EUR/USD

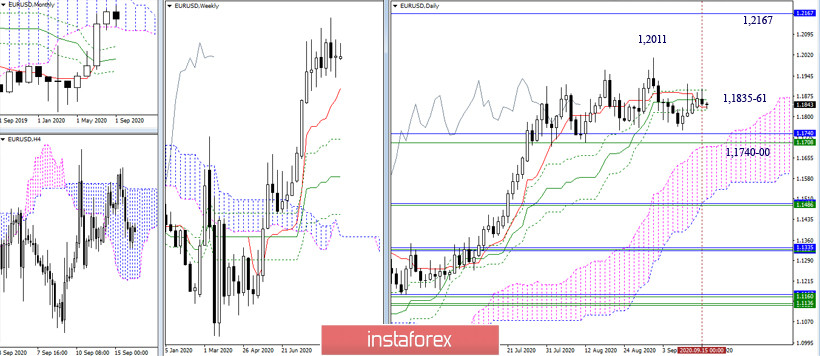

The pair continues to remain in the zone of attraction of the daily cross (main levels Tenkan 1.1835 + Kijun 1.1861). The conclusions and expectations about the possible scenarios for the development of the situation in the upper time intervals remain the same. Moreover, guidelines for movement are located at the same levels. The resistances can be noted at 1.2011 (maximum extreme) and 1.2167 (top of the monthly cloud), while the closest and most significant support zone still remains at 1.1740-00 (lower border of the monthly cloud + weekly short-term trend + upper border of the daily cloud).

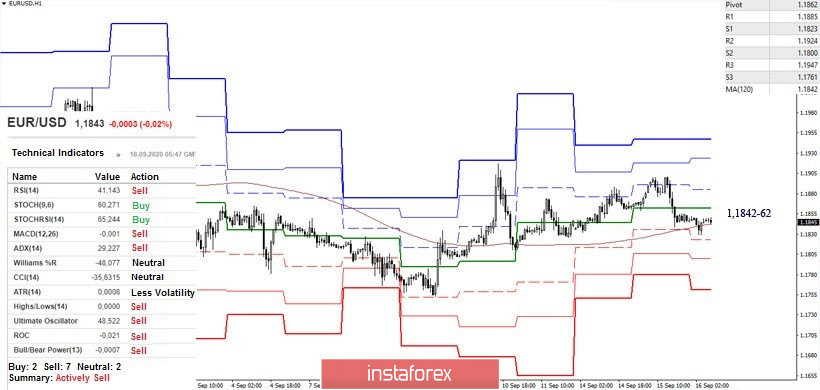

Today, the key levels of the lower halves 1.1842-62 (central pivot level + weekly long-term trend) unite their efforts with the center of attraction of the upper time intervals (1.1835-61), so for a reliable result (overcoming or rebounding) to appear in this area, you need confirmation from all timeframes, including the daily one. The resistances of classic pivot levels today are located at 1.1885 - 1.1924 - 1.1947, while supports are located at 1.1823 - 1.1800 - 1.1761.

GBP/USD

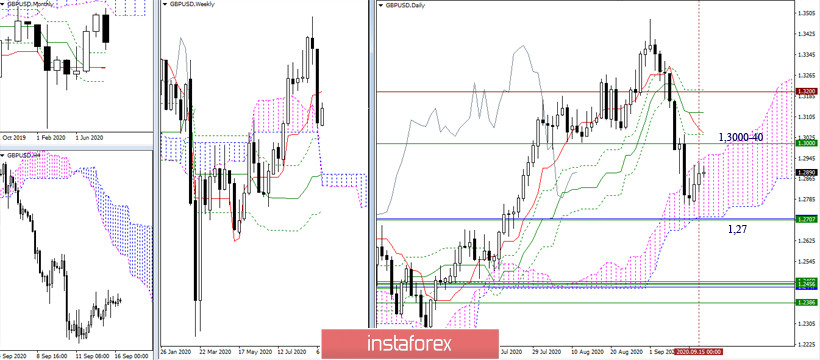

The pound has consolidated in the daily cloud Ichimoku - a zone of uncertainty. In view of this, the bullish players have been testing the upper limit of the cloud for several days in a row, and today it is at 1.2944. However, it remains in the cloud at the same time, since they fail to implement a full-fledged upward correction. The closest reference points for the development of the rise are 1.3000 (weekly Tenkan) - 1.3040 (daily Tenkan). The key downward reference point for this area now combines the Fibo Kijun support of the month and weeks, as well as the lower border of the daily cloud at 1.27.

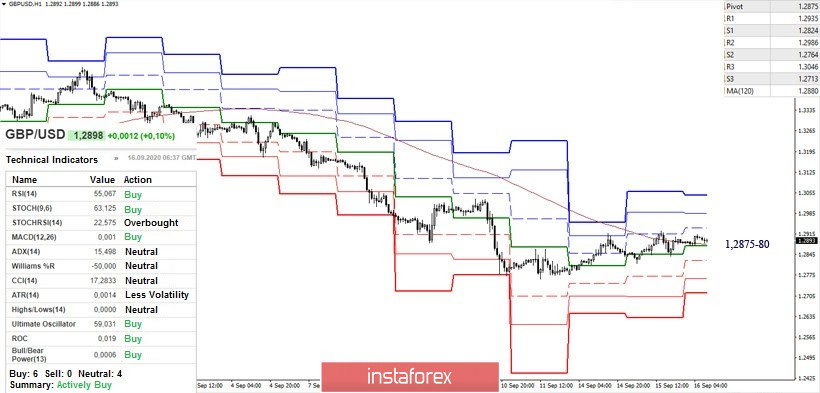

We are now seeing a slow, extended upward correction on the lower time frames. The players to rise are currently working above the key supports located at 1.2875-80 (central pivot level + weekly long-term trend). To hold positions and strengthen bullish moods, bullish traders need to maintain the current state of affairs, reverse moving averages and continue the rise more efficiently. The exit from the correction zone and the reliable restoration of the downward trend will facilitate the return of the bears, the main task for which will be testing the zone of influence of the supports of the higher halves at 1.27. The pivot points within the day are the classic pivot levels. Their resistances can be noted today at 1.2935 - 1.2986 - 1.3046, while supports are at 1.2824 - 1.2764 - 1.2713.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)