Today's data on the growth of the Eurozone business confidence index, as well as a report on economic expectations in Germany, helped the European currency to hold near weekly highs in the first half of the day, however, it did not reach active actions from buyers of risky assets. There is still a chance to break through the resistance of 1.1910 during the US session, after the release of several fundamental indicators on the US economy. But if this does not happen, the market may go into "hibernation" before tomorrow's meeting of the Federal Reserve System, as a result of which volatility will remain at a fairly low level.

As for the technical picture of the EURUSD pair, the prerequisites for further growth remain. To do this, buyers of risky assets need to gain a foothold above the level of the 19th figure, where they can safely wait for tomorrow's results of the Federal Reserve meeting, which can open the way to the level of the 20th figure and bring the pair closer to the range of 1.2060. If buyers do not show activity in the area of 1.1910 today, then we can expect a repeated return of the trading instrument to the support area of 1.1855, which the bulls managed to pick up yesterday on the second attempt. Larger minimums are in the field of 1.1800 and 1.1755. However, they can only be counted on if there are more serious changes in the Federal Reserve's monetary policy, which are unlikely to happen.

As noted above, economic expectations in Germany rose in September of this year, after a more than large increase in this indicator in August. This suggests that many believe in a faster economic recovery in the future and expect the most optimistic scenarios of the European Central Bank to be implemented. According to the ZEW research institute, the ZEW index of economic expectations in September 2020 jumped to 77.4 points against 71.5 points in August, with economists predicting that the indicator will fall to 70.0 points.

I was particularly pleased with the current situation index, which, despite the surge in infections from the coronavirus pandemic, improved in September, reaching -66.2 points against -81.3 points in August. Economists had expected this indicator to recover to -72.0 points. Given that many respondents expect a further noticeable recovery in the German economy, the indicator will continue to improve. While neither Covid-19, no Brexit is not afraid of self-confident Germans.

As for the Eurozone business sentiment index from the same ZEW Institute, it jumped to 73.9 points against 64 points in August this year, which also indicates that the scenario for a smaller contraction of the EU economy this year is realistic. Let me remind you that the recent conclusions of the European Central Bank economists concluded that the economy will contract less significantly in 2020 than previously expected. As a result of the new forecasts, the Eurozone economy is expected to contract by 8.0% in 2020, against the June forecast of a contraction of 8.7%. In 2021, the economy is expected to grow by about 5.0%.

Judging by what is currently happening in the Spanish economy and especially in the labor market, this country may become an outsider among the EU countries by the end of 2020, even ahead of Italy. Many economists predict a 14.5% contraction in Spain's GDP in 2020, which will be the worst indicator among the major Eurozone economies. It will be possible to expect a small rebound from the bottom only in 2021, and even then the growth of 5.2% will not allow us to forget about all the problems that the country faced during the coronavirus pandemic. The most stable economy will be Germany, where GDP is expected to decline by 5.6% by the end of 2020 and grow by 4.8% next year. As for France, the reduction may reach 10.3% of GDP in 2020, and Italy will lose about the same amount.

GBPUSD

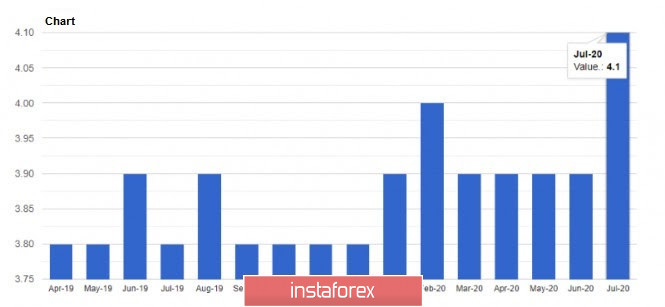

The British pound reacted positively to the data on the labor market, which showed only a slight deterioration in July this year against the June indicator. This minimal deviation for the worse is directly related to the current programs of support for the labor market by the government, which end in October this year. And only then will we be able to see the whole picture, provided that these programs are not extended further. According to the country's Bureau of National Statistics, UK unemployment rose to 4.1% in May-July from the April-June level of 3.9%. The data completely coincided with the forecasts of economists.

The number of unemployed in Britain was 1.398 million people, showing an increase of 62 thousand compared to the last reporting period. A good bonus for traders was a less active reduction in the average weekly wage, which fell by 1% in annual terms, while everyone expected it to fall by 1.3%. Excluding bonuses, the indicator grew by 0.2%, which indicates a recovery in the economy after the coronavirus.

As for the technical picture of the GBPUSD pair, it has not changed in any way compared to the morning forecast. A break in the support of 1.2770 will lead to the demolition of several bulls' stop orders and open lows in the area of 1.2720 and 1.2645 for the trading instrument. If the bill is stalled, then we can expect a surge of strength among buyers of the British pound. A break in the resistance of 1.2920, which is where the main trade is currently being conducted, will lead to new highs around 1.2990 and 1.3110.