Trading recommendations for the EUR / USD pair on September 21

Analysis of transactions

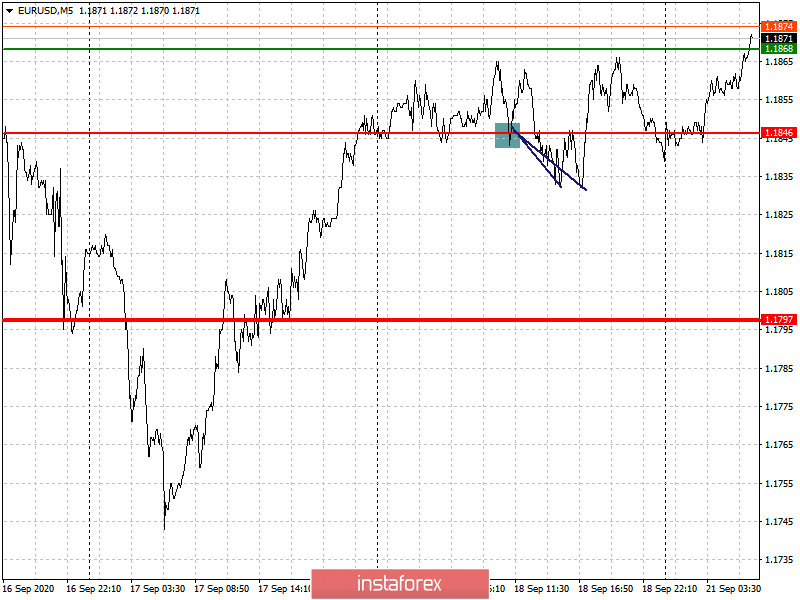

The euro is trading in a flat market due to the absence of news and macroeconomic reports that could support the currency to move in a clear direction. As a result, short positions from 1.1846 did not bring profit, contrary to what was expected, especially since movement in EUR / USD only to 15 pips.

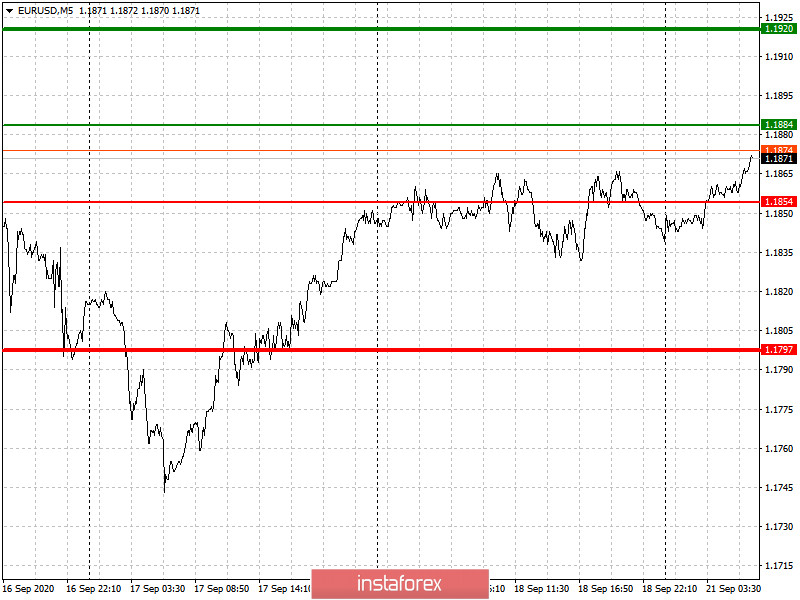

Key events for today are the speeches of ECB president Christine Lagarde and Fed chairman Jerome Powell, which will certainly set the direction where EUR / USD will move. However, the highest probability lies in a further strengthening of the euro against the dollar, which in turn means a continued rise of EUR / USD in the market.

- Buy positions from 1.1884 (green line on the chart) and then take profit around 1.1920. A large upward movement is expected to occur after the speech of ECB president Christine Lagarde.

