The British pound continues to strengthen its position against the US dollar even after the news that inflation in the UK in August this year fell less than expected. This once again suggests that the Bank of England will remain inclined to a soft policy, especially if the risk of a hard Brexit has only increased recently. Given that the uncertainty of the prospects for the recovery of the British economy also remains at a fairly high level, it is unlikely to count on a major recovery of the GBPUSD pair, especially when the issue of the sensational Brexit bills and the Irish customs border is not fully resolved.

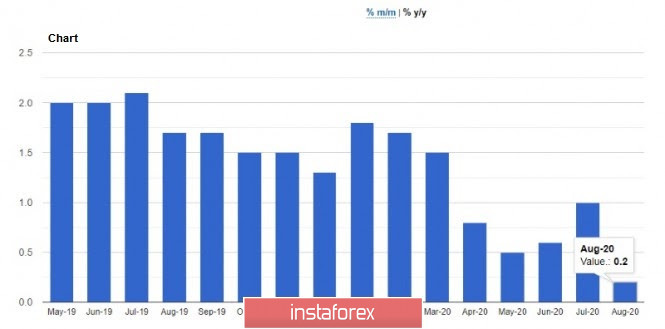

Given that inflation declined in August, the balance of risks for the Bank of England's policy will continue to be eased. The report shows that annual consumer price inflation in the UK fell to 0.2% from 1.0% in July, while economists had expected zero inflation. This led to a slight increase in the pound, which we have seen since the beginning of this week. However, the impact of inflation on the pound will be limited, as investors' attention is now focused on the situation around Brexit. Let me remind you that tomorrow the Bank of England will announce its decision on monetary policy and most economists do not expect any changes.

Annual consumer price inflation in the UK in 2020 will likely be within zero, especially after the abolition of state support for the labor market, which will lead to a sharp decline in income and spending, automatically dragging down prices. The slight strengthening of the British pound that we saw this summer will also put downward pressure on inflation.

As for the technical picture of the GBPUSD pair, it seems that the priority of the bulls is to break through and go beyond the resistance of 1.3040. Only then can we talk about the formation of a more serious bullish trend to strengthen the trading instrument to the highs of 1.3180 and 1.3250. If the pressure on the pound returns, then it will be possible to talk about the formation of a more powerful bearish impulse only after GBPUSD drops to the level of 1.2920, which the bears have been holding so well all this week. This scenario will increase the pressure on the pair and return it to the support range of 1.2840 and 1.2770.

A report from the Organization for Economic Cooperation and Development was published today, which revised forecasts for a reduction in global GDP for 2020. The data turned out to be better than the June forecasts, which is a good signal for buyers of risky assets in the medium term. The OECD now expects global GDP to shrink by 4.5% in 2020, while the June forecast suggested a reduction of 6%. As for growth in 2021, it was also revised to 5% from 5.2%. Most of all, the revision affected the reduction in US GDP, where losses are expected in the region of 3.8% against 7.3%. China's GDP in 2020 will be able to reach a growth of 1.8%, while previously it was predicted to decline by 2.6%. As for the Eurozone, its economy in 2020 will lose about 7.9% against 9.1% previously.

The OECD also outlined two scenarios for the development of the world economy in 2021. If restrictions are eased and a COVID-19 vaccine is found, the global economy is expected to grow by 7% in 2021. The negative scenario and the tightening of restrictions, to which everything is now going, assumes that the global economy will grow by only 2.5% in 2021. That's the problem.

Today it became known about another outbreak of coronavirus in the Eurozone, namely in Spain. Authorities in Madrid, which has suffered the most among Spanish cities, are reintroducing a quarantine regime in the most infected areas. Madrid accounts for about one-third of the affected population across the country. Since travel restrictions were lifted at the end of June, the number of infections in Spain has risen from a few hundred a day to thousands, ahead of other hard-hit countries such as the UK, Italy, and France.

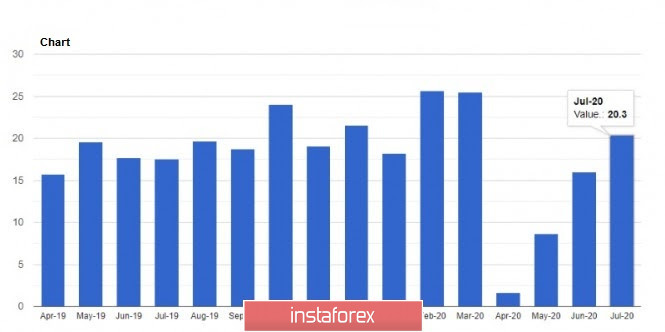

Today's report shows that Eurozone exports and imports continued to grow for the third month in a row in July, which provided little support to buyers of risky assets before the important meeting of the Federal Reserve System. According to the EU statistics agency, exports of goods from the Eurozone in July rose sharply by 6.5% and exceeded imports by 27.9 billion euros. Imports increased by 4.2%.

As for the technical picture of the EURUSD pair, a slight strengthening of the euro did not lead to significant market changes. The prerequisites for further growth remain. To do this, buyers of risky assets need to gain a foothold above the level of the 19th figure, where they can safely wait for the results of the Federal Reserve meeting, which can open the way to the level of the 20th figure and bring the pair closer to the range of 1.2060. If buyers do not show activity in the area of 1.1910 today, then we can expect a repeated return of the trading instrument to the support area of 1.1855, which the bulls managed to pick up today in the first half of the day. Larger minimums are in the field of 1.1800 and 1.1755. However, they can only be counted on if there are more serious changes in the Federal Reserve's monetary policy, which are unlikely to happen.

After the Fed meeting, traders need to understand whether the Central Bank will allow inflation to exceed the 2% target to compensate for those periods when it did not reach this level, and how interest rates will be linked to this. If the head of the Federal Reserve announces new methods of forming expectations by the Central Bank regarding the future trajectory of interest rates, the US dollar can significantly strengthen its position against the euro and other world currencies, as this approach will provide a more understandable guide for investors in the future. However, it is unlikely that we will hear radically new approaches to calculations and analysis at this meeting. Most likely, we will have to wait for the next meetings. The US dollar may also be supported by today's economic forecasts, which will be published after the meeting. The Fed is expected to update quarterly forecasts for economic activity for the better, which will capture the year 2023.