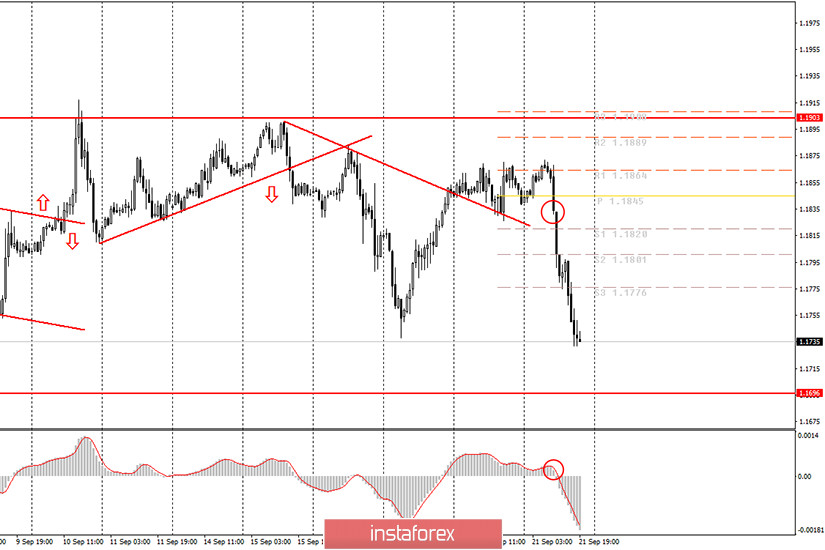

EUR/USD hourly chart

On Monday, September 21, EUR/USD moved sharply to the downside within the 1.1700 -1.1900 sideways channel where it has been holding for almost two months. In the course of the day, the euro dropped against the US dollar by 150 pips. In the morning, we did not recommend buying the euro, as the price was holding near the upper boundary of the flat channel. We also recommended that traders consider placing short positions at their own risk following the MACD sell signal. Thus, those traders who placed sell orders have gained the profit of about 100 pips. The price of the euro/dollar pair has shifted to the lower boundary of the channel. First of all, this means that short positions can be closed. Secondly, now it is better to open buy deals from this area. Unfortunately, today we have not received any clear signals on the internal trends in the sideways channel. There is still no trendline, or channel, or any other pattern that can be used to determine the current trend. Therefore, all deals are now associated with high risks.

From the fundamental point of view, there were no important events on Monday. That is, no macroeconomic reports were expected this day, so traders had no drivers to react to. However, it turned out that no statistical data is needed to cause sharp fluctuations on the pair. In the morning, the pair opened the day with a strong movement and continued the trend throughout the session.

On Tuesday, September 22, Fed Chairman Jerome Powell will testify before the US Congress. Tomorrow, the Fed chairman will give speech before the US House of Representatives Financial Services Committee regarding the implementation of the legislation from March 27. The new law provided the US economy with a record $2.2 trillion stimulus package in order to tackle the coronavirus pandemic. On Wednesday, Jerome Powell will testify before the Congress once again, this time in front of the House Select Committee on the Coronavirus Crisis. Both the announcements can potentially provide important information to market participants. On the other hand, Powell's attitude to the coronavirus crisis is rather skeptical. The Fed's Chair has repeatedly stated that the risks associated with the pandemic are extremely high, and the future of the US economy is uncertain. Thus, Jerome Powell is likely to announce something similar in the next two days. However, we insist that you do not skip these events, as they may be of great importance for the US currency.

Possible scenarios for September 22:

1) At the moment, we would recommend that novice traders should be cautious when opening buy deals on the pair. Currently, there is no clear signal that confirms long positions. However, it might be sensible to place buy orders from the lower boundary of the 1.17-1.19 channel, especially now when the pair dropped by almost 150 pips. You need to wait until the price pulls back to the upside by at least 50-70 pips. Thus, novice traders can open long positon at their own risk. An upward reversal of the MACD indicator may signal the completion of the downward movement. At the same time, it is important that both the quotes and the indicator show an uptrend.

2) Currently, selling the pair is not relevant any longer as it has already gone down by 150 pips. So, the beginners are recommended to close their short positions now. Otherwise, they can wait until the MACD indicates an upward signal and close short positions after that. However, we would not recommend waiting for the MACD upside reversal. It is highly possible that the indicator will start showing mixed signals.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trendlines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (10, 20, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exit the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.