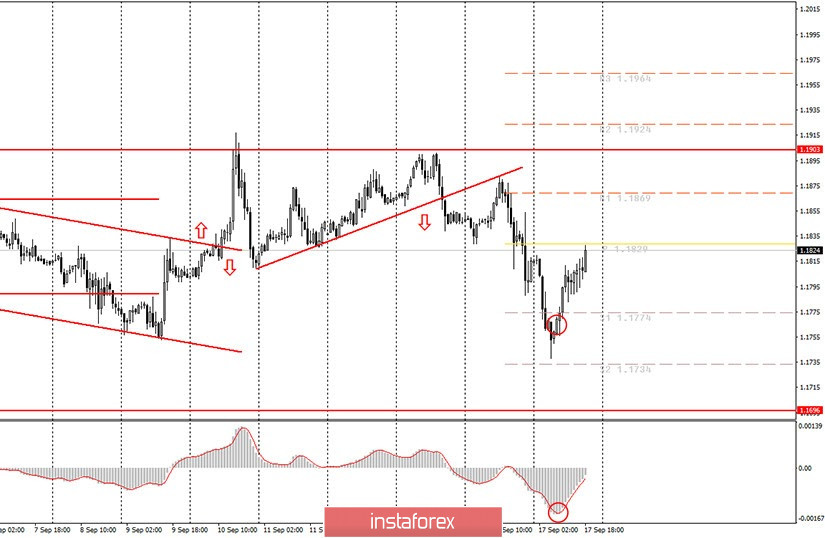

Hourly chart of the EUR/USD pair

The EUR/USD pair turned to the upside in the morning and began to restore previously lost positions on Thursday, September 17. The MACD indicator moved up almost simultaneously with the price, so novice traders could get out of short positions according to our morning recommendations, or on the signal of the MACD indicator up. Unfortunately, there are no trend lines, channels or other patterns that currently support an upward or downward trend within the $1.17-1.19 side channel. Thus, we would be deprived of the opportunity to declare a trend change during the day, although the upward movement seems to be quite strong. The euro/dollar pair aims to return to the upper area of the sideways channel. But in general, the pair remains flat. We remind novice traders to consider buying or selling more seriously when the price leaves the $1.17-1.19 channel.

The report on inflation in the European Union acted as the fundamental background on Thursday. Despite the fact that the consumer price index remained at the level of -0.2% in annual terms. This means that prices in the European Union have decreased (!!!) by 0.2% compared to August 2019. It also means that deflation has been recorded in Europe, which is very bad for the European economy, its recovery and the prospects for tightening monetary policy. In any case, this is a very negative factor that traders did not pay any attention to. The euro continued to rise in price during the day despite a weak inflation report. What's most interesting is that the report on claims for unemployment benefits in the US also showed an overall decrease in unemployment in the country, but also went unnoticed by traders. This report is not important, however, it could provide at least a small support to the US currency. Thus, throughout the day, market participants simply corrected the pair after the previous fall, that is, they worked on pure technique.

The European Union will not publish a single macroeconomic report on Friday, September 18. In the United States, only the University of Michigan Consumer Confidence Index is scheduled for the day, which is not an important report. Thus, in general, we can assume that news and reports may not influence the currency pair's movement tomorrow. Based on this, we can conclude that volatility will go down tomorrow, and the pair may start to adjust against the correction.

Possible scenarios for September 18:

1) Novice traders are still not recommended to buy at this time, since the price failed to overcome the 1.1903 level once again, which is the upper line of the side channel. Also, there is not a single serious pattern that would support the upward trend.

2) Selling still looks more attractive now, as traders have not overcome the 1.1903 level, and the price has settled below the upward trend line. Thus, novice traders may consider opening new short positions on a new sell signal from the MACD indicator with targets at 1.1774 and 1.1734. If the price moves down in the next few hours, then traders may still have time to open shorts today. Otherwise, we recommend waiting for tomorrow morning and considering the possibility of opening new positions tomorrow.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.