Yesterday's trading once again showed that the British pound is prone to decline and is under selling pressure. On the first trading day of the new week, the pound/dollar sank significantly, ending trading at 1.2812.

Meanwhile, British Prime Minister Boris Johnson is increasingly predicting the second wave of COVID-19. And in fact, recently in the UK, as in several other European countries, the daily increase in people infected with a new type of coronavirus infection has increased significantly. The British Prime Minister believes that vaccination of the population of the Foggy Albion can change this situation. In the meantime, the Cabinet of Ministers of the country is again ready to introduce several restrictions and has already begun to do so. However, the British, like many other citizens of European countries, are already tired of all these restrictions, which do not bring much success in the fight against COVID-19. However, if there were no restrictions at all, the situation with the spread of coronavirus and deaths from the cursed pandemic would be simply catastrophic.

Among the main events of today, it is worth noting the speech of the head of the Bank of England and the first part of the semi-annual report on monetary policy, which Jerome Powell will address US congressmen. These events can significantly affect the price dynamics of the GBP/USD pair, but even so, the tendency to reduce this instrument is visible.

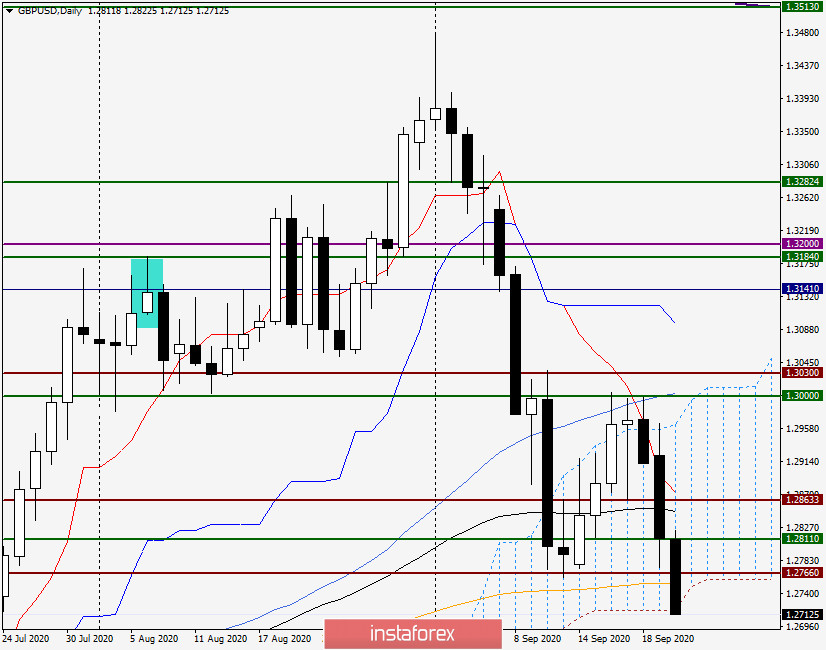

Daily

Although the beginning of yesterday's trading was quite positive for the pound, the pair failed to get out of the Ichimoku indicator cloud in the end. Moreover, after unsuccessful attempts to do this, another strong fall in the exchange rate followed. In today's trading, the pressure does not weaken, and the pair is already trading below the important mark of 1.2800, near 1.2765. It is worth noting that there is also a strong 200 exponential moving average, which is quite capable of providing strong support. But will it be possible to do this in the current situation, when the sterling is so weak and under strong selling pressure? In my opinion, the only hope for the pound bulls may be the speeches of the head of the Federal Reserve Jerome Powell, who is not inclined to shine with optimism and bullish rhetoric in his speeches. If the market takes a negative view of the speech of the head of the Federal Reserve, the pound/dollar pair has a chance to rebound to the area of 1.2850. In all other scenarios, GBP/USD will continue to remain under selling pressure.

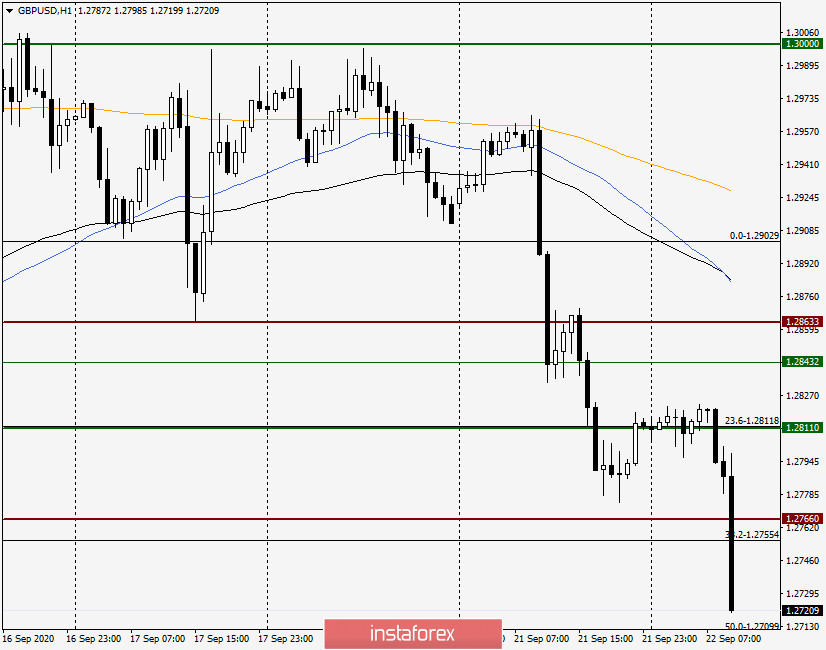

H1

Based on this assumption, it is risky and aggressive to try to sell right now. Moreover, the pair has already made a correction or consolidation in the sideways range of 1.2820-1.2800, after which it turned in the south direction to conquer new targets at the bottom. If there is a real correction of the exchange rate and the pair rises to the area of 1.2850-1.2885, here it will be necessary to observe the behavior of the price, and when the corresponding signals appear, open short positions on GBP/USD. In truth, it is hard to believe that such high prices will give at this stage of time. It will be much more realistic to count on attempts to return the quote above 1.2800, which will end with another bull fiasco for the British pound. This assumption implies sales near the iconic level of 1.2800.