Yesterday's trading once again showed that the US dollar was again in demand as a safe asset due to the arrival of a new wave of COVID-19. The situation with the spread of coronavirus in the world continues to heat up. The leader in the daily number of infected people is still India, where the daily increase in new COVID-19 diseases is one hundred thousand. A high increase in the daily number of cases continues to be maintained in the United States of America. Brazil continues to be among the sad top three in terms of the number of cases of a new type of coronavirus infection.

As for Europe, there is also an increase in the daily number of cases in some countries. In this regard, restrictive measures are re-entering into force in several countries, which require the wearing of protective masks and restrict the gathering of people over six people. As was already the case in the spring, kindergartens and schools are being closed again, as well as bars and restaurants are being tightened. There are more and more voices about the coming of the second wave of COVID-19, and the leaders of countries declare the need to purchase and use the COVID-19 vaccine as soon as possible.

Another issue that concerns market participants is the ability of the US Congress to agree on additional measures to support the world's leading economy. All this taken together does not in any way contribute to risk sentiment in the markets, which was proved at yesterday's trading by significant declines in currencies such as the Australian dollar and the euro.

Yesterday's speech by the head of the Federal Reserve, Jerome Powell, was virtually ignored by market participants, however, the chief American banker will speak twice more this week, and some other Fed leaders will also make statements. From these speeches, investors expect to learn more details about the Fed's new monetary policy, which concerns the inflationary component. Today, at 15:00 (London time), a member of the Federal Open Market Committee, Charles Evans, will deliver his speech, and at 15:30 (London time), the first part of the semi-annual monetary policy report will be delivered by Fed Chairman Jerome Powell on Capitol Hill.

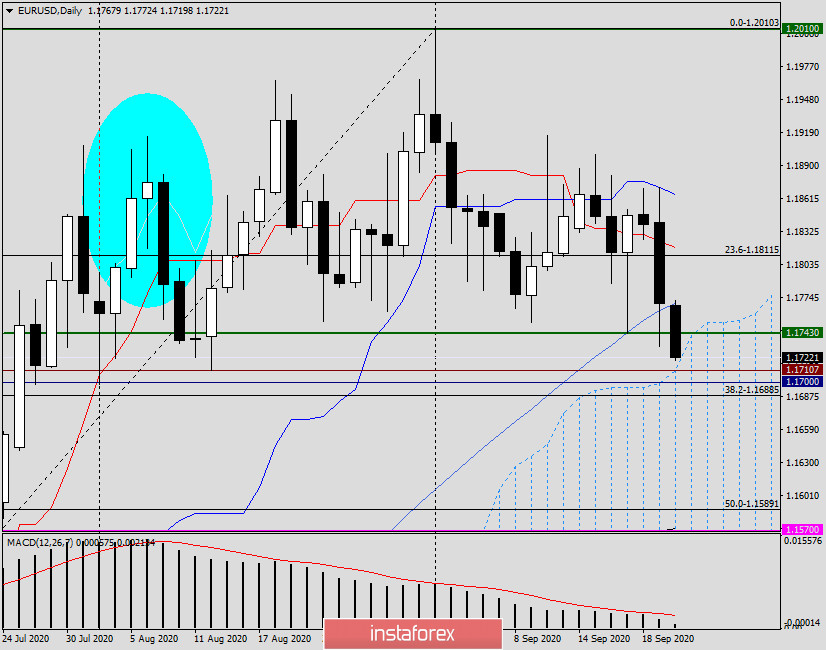

Daily

Following the results of yesterday's trading, the main currency pair of the Forex market showed a decline, during which an attempt was made to break through the 50 simple moving average and support at 1.1743. However, both the 50 MA and the level itself were again able to repel the sellers' attack, but not for long. As you can see, at the end of the article, EUR/USD is again under selling pressure and attempts to break through the support at 1.1743 continue. Yesterday, the pair was already at 1.1731, and today, at the moment, it was able to fall only to 1.1733. In my opinion, the market's reaction will depend on the speech of the head of the Fed. If Powell disappoints investors, the euro/dollar can significantly bounce up and end trading above 1.1800, which will be perceived as a bullish signal. Otherwise, the pair risks falling below another significant level of 1.1700 and may end Tuesday's session under this important mark. If the second scenario is implemented, the subsequent decline may become more intense with subsequent targets at 1.1600 and 1.1500.

In my opinion, the main trading idea for today is sales. I recommend looking for an opportunity to sell the pair after short-term bounces to the price zone of 1.1765-1.1800. If the euro/dollar falls below 1.1700 and gets a foothold under this important mark, then, on a rollback to the area of 1.1700-1.1740, we will also consider selling the main currency pair.