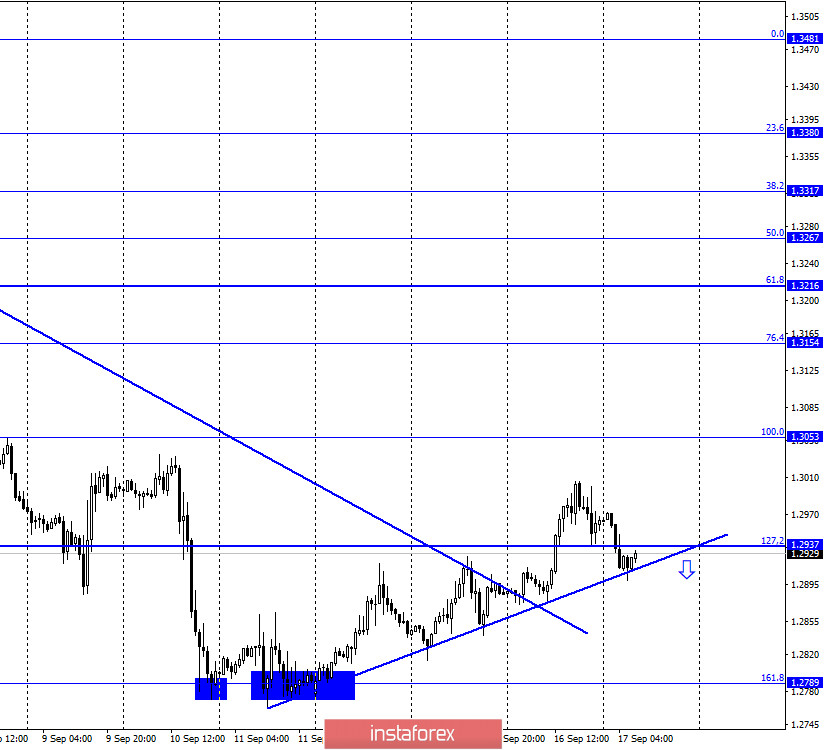

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US dollar and fell to the ascending trend line, which was built recently. However, the rebound of quotes from this line will work in favor of the British and the resumption of growth in the direction of the corrective level of 100.0% (1.3053). Fixing the pair's rate under the trend line will increase the probability of continuing to fall in the direction of the Fibo level of 161.8% (1.2789). Yesterday's results of the FOMC meeting and Jerome Powell's speech also had an impact on the pound/dollar pair, and the US dollar rose by about the same 100 points against the British dollar. The Bank of England will be summing up the results of the meeting in the UK today. As with the FOMC, traders do not expect changes in monetary policy. Most likely, the Bank of England will maintain a "dovish approach", as in recent weeks the probability of the UK leaving the European Union on December 31, 2020 without an agreement has sharply increased. In addition, the likelihood of a conflict between the EU and Britain has sharply increased due to the bill, which involves changing the mode of operation of the Northern Ireland border at the request of London, and not according to previous agreements with Brussels. Thus, the Bank of England will definitely not be optimistic in its summary and may hint at a possible deterioration in economic conditions. In addition, many experts believe that the program to stimulate the economy will be expanded over the next few months.

