At the end of its two-day meeting, the US Federal Reserve (FRS) kept the refinancing rate in the range of 0.00-0.25%. 8 out of 10 members of the Open Market Committee voted for this decision, and this fully coincided with market expectations.

As previously anticipated, the main focus was on the negative impact of the COVID-19 pandemic on the economy of the United States of America, possibly even in the long term. However, according to Fed officials, economic conditions have improved recently, which does not give grounds to stop buying assets earlier at a given pace. It was no surprise that the Federal Reserve announced that rates will remain at current low levels for a long time, namely, until the employment and inflation targets are met. In general, the Fed forecasts that rates will remain at current levels until the end of 2023. Inflation forecasts for the current year are 1.2%, and unemployment in 2020 is expected at 7.6%.

The subsequent press conference of Fed Chairman Jerome Powell did not bring any surprises. Powell complained that economic activity is still lagging behind the pace seen before COVID-19. Nevertheless, Powell is optimistic about the future and is ready to use all available tools to restore the world's leading economy if necessary. To date, the Fed's monetary policy, according to the head of this department, is quite adequate and brings the necessary results.

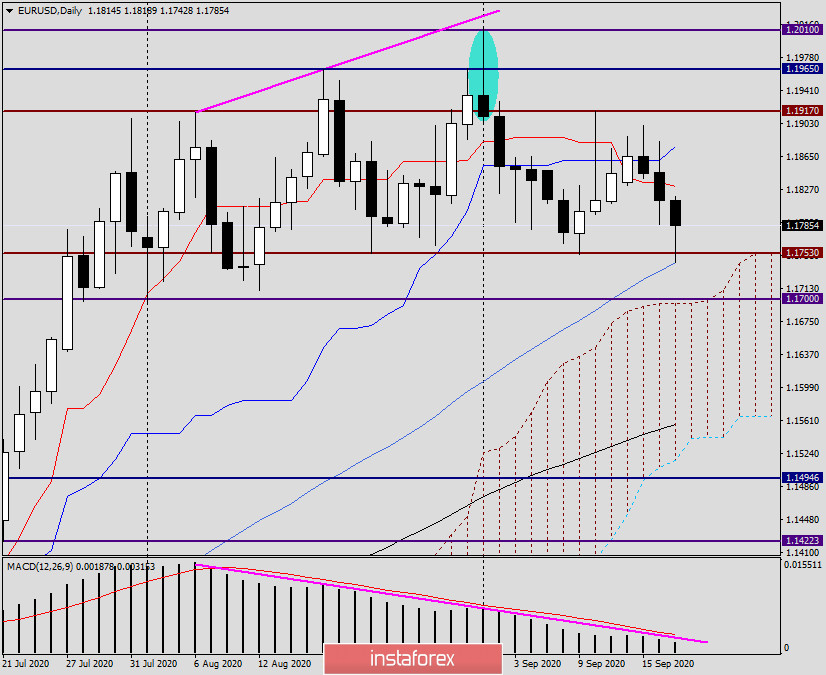

Daily

Despite the fact that in general, the results of the Fed meeting and the press conference of Jerome Powell did not bring any surprises, the US dollar gained support and strengthened against the single European currency. Yesterday's trading on EUR/USD ended at 1.1814, however, the decline of the main currency pair continued with a new force today. At the time of writing, the key support level of 1.1753 (the lower limit of the range), as well as the 50 simple moving average, has already been tested for a breakdown. It was the 50 MA that triggered the current rebound for EUR/USD when trying to break through 1.1753.

Let me remind you that the task of the bears for the pair is that it is necessary to break not only 1.1753, but also a significant mark of 1.1700 with mandatory fixing under this level. To increase the rate, you need to stay above 1.1800, then break through the Tenkan and Kijun lines, which are located at 1.1830 and 1.1876, respectively. Only then will it be possible to re-test the strength of the key resistance zone, which is located in the area of 1.1900-1.1917.

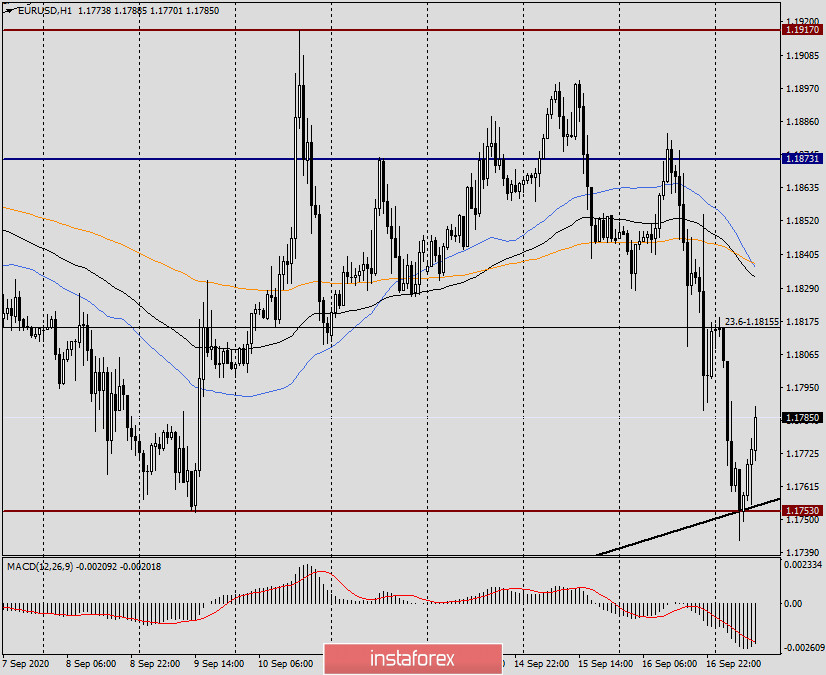

H1

As expected in the previous review of EUR/USD, one of the options for opening long positions will be a decline to the support area of 1.17853, where the lower border (black) of the ascending channel also passes. As you can see, there was an upward rebound from the designated zone, and at the end of the review, the strengthening of the euro/dollar continues.

Trading recommendations for EUR/USD:

Given the positive reaction of market participants to the results of the Fed meeting, the US dollar may continue to strengthen, but after a slight adjustment. Now the main currency pair is trading under the important level of 1.1800, above which the euro bulls will try to return the quote. In this case, I suggest that you watch the price behavior in the area of 1.1800-1.1830, and sell the pair if there are bearish reversal signals.