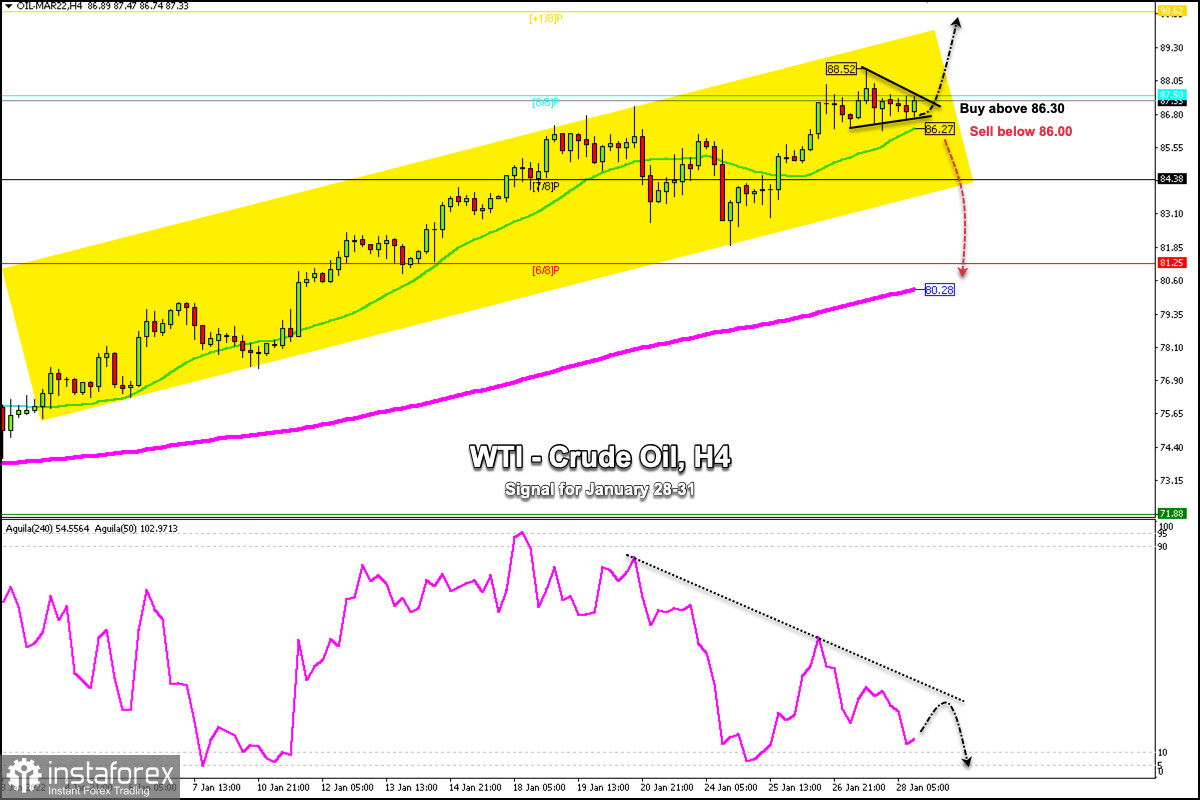

In the early American session, WTI (#CL) is trading around 86.50, just below 8/8 Murray and below its high of 88.52.

According to the 4-hour chart, the trend for crude remains bullish, so our opportunity will be to continue buying while WTI remains above the 21 SMA located at 86.30.

If in the next few hours Crude Oil consolidates again above 87.50 (8/8), it will be an opportunity to buy with targets towards +1/8 of Murray located at 90.62.

The escalating jitters between Russia and Ukraine will drastically affect the energy markets. If the conflict escalates into war, this would push oil prices to the $125 level, as reported by Rabobank strategists.

Assuming all countries stop Russian energy purchases, the potential impact on prices would be huge, with oil rising to $175 and European gas to $250.

This Crude scenario could affect the global economy, a very expensive oil, will also raise the prices of raw materials and basic foods that affect the final consumer.

Conversely, if Crude oil consolidates below the 21 SMA located at 86.27 and makes a daily close, it will be an opportunity to sell with targets at 84.38 and until the 200 EMA located at the psychological level of 80.28.

Our trading plan for the next few hours is to continue buying crude with targets at 90.62. We can see the formation of a symmetrical triangle pattern. A break above this pattern could trigger a new round of buying WTI with targets towards 90.62 (+1/8).