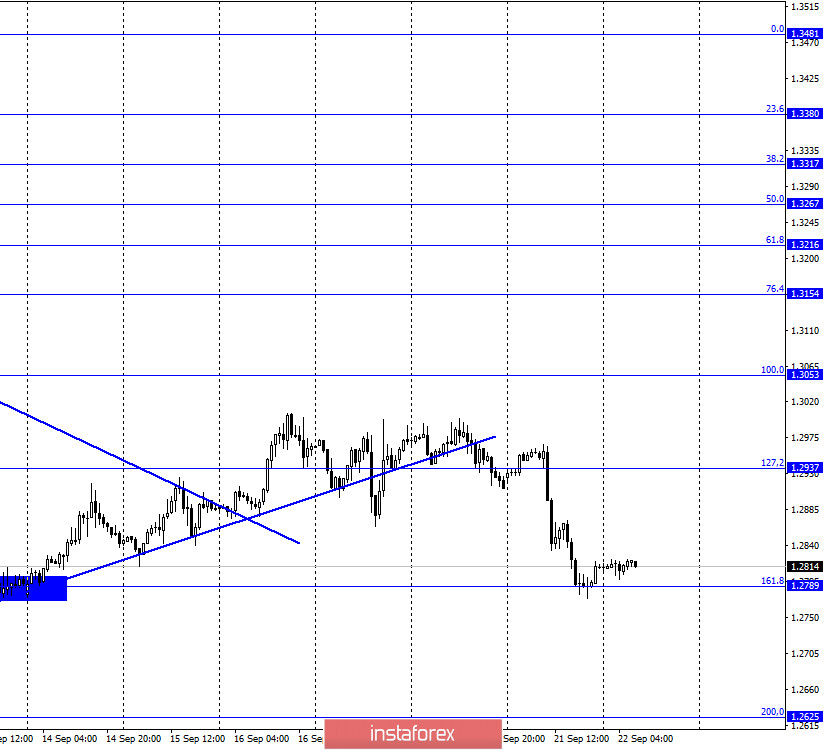

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell to the corrective level of 161.8% (1.2789) after two fixes were made under the ascending trend line. Thus, the demand for the British remains quite low for several reasons and factors. Closing the pair's quotes below this level will increase the probability of continuing to fall towards the next corrective level of 200.0% (1.2625). A few days ago, Boris Johnson announced that the UK was facing a second wave of the pandemic. It seems that the British authorities only informed the population about the threat, however, they do not know what to do and how to stop the virus this time. In practice, it turned out that London can not offer anything like this, and it does not have a universal coronavirus remedy. According to the latest data from the Johns Hopkins Institute, about 4,000 people get sick every day in the UK. These are almost the maximum levels of the first wave. The country's chief health officer, Chris Whitty, began sounding the alarm and said that the country is facing a very difficult winter. The Prime Minister is due to make a new statement to the nation in a few days. This is very bad news for the British. Recall that in recent years, this currency fell due to a lot of misfortunes. Failed negotiations with the EU, Boris Johnson's strange bill, now here's a new wave of coronavirus. The fall in the British dollar will likely continue.

