American companies will be able to borrow money now even easier. On the one hand, this is good, since business owners who are in a difficult situation will be able to get another funding. On the other hand, the uncontrolled financing that the Fed is practically engaged in has placed a burden on the banking system. It will not end well but will only increase the debt burden and lead to a larger bankruptcy.

On Friday, it became known that the US Federal reserve has published new recommendations for banks. They focus on increasing the availability of loans that are currently issued under the emergency program for lending to small and medium-sized businesses. We are talking about the same $ 600 billion program that was approved at the beginning of this summer. It is worth remembering that since July of this year, banks have been selling up to 95% of loans issued to the Federal reserve at the request of the above-mentioned program. A more flexible approach to loan evaluation has also been developed by the commercial banking regulatory Commission and the Federal Deposit insurance Corporation which will allow loans to be issued even to those who have difficulties providing all the necessary information.

In the meantime, Germany - the Euro zone's largest economy is preparing to increase borrowing on the foreign market. As it became known, the German authorities are ready to get into new debts in 2021 as per the plan of German Finance Minister Olaf Scholz. The published report indicates that Berlin is ready to borrow up to 100 billion euros through the sale of government bonds. Nevertheless, all the money is planned to be spent on fighting the consequences of the coronavirus pandemic. It was reported earlier that the authorities plan to issue securities in the amount of 80 billion euros during this year. Despite the fact that the yield on these investment instruments is quite minimal, many investors consider them as the most conservative and secured securities.

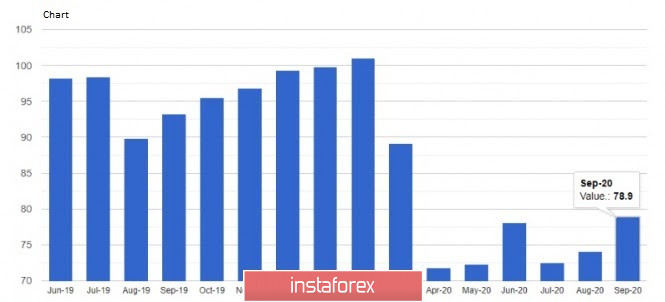

As of Friday's fundamental statistics, there is not much to talk about other than the US consumer sentiment indicator. The expiration of additional Federal unemployment benefits could not hurt the economic recovery as many analysts had feared based from a good report of the University of Michigan. Let me remind you that the program ended at the end of July this year. The report indicates that the overall consumer sentiment index in early September 2020 jumped to 78.9 points, almost returning to its pre-crisis value, at least until the moment when the coronavirus pandemic began to rage in the United States.

Based on the forecasts of economists who expected the index to be 75.4 points, the data result was much stronger. The opening up of the economy is good but the risk of another surge in Covid-19 infections will clearly hold back further recovery in the fall of this year. The current economic situation index rose to 87.5 points in September from 82.9 points in August, while the consumer expectations index rose to 73.3 points from 68.5 points a month earlier.

The Conference Board report indicated an increase in the index as per the data on the leading indicator. So, the closely watched Conference Board index which indicates economic cycles in the United States continued its growth in August this year reaching 106.5 points and jumping immediately by 1.2% compared to July. Economists had expected the index to show growth of 1.4%. The slower growth of the index once again indicates a slowdown in the economic recovery at the end of this summer. It should also be noted that the index remains 4.7% below the February level.

The growth of data in the current account deficit of the US balance of payments as per 2nd quarter this year were ignored because the information is no longer particularly concerned. As for the figures, the report of the US Department of Commerce indicates an increase in the deficit to $ 170.5 billion against $ 111.5 billion in the 1st quarter. The Ministry noted that this development of the situation threatens to reduce the positive balance of primary income and trade in services.

There were also several speeches by representatives of the Federal reserve system but they did not have much weight in the overall market picture for the day on Friday evening. Attention was drawn only to statements by the President of the Federal reserve Bank of St. Louis, James Bullard, who emphasized that he very much expects inflation to accelerate in the near future. However, inflation will remain acceptable and remains a mystery based on his opinion. He said that a number of factors will put upward pressure on the growth rate, one of which is a looser monetary policy. By the way, so far this approach has not led to a sharp inflationary jump but everything can be attributed to the coronavirus pandemic which has paralyzed the economy. Bullard also drew attention to the huge budget shortage which has historically been a catalyst for inflation.

Based on EURUSD currency pair technical picture, the further growth of risky assets will directly depend on the breakout of the resistance of 1.1870 which was formed last Friday. Going beyond this range will easily open the way for the trading instrument to reach the highs of 1.1915 and 1.1970 levels. But the main goal of the bulls is still the 20th figure, the breakthrough of which will provide the Euro with new major players who are betting on the further growth of risky assets. If at the beginning of the week we will observe a decline in the Euro, it is best not to rush with purchases but wait for the update of a large support of 1.1790 level or open long positions after the test of the week's minimum of 1.1740 level. But it should be understood that a return to the area of these levels will increase the likelihood of a resumption of the bear market in risky assets.

Today, it is necessary to focus on the entry of the President of the European Central Bank, Christine Lagarde, who can set the direction of the Euro. Later we will have a presentation by the head of the Federal reserve system Jerome Powell. If his speech does not change from last week, the US dollar may weaken.