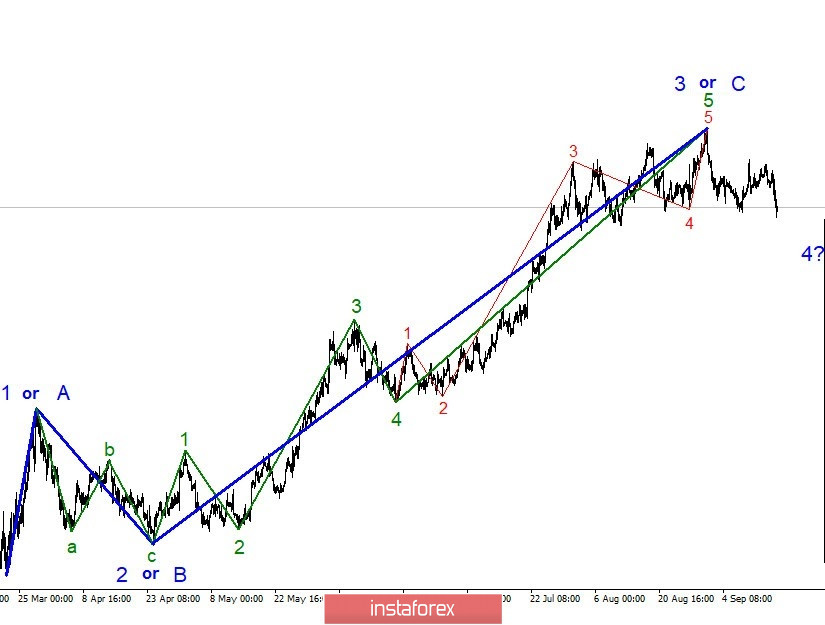

Globally, the wave pattern of the EUR/USD pair still looks quite convincing, and its daily movements completely fit into it. Moreover, the quotes leaving the reached highs confirms the assumption that the formation of wave 3 or C is completed. It is presumed that wave 4 takes on a three-wave form, at least now waves 1 and 2 or a and b are clearly visible in it. Thus, the quotes' decline may continue within the third wave from at 4 in the near future. The US currency received market support after yesterday's Fed meeting, but it is unclear when it will last. Will the market have enough strength only to build wave 4, or will there be a full-fledged downward trend section?

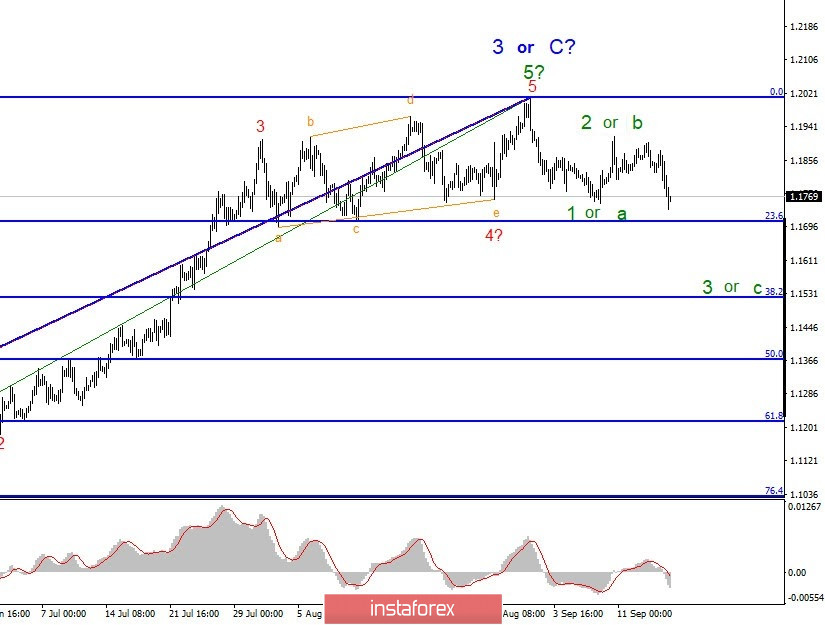

The wave pattern on a smaller scale shows that the formation of the supposed wave 2 or b is already completed. If the current wave pattern is correct, then the decline in quotes will continue today and tomorrow with targets located near the 23.6% Fibonacci level. Moreover, breaking through this level successfully will indicate that the markets are ready for new sales. So far, the entire current wave pattern implies only the construction of corrective wave 4.

All the most interesting things happened last night. The Fed provided a lot of information to the markets. Let me remind you that just a week ago, the markets started buying the Euro at the speech of Christine Lagarde, when there were no reasons for this. As a result, the markets got rid of the Euro the next day, thus admitting their mistake. This time, the US currency added 25 points yesterday, and another 45 today. The main reason for the increase in demand for the US currency was Jerome Powell's statements that the US economy is recovering at a good pace, faster than expected two months ago. In addition, the Fed raised its forecasts for 2020 in terms of unemployment, inflation and GDP, which were also noticed by the markets. In addition to specific statements and figures, there was a lot of populist rhetoric. For example, there was a lot of controversy and disagreement with the wording "maintaining the key rate until the end of 2023". Earlier, it was said that the rate will remain at the current level until the end of 2022, or, to be more precise, until inflation returns to a stable 2%, and the labor market does not match full employment. To simply put it, the economy needs to fully recover from the crisis for the Fed to re-tighten monetary policy. The inflation rate should stabilize at 2% or slightly more, and the labor market needs to return to pre-crisis levels. Thus, I believe that the definitions "until 2022" or "until 2023" do not mean anything more. The Fed will make decisions based on economic conditions, not based on numbers on the calendar.

General conclusions and recommendations:

Since the euro/dollar pair has presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section starting on September 1, I recommend selling the pair with targets located near the calculated levels of 1.1706 and 1.1520, equating to 23.6% and 38.2% Fibonacci. Here, we should expect the construction of a downward wave. A successful attempt to break through the level of 1.1706 will allow us to remain in sales.