speculators) is beginning to change towards the "bearish". The Commercial group was actively getting rid of both long contracts and short contracts, closing almost 40,000 in total. All major players in the foreign exchange market got rid of 69 thousand contracts during the reporting week. Thus, I can conclude that the trend is beginning to change and major players are starting to look closely at purchases of the US dollar.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with the targets of 1.1857 and 1.1821, if the rebound from the upper border of the side corridor is performed on the 4-hour chart. I recommend buying the pair if it closes above the upper border of the side corridor on the 4-hour chart with a target of 1.2027.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.