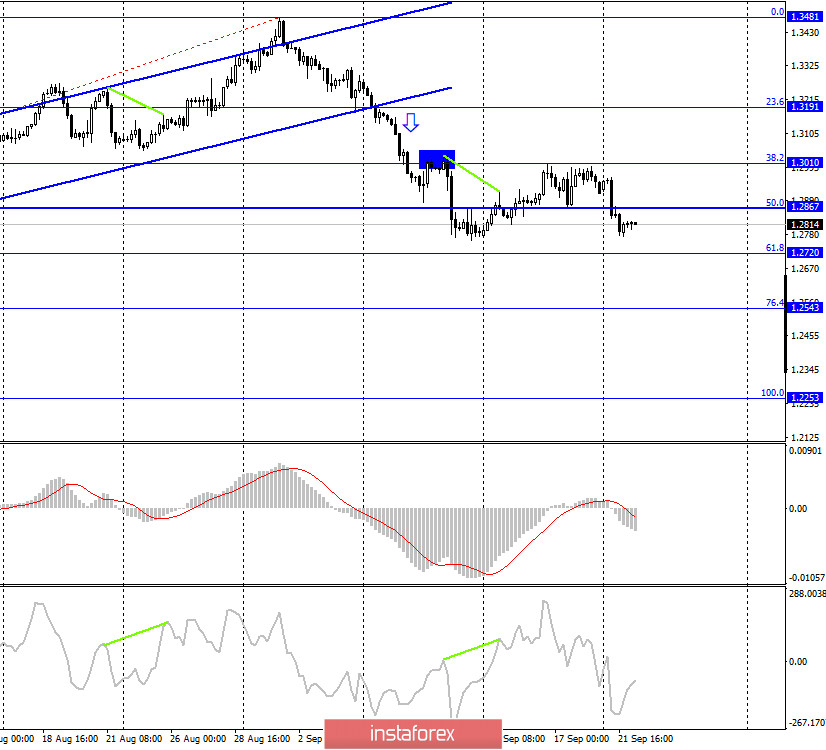

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US currency and began a new process of falling, consolidating under the corrective level of 50.0% (1.2867). Thus, the process of falling can now be continued towards the next Fibo level of 61.8% (1.2720). Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the Fibo level of 76.4% (1.2776), which allowed the pair to perform only a small increase. At the moment, a return to the corrective level of 76.4% has been made. A new rebound from this level will again work in favor of the British currency and the beginning of new growth in the direction of the corrective level of 100.0% (1.3199). Closing quotes below the level of 76.4% will increase the chances of continuing to fall.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, so a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

There were no major economic reports or other events in the UK or America on Monday. Nevertheless, the British dollar's quotes fell again. Thus, the information background was not necessary for traders to conduct active trading.

News calendar for the US and UK:

Great Britain - Bank of England Governor Andrew Bailey will deliver a speech (07:30 GMT).

United States - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (14:30 GMT).

On September 22, the UK and the US will host speeches by the heads of central banks of these countries, which may be reflected on the chart of the pound/dollar pair.

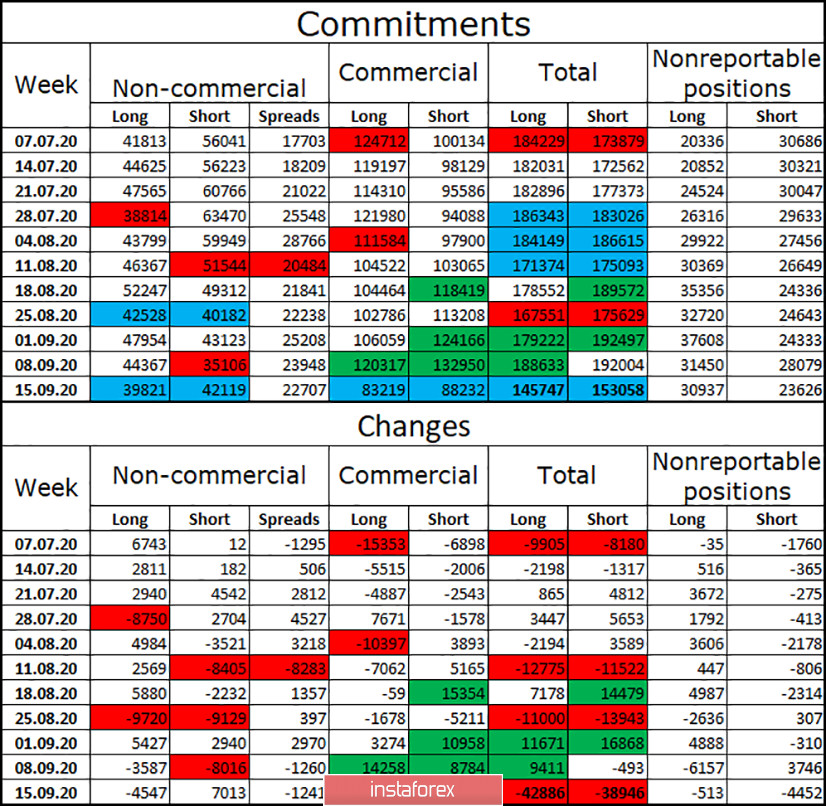

COT (Commitments of Traders) report:

The latest COT report on the British pound, released last Friday, turned out to be much more logical than the previous one. This time, the report showed that the "Non-commercial" group reduced the number of long contracts on its hands by 4,547 units and opened 7,013 short contracts. Thus, the mood of the most important group (the group of professional speculators) became more "bearish" during the reporting week. Given that the British pound has fallen by 700 points since September 1, this behavior of the "Non-commercial" group is logical. The "Commercial" group (hedgers) managed to close about 80 thousand contracts during the reporting week, in equal shares of short and long. For comparison, 80 thousand contracts are more than the total number of contracts currently in the hands of speculators. Thus, the attractiveness of the British in the eyes of major traders begins to decline, and quite strongly.

Forecast for GBP/USD and recommendations for traders:

I recommend selling the British currency with a target of 1.2625 if the close is made under the level of 161.8% (1.2789) on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.