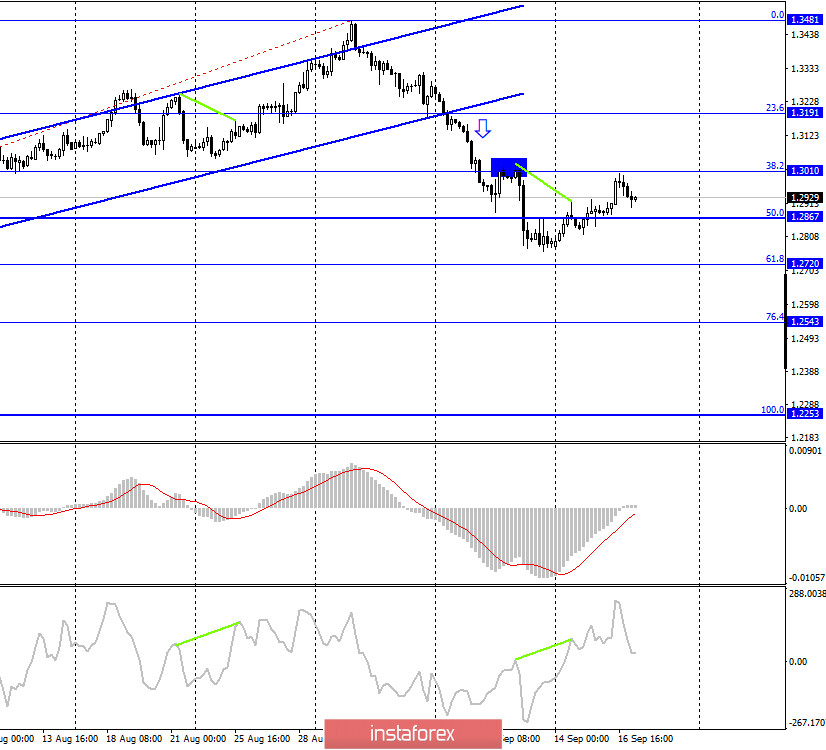

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US currency near the corrective level of 38.2% (1.3010). Thus, the fall of quotes in the direction of the corrective level of 50.0% (1.2867) began. Fixing the pair's rate even below this level will increase the chances of a further fall in the British dollar's quotes in the direction of the Fibo level of 61.8% (1.2720). However, the rising trend line on the hourly chart is more important now.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the Fibo level of 76.4% (1.2776), which now allows traders to expect some growth in the direction of the corrective level of 100.0% (1.3199). Fixing quotes under the Fibo level of 76.4% will increase the chances of a further fall in the direction of the corrective level of 61.8% (1.2516).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downtrend line, so a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

On Wednesday, the UK released a report on inflation for August, which slightly exceeded forecasts, but fell to 0.2% y/y. This value is close to the value of European inflation and is very low.

News calendar for the US and UK:

Great Britain - decision on the main interest rate of the Bank of England (11:00).

UK - planned volume of asset purchases by the Bank of England (11:00 GMT).

UK - monetary policy summary (11:00 GMT).

Great Britain - Bank of England Governor Andrew Bailey will deliver a speech (12:00 GMT).

US - number of primary and secondary applications for unemployment benefits (12:30 GMT).

On September 17, traders' attention will be focused on the Bank of England's monetary policy decisions and the speech of its Governor, Andrew Bailey.

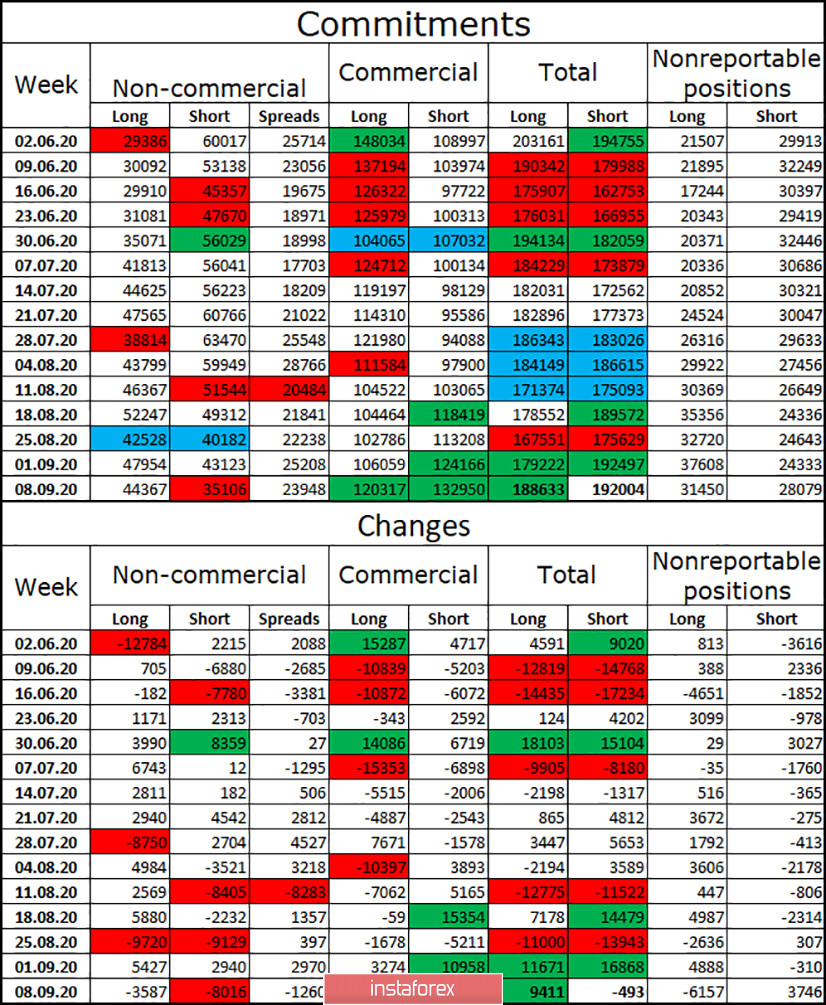

COT (Commitments of Traders) report:

The paradoxical COT report on the British. You can't say otherwise. According to the latest COT report, major players in the "Non-commercial" group were cutting long contracts, however, they were also cutting short contracts. 8 thousand sales and 3.5 thousand purchases. So it turns out that the British even had to show growth. However, on September 2, it began a severe fall and has now fallen by 700 points. The same applies to the Commercial group, which increased long contracts in the amount of 14 thousand and increased short contracts in the amount of 9 thousand. Again, it turns out that the British pound should have shown growth in the reporting week. In general, the reported data turned out to be very strange and did not correspond to what was happening in the foreign exchange market.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with a target of 1.2789 if the close is made under the trend line on the hourly chart. I recommend opening purchases of the British dollar if there is a rebound from the trend line on the hourly chart, with a target of 1.3053.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.