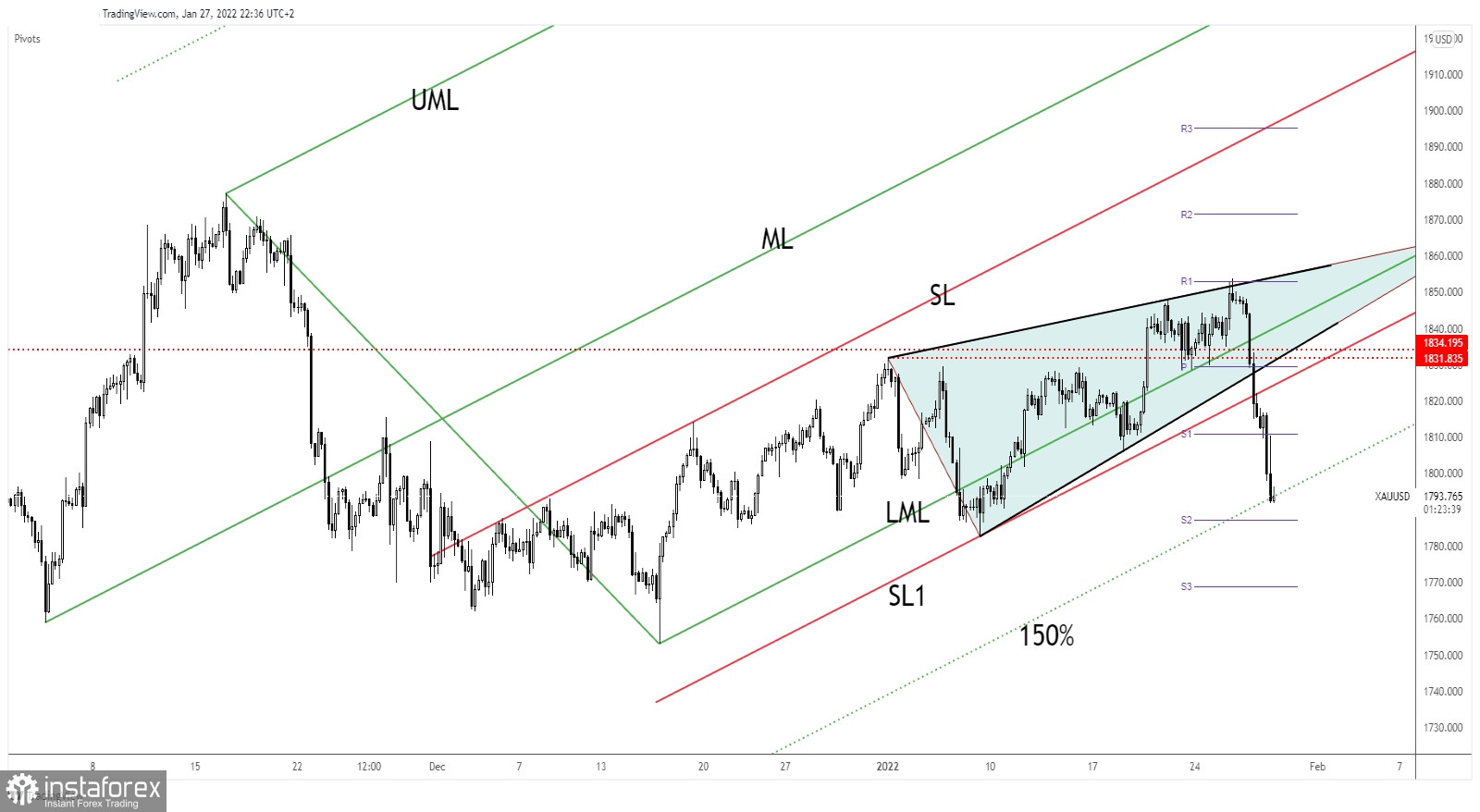

Gold dropped as much as 1,791.86 today and now is fighting hard to rebound and recover after its massive drop. In my previous analysis, I've talked about a potential Rising Wedge pattern that could announce a downside reversal.

XAU/USD started to drop before the FOMC as the traders expected a hawkish tone. As you already know, the FED signaled rate hikes in March. The Federal Reserve could hike rates more than three times during the year, that's why the USD rallied and Gold plunged.

Tomorrow, the US Core PCE Price Index, Revised UoM Consumer Sentiment, Personal Income, and Personal Spending could have an impact on Gold.

XAU/USD Reached A Dynamic Support!

Gold ignored the near-term downside obstacles and now it has reached the 150% Fibonacci line which stands as potential dynamic support. A valid breakdown below it may announce a downside continuation.

A false breakdown could announce a temporary rebound, a bullish momentum. After its massive drop, XAU/USD could try to increase a little. We may have a new selling opportunity if the price of Gold will increase a little.

XAU/USD Outlook!

After reaching the 150% Fibonacci line, Gold could try to rebound. It could come back to test and retest the 1,800 and 1,810 levels. This scenario could bring new selling opportunities. The bias is bearish, so a valid breakdown below the 150% line could confirm more declines at least towards 1,782.67 former low.