The main event of today and the whole week will be the results of the two-day meeting of the US Federal Reserve System (FRS) on monetary policy. Moreover, the September meeting of the Federal Reserve will be held in full format. In addition to the decision on interest rates, the Fed will publish new forecasts for the economy, as well as a press conference by Federal Reserve Chairman Jerome Powell. In light of recent changes in the direction of greater tolerance for inflation, the speech of the head of the Fed is very interesting and important. Will Powell be able to surprise the markets again? Maybe no, however, the probability of dovish rhetoric is very high. And where to go? First, COVID-19, which virtually nullified all the previous successes of the American economy. However, this is already in the past, and now we need to restore everything and return to normal. Two other important points affect the policy of the US Central Bank - the notorious yield curve and the US presidential election, which will be held in November this year. In my personal opinion, the second event is much more important. It is still unknown what is better: the re-election of the expressive and extravagant Trump for a second term or the arrival of the deep pensioner Biden, who can not always shine with adequacy.

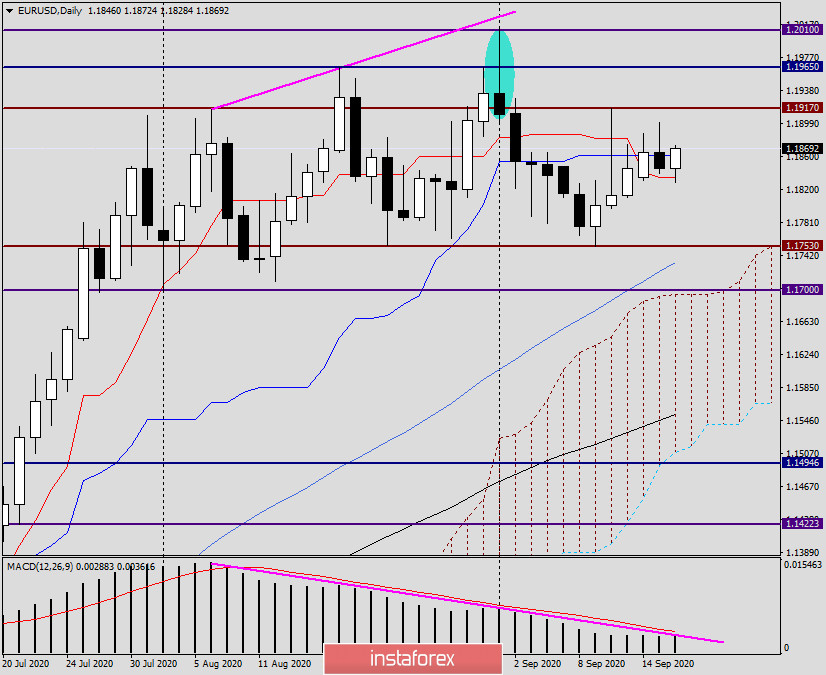

Daily

Despite high expectations of the Fed's dovish rhetoric, the US dollar strengthened against the single European currency in yesterday's trading. In my opinion, this is mostly due to technical factors and the ongoing consolidation of the main currency pair in the range of 1.1917-1.1753, the direction of exit from which is still questionable. I don't think we should remind you once again of the importance of breaking through the two defining levels of 1.1700 and 1.2000, which will determine the future direction of the main currency pair. However, quite often it happens that the main role in the further direction of price movement is played by completely different marks. In my opinion, the levels of 1.2100 and 1.1600 are no weaker than the two indicated above and are also in the focus of investors' attention.

If we look at the current technical picture for EUR/USD, it is rather vague and does not answer the further direction of the quote. As you can see, the euro/dollar is trading in a relatively narrow price range, near the Tenkan and Kijun lines of the Ichimoku indicator. I suggest you look at one of the lower timeframes and look for interesting and technically sound options for entering the market.

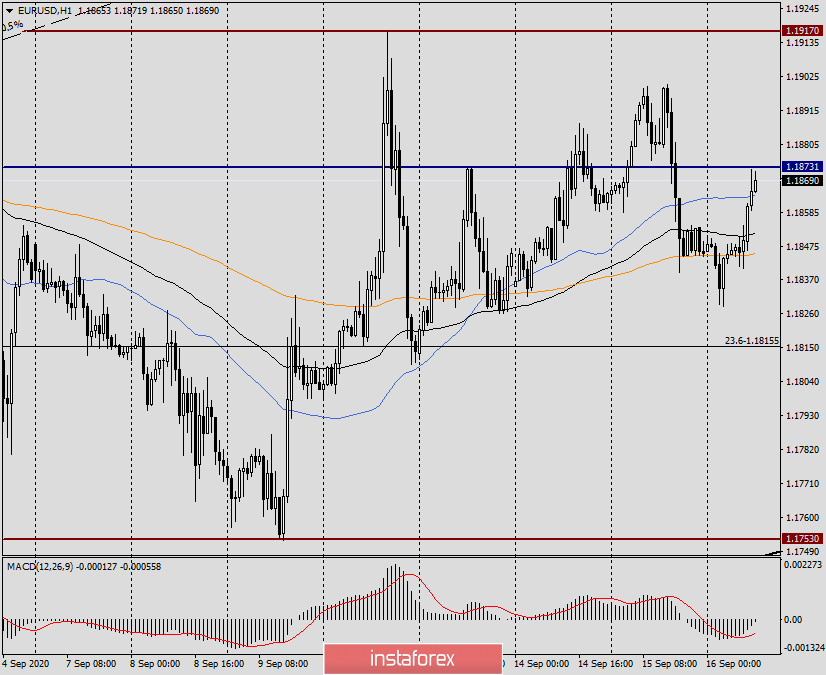

H1

After yesterday's decline, the pair is correcting and showing moderate strengthening. The course of trading will show how long it will last, especially after 19:00 London time, when the Fed's decision on rates and updated economic forecasts will be published. Moreover, at 19:30 (London time), the press conference of Fed Chairman Jerome Powell will begin.

Since the market is in the waiting mode for these events and there is still some uncertainty, I will indicate technically sound points for entering the market, and in both directions.

In my opinion, it is better to look for sales after the pair rises to the price zone of 1.1900-1.1910. I believe that if the pair is fixed above 1.1900, the long-term growth will not be long in coming. Purchases are quite interesting and attractive in the case of a decline in the price area of 1.1800-1.1750. At the same time, in both cases, it would be nice to see confirmation signals for opening trades.