To open long positions on GBPUSD, you need:

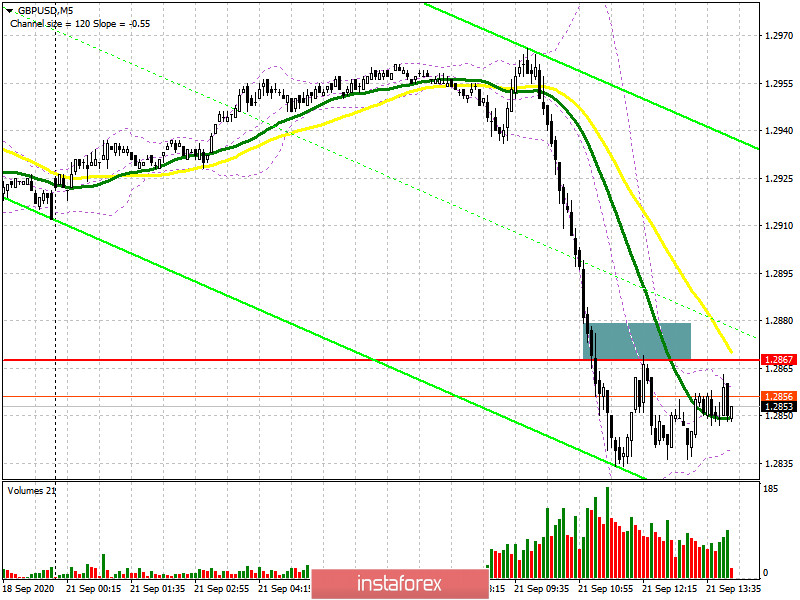

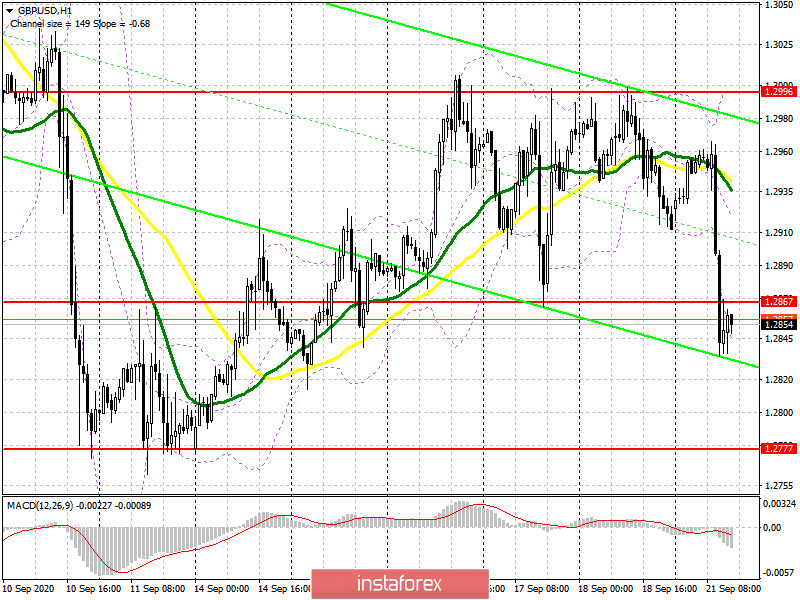

Unfortunately, it was not possible to hold a new and powerful wave of the fall of the British pound in the first half of the day, however, it was still possible to take its 30 points from the market. Let's look at where and how this could be done. The sharp fall in the pound occurred after reports that the German authorities are strengthening measures aimed at fighting the coronavirus, deploying operational help points with the arrival of moves, where people can turn in case of symptoms of the disease. The resignation of the Czech Health Minister and his statements also put pressure on buyers of risky assets, including the British pound, where new outbreaks of COVID-19 are recorded. The 5-minute chart clearly shows that after the breakout of the support of 1.2867, where the bulls did not even try to return to the market, there was an upward correction and a test of this area from the bottom up, which formed a good entry point for short positions. However, so far the downward movement was about 30 points, after which consolidation began. Most likely, the bulls will try to return to this level, however, it will be possible to open long positions from it only after testing this area from top to bottom on the volume, which will form a good entry point for long positions with the main goal of restoring to the area of the maximum of 1.2996, where I recommend fixing the profits. If the bulls fail to regain the area of 1.2867 and the pressure on the pound persists in the second half of the day, it is best to postpone long positions until the low of 1.2777 is updated, based on a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

The primary task of sellers will be to protect the resistance of 1.2867, and as long as trading is below this level, the pressure on the pound will remain. The bulls may achieve a breakdown and take out stop orders of speculative bears. However, a repeated return of the pair under the range of 1.2867 will form an additional signal to sell GBP/USD, the main goal of which will be to test the minimum of 1.2777 and update the support of 1.2725, where I recommend fixing the profits. A test of the new area of 1.2725 will also be a clear signal for the continuation of a large bearish trend in the medium term. If the bulls turn out to be stronger and take the resistance of 1.2867, it is best to abandon sales until the test of last week's maximum of 1.2996, from which you can open short positions on the pound immediately on the rebound in the expectation of correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily averages, which indicates an attempt by sellers to return the market under their control.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator in the area of 1.2996 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.