- Sell shorts from 1.1854 (red line on the chart) and then take profit at the level of 1.1797. However, note that the potential of a decline is extremely limited as the downward trend is already over.

Trading recommendations for the GBP / USD pair on September 21

Analysis of transactions

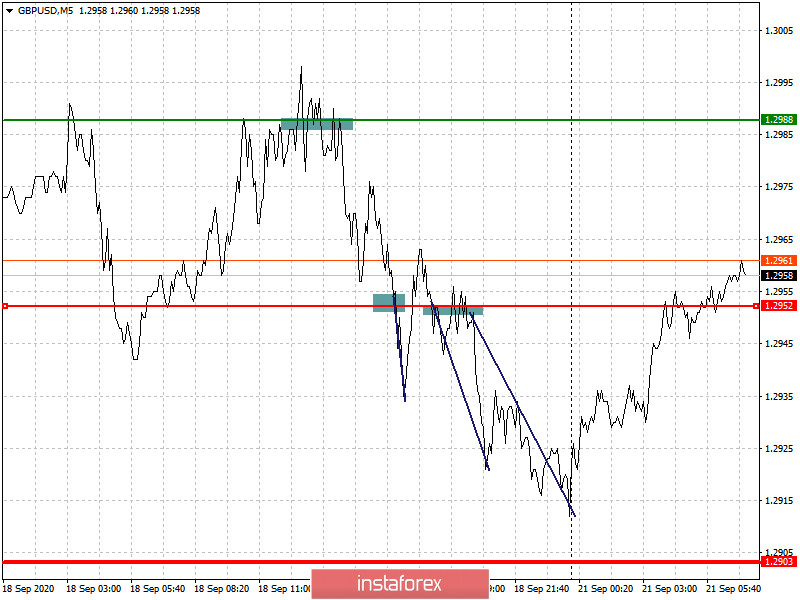

Just like the euro, the pound also traded in a flat market, having both long positions and short positions canceling each other out.

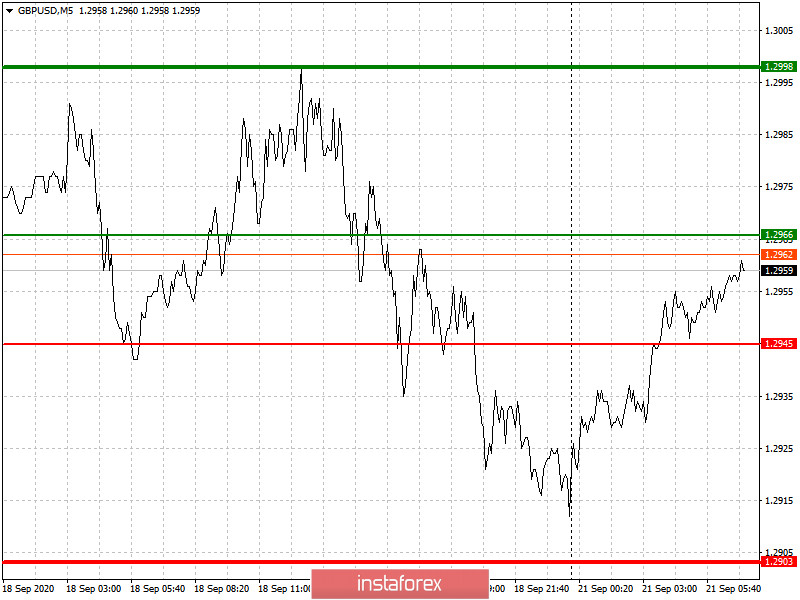

The important events that traders should watch out for today are the speech of Fed chairman Jerome Powell and the news related to Brexit. Any update pertaining to the escalation of dispute will increase pressure on the British pound.

- Buy the pound at a price level of 1.2966 (green line on the chart) and then take profit around the level of 1.2998 (thicker green line on the chart).

- Sell the pound at a price level of 1.2945 (red line on the chart) and then take profit at least at 1.2903. Any negative from the EU or an intensification of the Brexit dispute will put pressure on the pound.